Seagate 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

payments. The 5.75% Debentures are currently convertible for a cash payment of $167.50 per $1,000 principal

amount of debentures.

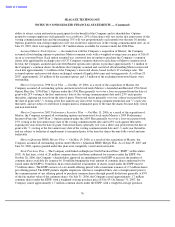

$60 million LIBOR Based China Manufacturing Facility Loan. As a result of the Maxtor acquisition, the

Company assumed an outstanding plant construction loan in the amount of $30 million and an outstanding project

loan in the amount of $30 million from the Bank of China to Maxtor Suzhou (“MTS”). These borrowings are

collateralized by the Company’s facilities in Suzhou, China. The interest rate on the plant construction loan is

LIBOR plus 60 basis points, with the borrowings repayable in two installment payments of $15 million each, one due

in October 2008 and the other due in April 2009. The interest rate on the project loan is LIBOR plus 100 basis points,

and the borrowing is repayable in August 2009. Interest payments on both the construction loan and the project loan

are made semi-annually on October 15 and April 15. The loans require MTS to maintain annual financial covenants,

including a maximum liability to assets ratio and a minimum earnings to interest expense ratio, with which MTS was

in compliance at June 29, 2007.

In accordance with APBO No. 14, Accounting for Convertible Debt and Debt Issued with Stock Purchase

Warrants, (“APBO 14”), the Company determined the existence of substantial premium for both the 2.375% Notes

and 6.8% Notes and recorded the notes at par value with the resulting excess over par (the substantial premium)

recorded in Additional Paid-In Capital in Shareholders’

Equity. All other debt assumed in the Maxtor acquisition was

recorded at fair market value (see Note 10).

$400 Million Aggregate Principal Amount of 8% Senior Notes Previously due May 2009. In October 2006, the

Company redeemed its 8% Senior Notes due May 2009 (the “8% Notes”) at a redemption price of $1,040 per $1,000

principal amount of Notes for a total amount paid of $416 million. The redemption premium of $16 million as well

as approximately $3 million of unamortized issuance costs were recorded as interest expense in the Company’s

Consolidated Statement of Operations.

The Company has guaranteed all Senior Notes on a full and unconditional basis (see Note 14).

Revolving Credit Facility. HDD has a senior unsecured $500 million revolving credit facility that matures in

September 2011. The $500 million revolving facility, which was entered into in September 2006, replaced the then-

existing $100 million revolving credit facility.

The credit agreement that governs the Company’s revolving credit facility contains covenants that must be

satisfied in order to remain in compliance with the agreement. The credit agreement contains three financial

covenants: (1) minimum cash, cash equivalents and marketable securities; (2) a fixed charge coverage ratio; and (3) a

net leverage ratio. As of June 29, 2007, the Company is in compliance with all covenants.

The $500 million revolving credit facility is available for cash borrowings and for the issuance of letters of

credit up to a sub-limit of $100 million. Although no borrowings have been drawn under this revolving credit facility

to date, the Company had utilized $47 million for outstanding letters of credit and bankers’ guarantees as of June 29,

2007, leaving $453 million for additional borrowings. The credit agreement governing the revolving credit facility

includes limitations on the ability of the Company to pay dividends, including a limit of $300 million in any four

consecutive quarters.

74