Seagate 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

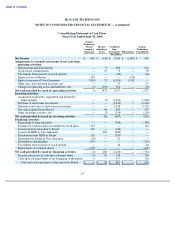

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

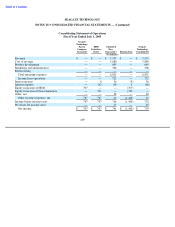

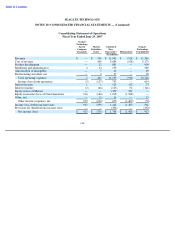

Quarterly Data

The Company operated and reported financial results based on 13 week quarters in fiscal 2007 and 2006, which

ended on the Friday closest to September 30, December 31, March 31, and June 30.

The results for the first quarter of fiscal year 2007 include a $40 million increase in the provision for doubtful

accounts related to the termination of the Company’s distributor relationship with eSys and its related affiliated

entities, approximately $24 million of stock-based compensation, Maxtor’s operating losses and related charges to

the Company’s acquisition of Maxtor which include $34 million in integration and retention costs, net of related tax

effects, $34 million in the amortization of intangibles and $13 million in stock-

based compensation charges related to

Maxtor options assumed and nonvested shares exchanged, net of related tax effects.

The results for the second quarter of fiscal year 2007 include approximately $25 million of stock-based

compensation, $19 million in charges related to the redemption of the Company’s 8% Notes, Maxtor’s operating

losses and charges related to the Company’s acquisition of Maxtor Corporation which include $10 million in

integration and retention costs, net of related tax effects, $40 million in the amortization of intangibles, $18 million in

customer compensatory claims relating to legacy Maxtor products and $7 million in stock-based compensation

charges related to Maxtor options assumed and nonvested shares exchanged.

The results for the third quarter of fiscal year 2007 include approximately $29 million of stock-based

compensation and charges related to the Company’s acquisition of Maxtor, which include $53 million in the

amortization of intangibles.

The results for the fourth quarter include a $359 million tax benefit resulting from a favorable adjustment to the

valuation allowance related to our deferred tax assets, $24 million of stock-based compensation expense, a

$29 million net restructuring and impairment charges and $23 million in amortization of intangibles related to the

Maxtor acquisition.

118

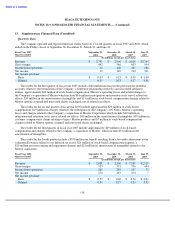

15.

Supplementary Financial Data (Unaudited)

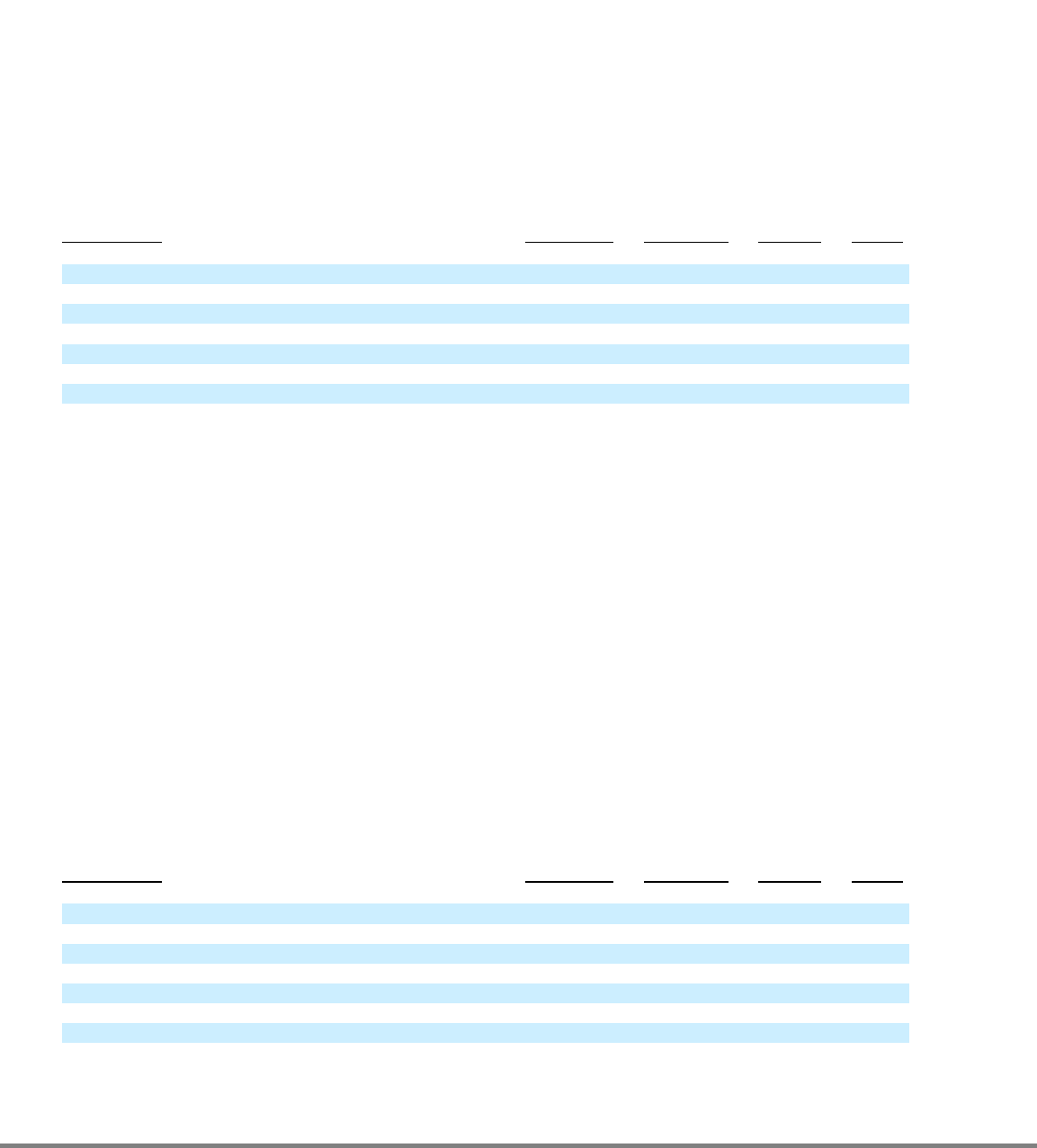

Fiscal Year 2007

September 29,

December 29,

March 30,

June 29,

Quarters Ended

2006

2006

2007

2007

(In millions, except per share data)

Revenue

$

2,793

$

2,996

$

2,828

$

2,744

Gross margin

442

546

603

594

Income from operations

12

166

247

188

Net income

19

140

212

541

Net income per share:

Basic

$

0.03

$

0.25

$

0.39

$

1.00

Diluted

0.03

0.23

0.37

0.96

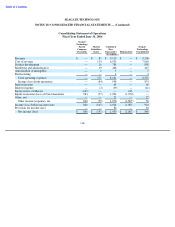

Fiscal Year 2006

September 30,

December 30,

March 31,

June 29,

Quarters Ended

2005

2005

2006

2007

(In millions, except per share data)

Revenue

$

2,088

$

2,300

$

2,289

$

2,529

Gross margin

535

591

556

454

Income from operations

265

284

253

72

Net income

272

287

274

7

Net income per share:

Basic

$

0.57

$

0.60

$

0.56

$

0.01

Diluted

0.54

0.57

0.53

0.01