Seagate 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

of the implied volatility of its traded options and historical volatility of its share price. The impact of this change in

the assumptions used to determine volatility was not significant.

Expected Dividend — The Black-Scholes-Merton valuation model calls for a single expected dividend yield as

an input. The dividend yield is determined by dividing the expected per share dividend during the coming year by the

grant date share price. The expected dividend assumption is based on the Company’s current expectations about its

anticipated dividend policy. Also, because the expected dividend yield should reflect marketplace participants’

expectations, the Company does not incorporate changes in dividends anticipated by management unless those

changes have been communicated to or otherwise are anticipated by marketplace participants.

Risk-Free Interest Rate — The Company bases the risk-free interest rate used in the Black-Scholes-Merton

valuation method on the implied yield currently available on U.S. Treasury zero-coupon issues with an equivalent

remaining term. Where the expected term of the Company’s stock-

based awards do not correspond with the terms for

which interest rates are quoted, the Company performed a straight-line interpolation to determine the rate from the

available term maturities.

Estimated Forfeitures — When estimating forfeitures, the Company considers voluntary termination behavior

as well as analysis of actual option forfeitures.

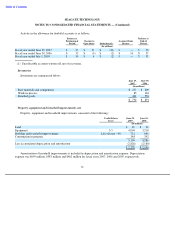

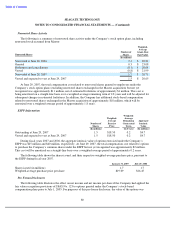

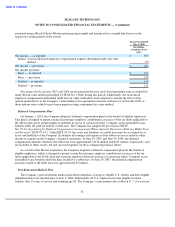

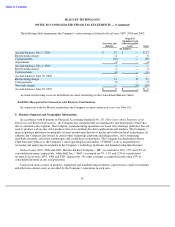

Fair Value — The fair value of the Company’s stock options granted to employees, assumed from Maxtor and

issued from the ESPP for fiscal years 2007, 2006 and 2005 were estimated using the following weighted-average

assumptions:

Stock Compensation Expense

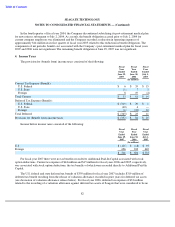

Stock Compensation Expense — The Company recorded $101 million and $74 million of stock-based

compensation during fiscal years 2007 and 2006, respectively and the Company also recorded $27 million and

78

Fiscal Years Ended

2007

2006

2005

Options under Seagate Plans

Expected term (in years)

4.0

3.5

-

4.0

3.0

-

3.5

Volatility

37

-

39%

40

-

43%

50

-

80%

Expected dividend

1.3

-

1.9%

1.2

-

2.3%

1.3

-

2.3%

Risk

-

free interest rate

4.4

-

4.8%

4.1

-

5.0%

2.9

-

3.6%

Estimated annual forfeitures

4.5%

4.6

-

4.9%

—

Weighted

-

average fair value

$7.41

$7.15

$6.55

Options under Maxtor Plans

Expected term (in years)

—

0

-

4.8

—

Volatility

—

36

-

39%

—

Expected dividend

—

1.3%

—

Risk

-

free interest rate

—

5.0

-

5.1%

—

Weighted

-

average fair value

—

$

10.49

—

ESPP

Expected term (in years)

0.5

0.5

-

1.0

0.5

-

1.0

Volatility

33

-

34%

37

-

41%

30

-

60%

Expected dividend

1.4

-

1.5%

1.2

-

1.7%

1.9

-

2.1%

Risk

-

free interest rate

5.0

-

5.2%

3.6

-

4.5%

1.6

-

2.2%

Weighted

-

average fair value

$5.80

$7.28

$3.86