Seagate 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

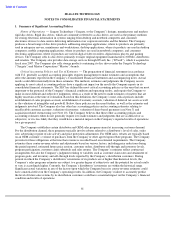

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

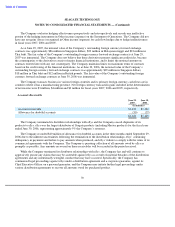

classified as cash equivalents or short-term investments and are stated at fair value with unrealized gains and losses

included in accumulated other comprehensive income (loss), which is a component of shareholders’ equity. The

amortized cost of debt securities is adjusted for amortization of premiums and accretion of discounts to maturity.

Such amortization and accretion are included in interest income. Realized gains and losses are included in other

income (expense). The cost of securities sold is based on the specific identification method. The Company invests in

auction rate securities. Auction rate securities that have stated maturities greater than three months, are classified as

marketable securities unless they are purchased three months or less from contractual maturity.

Strategic Investments — The Company enters into certain strategic investments for the promotion of business

and strategic objectives and typically does not attempt to reduce or eliminate the inherent market risks on these

investments. Both marketable and non-marketable investments are included in the accompanying balance sheets in

other assets, net. Non-marketable investments are recorded at cost and are periodically analyzed to determine

whether or not there are indicators of impairment. The carrying value of the Company’s strategic investments at

June 29, 2007 and June 30, 2006 totaled $25 million and $11 million, respectively.

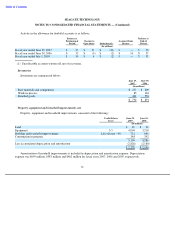

Concentration of Credit Risk — The Company’s customer base for disc drive products is concentrated with a

small number of OEMs and distributors. Financial instruments, which potentially subject the Company to

concentrations of credit risk, are primarily accounts receivable, cash equivalents and short-term investments. The

Company performs ongoing credit evaluations of its customers’ financial condition and, generally, requires no

collateral from its customers. The allowance for doubtful accounts is based upon the expected collectibility of all

accounts receivable. The Company places its cash equivalents and short-term investments in investment-grade,

highly liquid debt instruments and limits the amount of credit exposure to any one issuer.

Supplier Concentration — Certain of the raw materials and components used by the Company in the

manufacture of its products are available from a limited number of suppliers. Shortages could occur in these essential

materials and components due to an interruption of supply or increased demand in the industry. If the Company were

unable to procure certain of such materials or components, it would be required to reduce its manufacturing

operations, which could have a material adverse effect on its results of operations. In addition, the Company has

made prepayments to certain suppliers. Should these suppliers be unable to deliver on their obligations or experience

financial difficulty, the Company may not be able to recover these prepayments.

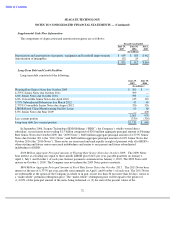

Newly Adopted and Recently Issued Accounting Pronouncements — In February 2007, the FASB issued

SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities — Including an Amendment of

FASB Statement No. 115

(“SFAS No. 159”). SFAS No. 159 permits entities to choose to measure many financial

instruments and certain other items at fair value. Unrealized gains and losses on items for which the fair value option

has been elected will be recognized in earnings at each subsequent reporting date. SFAS No. 159 is effective for

financial statements issued for fiscal years beginning after November 15, 2007. The Company is currently evaluating

the impact that the adoption of SFAS No. 159 will have on its consolidated results of operations and financial

condition.

In September 2006, the FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans — An Amendment of FASB No. 87, 88, 106 and 132(R) (“SFAS No. 158”).

SFAS No. 158 requires that the funded status of defined benefit postretirement plans be recognized on a company’s

balance sheet, and changes in the funded status be reflected in comprehensive income, effective for fiscal years

ending after December 15, 2006, which the Company adopted in its fiscal year ended June 29, 2007 and did not have

a material impact on our consolidated results of operations or financial condition. SFAS No. 158 also requires

companies to measure the funded status of the plan as of the date of its fiscal year-end, effective for fiscal years

ending after December 15, 2008. The Company expects to adopt the measurement provisions of SFAS No. 158 in its

fiscal year 2010, effective June 30, 2009. The Company does not expect the adoption of SFAS No. 158 to have a

material impact on its consolidated results of operations or financial condition.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS No. 157”) which

defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and

65