Seagate 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

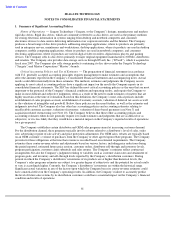

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Financial Instruments

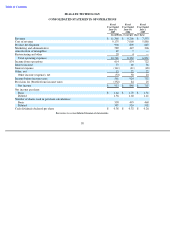

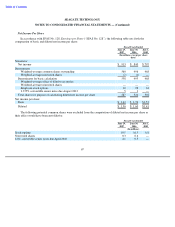

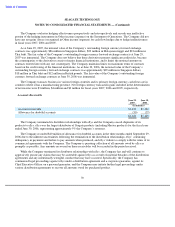

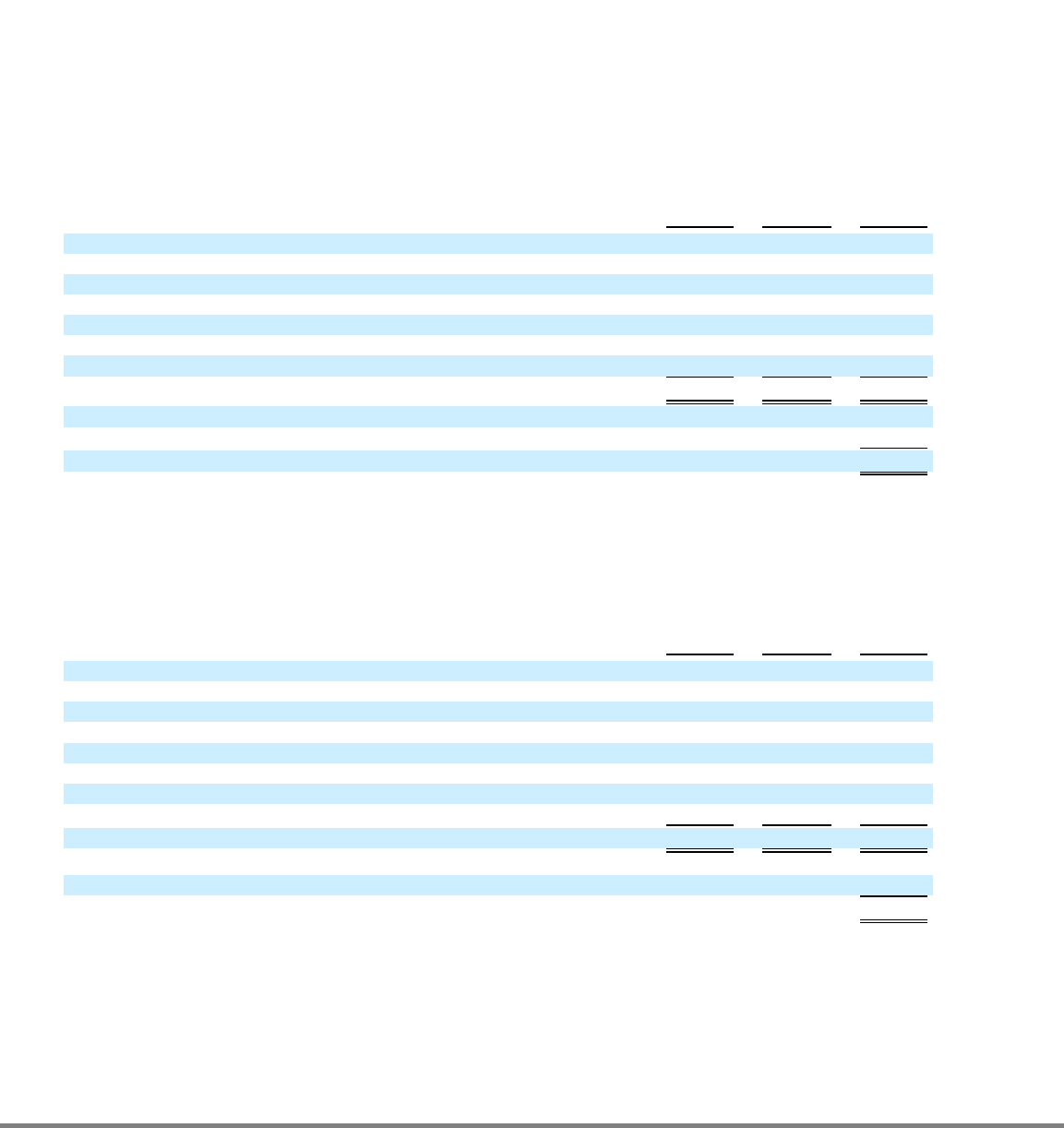

The following is a summary of the fair value of available-for-sale securities at June 29, 2007 (in millions):

At June 29, 2007, the Company had marketable securities with a fair value of $23 million that had been in a

continuous unrealized loss position for a period greater than twelve months. The Company reviewed these

marketable securities and determined that no investments were other-than-temporarily impaired at June 29, 2007.

The unrealized loss on these marketable securities was immaterial.

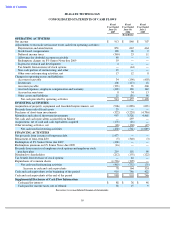

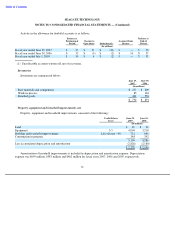

The following is a summary of the fair value of available-for-sale securities at June 30, 2006 (in millions):

At June 30, 2006, the Company had marketable securities with a fair value of $58 million that had been in a

continuous unrealized loss position for a period greater than twelve months. The Company reviewed these

marketable securities and determined that no investments were other-than-temporarily impaired at June 30, 2006.

The unrealized loss on these marketable securities was immaterial.

68

2.

Balance Sheet Information

Amortized

Unrealized

Cost

Loss

Fair Value

US Government & Agency

$

145

$

(1

)

$

144

Asset Backed Securities

4

—

4

Corporate Bonds

21

—

21

Municipal Bonds

5

—

5

Commercial Paper

768

—

768

Bank time deposits

4

—

4

Money Market

72

—

72

Total

$

1,019

$

(1

)

$

1,018

Included in cash and cash equivalents

$

862

Included in short term investments

156

$

1,018

Amortized

Unrealized

Cost

Loss

Fair Value

US Government & Agency

$

624

$

(7

)

$

617

Asset Backed Securities

49

—

49

Corporate Bonds

83

(1

)

82

Municipal Bonds

7

—

7

Auction Rate Securities

68

—

68

Commercial Paper

338

—

338

Bank time deposits

5

—

5

Money Market

414

—

414

Total

$

1,588

$

(8

)

$

1,580

Included in cash and cash equivalents

$

757

Included in short term investments

823

$

1,580