Seagate 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

longer realizable as a result of the Maxtor acquisition and Seagate filing U.S. tax returns with Maxtor on a

consolidated basis in subsequent years.

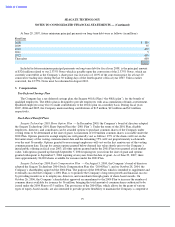

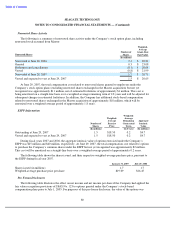

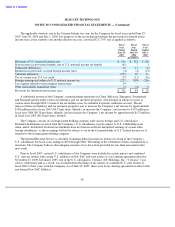

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The significant

components of the Company’s deferred tax assets and liabilities were as follows:

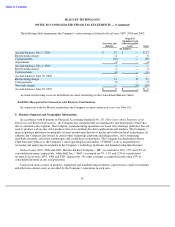

During fiscal year 2007 the Company reduced its valuation allowance recorded in prior years for deferred tax

assets by $641 million of which $319 million was recorded as a deferred tax benefit and $322 million was recorded a

as reduction to Maxtor goodwill. The release of the previously recorded U.S. valuation allowance was largely due to

the completion during 2007 of the restructuring of the Company’

s intercompany arrangements, which will enable the

Company to forecast future U.S. taxable income with greater certainty and U.S. taxable income from the

intercompany sale of certain Maxtor assets.

83

June 29,

June 30,

2007

2006

(In millions)

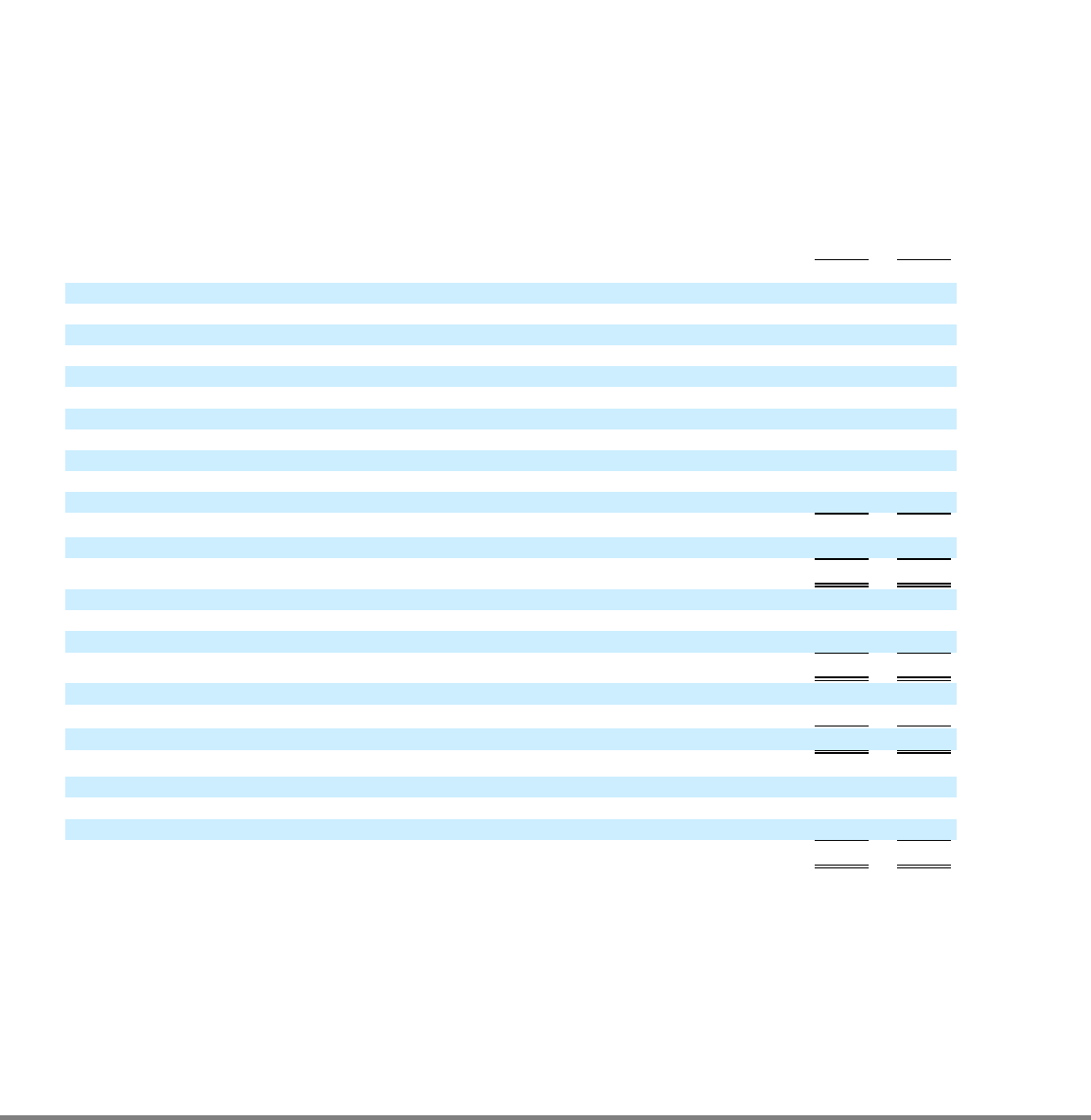

Deferred Tax Assets

Accrued warranty

$

129

$

108

Inventory valuation accounts

32

26

Receivable reserves

22

26

Accrued compensation and benefits

119

86

Depreciation

185

192

Restructuring allowance

16

46

Other accruals and deferred items

115

95

Net operating losses and tax credit carry

-

forwards

436

522

Capitalized research and development

32

62

Other assets

12

10

Total Deferred Tax Assets

1,098

1,173

Valuation allowance

(399

)

(979

)

Net Deferred Tax Assets

$

699

$

194

Deferred Tax Liabilities

Unremitted earnings of certain foreign entities

$

(5

)

$

(78

)

Acquired intangibles assets

(31

)

(42

)

Total Deferred Tax Liabilities

$

(36

)

$

(120

)

Net Deferred Tax Assets/(Liabilities)

$

663

$

74

Deferred taxes on Inter

-

company transactions

$

105

$

4

Total Deferred Tax Assets

$

768

$

78

As Reported on the Balance Sheet

Current assets

—

Deferred Income taxes

$

196

$

48

Non

-

current assets

—

Deferred Tax Assets

574

33

Other non

-

current liabilities

(2

)

(3

)

Total Deferred Income Taxes

$

768

$

78