Seagate 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

measured from the period beginning June 30, 2001 and ending the most recent fiscal quarter in which financial

statements are internally available.

We are restricted in our ability to pay dividends by the covenants contained in the revolving credit facility. Our

declaration of dividends is also subject to Cayman Islands law and the discretion of our board of directors. Under the

terms of the Seagate Technology shareholders agreement (which was amended on September 2, 2004) at least seven

members of our board of directors must approve the payment of dividends in excess of 15% of our net income in the

prior fiscal year (provided that such consent is not required to declare and pay our regular quarterly dividend of up to

$0.10 per share). In deciding whether or not to declare quarterly dividends, our directors will take into account such

factors as general business conditions within the disc drive industry, our financial results, our capital requirements,

contractual and legal restrictions on the payment of dividends by our subsidiaries to us or by us to our shareholders,

the impact of paying dividends on our credit ratings and such other factors as our board of directors may deem

relevant.

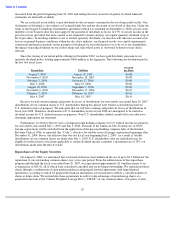

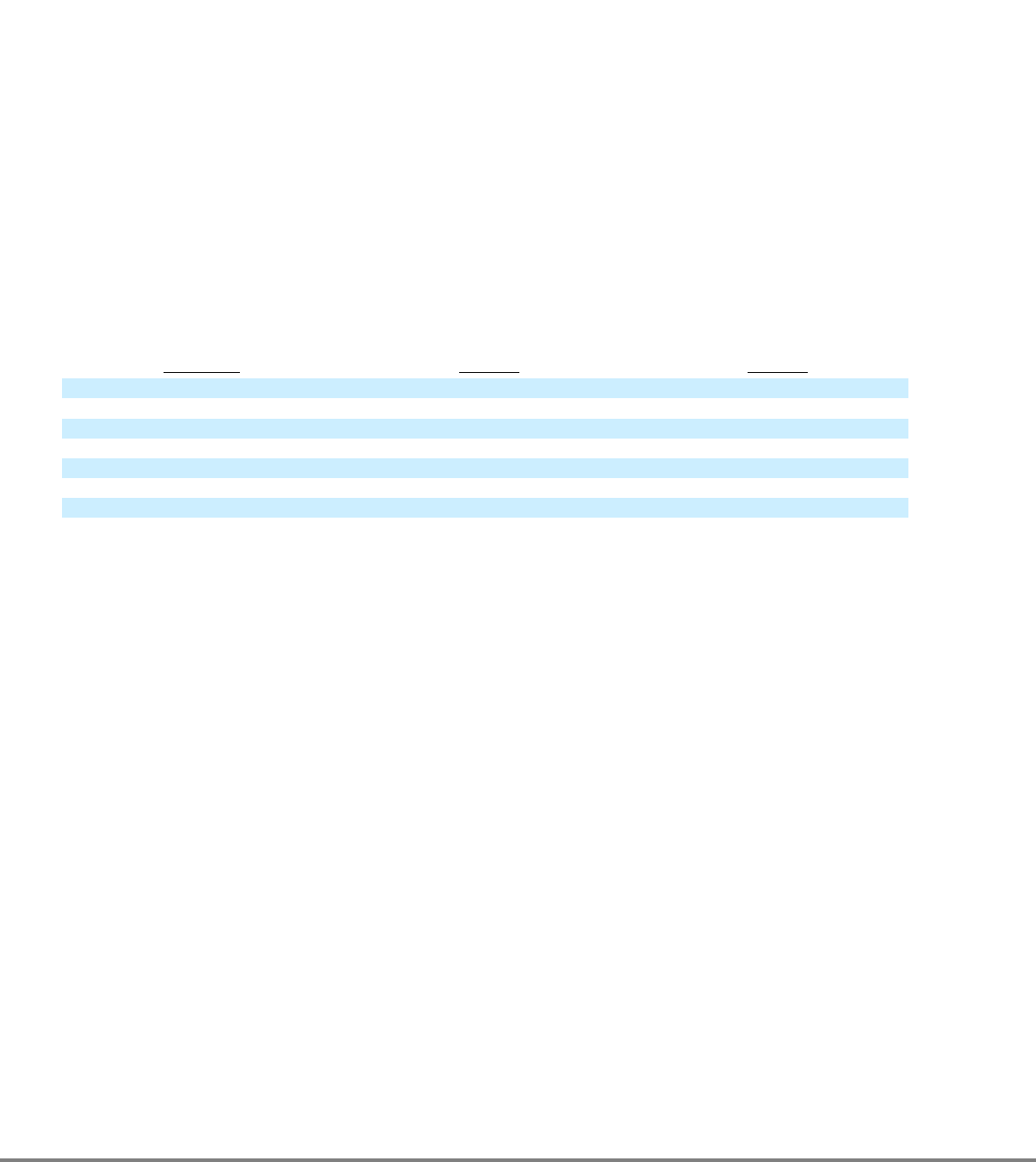

Since the closing of our initial public offering in December 2002, we have paid dividends, pursuant to our

quarterly dividend policy totaling approximately $604 million in the aggregate. The following are dividends paid in

the last two fiscal years:

Because we had current earnings and profits in excess of distributions for our taxable year ended June 29, 2007,

distributions on our common shares to U.S. shareholders during this period were treated as dividend income for

U.S. federal income tax purposes. We anticipate that we will have earnings and profits in excess of distributions in

fiscal year 2008. Therefore, distributions to U.S. shareholders in fiscal year 2008 are anticipated to be treated as

dividend income for U.S. federal income tax purposes. Non-U.S. shareholders should consult with a tax advisor to

determine appropriate tax treatment.

Furthermore, we believe that we were a foreign personal holding company for U.S. federal income tax purposes

for our taxable years ended July 1, 2005 and July 2, 2004. Pursuant to the American Jobs Creation Act of 2004,

foreign corporations will be excluded from the application of the personal holding company rules of the Internal

Revenue Code of 1986, as amended (the “Code”), effective for taxable years of foreign corporations beginning after

December 31, 2004. For us, the effective date was our fiscal year beginning July 2, 2005. As a result, if taxable

distributions on our common shares are made after July 1, 2005, U.S. shareholders who are individuals may be

eligible for reduced rates of taxation applicable to certain dividend income (currently a maximum rate of 15%) on

distributions made after the effective date.

Repurchases of Our Equity Securities

On August 8, 2006, we announced that our board of directors had authorized the use of up to $2.5 billion for the

repurchase of our outstanding common shares over a two-year period. From the authorization of this repurchase

program and through the fiscal year ended June 29, 2007, we repurchased approximately 62.0 million shares at an

average price of $24.62, all of which were considered cancelled and are no longer outstanding. We repurchased these

shares through a combination of open market purchases and prepaid forward agreements with large financial

institutions, according to which we prepaid the financial institutions a fixed amount to deliver a variable number of

shares at future dates. We entered into these agreements in order to take advantage of repurchasing shares at a

guaranteed discount to the Volume Weighted Average Price (“VWAP”) of our common shares. Our policy to date

33

Dividend

Record Date

Paid Date

per Share

August 5, 2005

August 19, 2005

$0.08

November 4, 2005

November 18, 2005

$0.08

February 3, 2006

February 17, 2006

$0.08

May 5, 2006

May 19, 2006

$0.08

August 18, 2006

September 1, 2006

$0.08

November 3, 2006

November 17, 2006

$0.10

February 2, 2007

February 16, 2007

$0.10

May 4, 2007

May 18, 2007

$0.10