Seagate 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

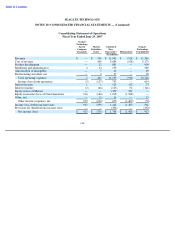

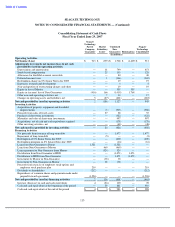

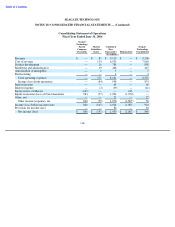

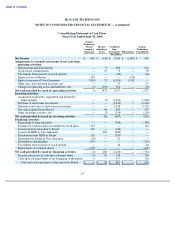

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

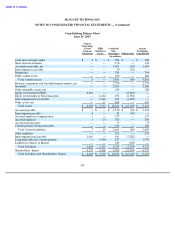

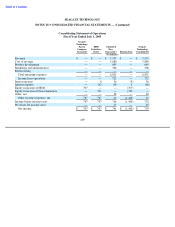

On May 19, 2006, in connection with the acquisition of Maxtor, the Company, Maxtor and the trustee under the

indenture for the 2.375% Notes and 6.8% Notes entered into a supplemental indenture pursuant to which the notes

became convertible into the Company’s common shares. In addition, the Company agreed to fully and

unconditionally guarantee the 2.375% Notes and 6.8% Notes on a senior unsecured basis. The Company’s

obligations under its guarantee rank in right of payment with all of its existing and future senior unsecured

indebtedness. The indenture does not contain any financial covenants and does not restrict Maxtor from paying

dividends, incurring additional indebtedness or issuing or repurchasing its other securities (see Note 5). The

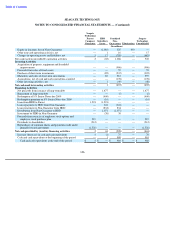

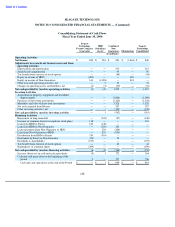

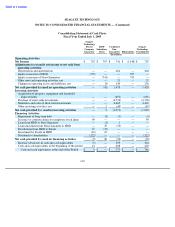

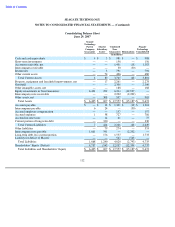

following tables present parent guarantor, subsidiary issuer and combined non-guarantors condensed consolidating

balance sheets of the Company and its subsidiaries at June 29, 2007 and June 30, 2006, the condensed consolidating

statements of operations and cash flows for the fiscal years ended June 29, 2007 and the period from May 19, 2006 to

June 30, 2006. The information classifies the Company’s subsidiaries into Seagate Technology-parent company

guarantor, Maxtor-subsidiary issuer and the Combined Non-Guarantors based on the classification of those

subsidiaries under the terms of the 2.375% Notes and 6.8% Notes.

From the date of acquisition (May 19, 2006) through June 30, 2006, Maxtor was a wholly-owned direct

subsidiary of Seagate Technology. The accompanying condensed consolidating balance sheet as of June 30, 2006

reflects the corporate legal structure of Seagate Technology, HDD, and the Combined Non-Guarantors, as they

existed at that time. On July 3, 2006, through a corporate organizational change and realignment, Maxtor became a

wholly-owned indirect subsidiary of HDD and of Seagate Technology. As a result, beginning July 3, 2006, the

investment in Maxtor is accounted for on an equity method basis in the financial information of HDD, a non-

guarantor, and therefore, the balance sheet of the Combined Non-Guarantors as of June 29, 2007 reflects the

investment in Maxtor on an equity method basis. Certain intercompany balances have been reclassified to conform to

the current presentation.

111