Seagate 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

deducted from shares outstanding. The agreements require the physical delivery of shares; there were no settlement

alternatives, except in the case of certain defined extraordinary events which are outside the control of Seagate and

the financial institutions. The parameters used to calculate the final number of shares deliverable are the total

notional amount of the contract and the average VWAP of our common shares during the contract period less the

agreed upon discount. The contracts are indexed solely to the price of Seagate’s common shares.

During fiscal year 2007, we repurchased 24.3 million shares through open market repurchases. In addition, we

made payments totaling $950 million under prepaid forward agreements and took delivery of 37.7 million shares

using prepaid forward agreements. Shares physically delivered to us were cancelled and are no longer outstanding.

At June 29, 2007, there were no outstanding prepaid forward agreements to repurchase our common shares.

During the fourth quarter of fiscal year 2006, we repurchased 16.7 million shares under a previously authorized

stock repurchase program. The program authorizing repurchases in the fourth quarter of fiscal year 2006 was

completed and there is no outstanding authority for further shares to be purchased under that program.

In addition, as part of our strategy, we may selectively pursue strategic alliances, acquisitions and investments

that are complementary to our business. Any material future acquisitions, alliances or investments will likely require

additional capital. We may enter into more of these types of arrangements in the future, which could also require us

to seek additional equity or debt financing. Additional funds may not be available on terms favorable to us or at all.

We will require substantial amounts of cash to fund scheduled payments of principal and interest on our

indebtedness, future capital expenditures, any increased working capital requirements and share repurchases. If we

are unable to meet our cash requirements out of existing cash or cash flow from operations, we cannot assure you

that we will be able to obtain alternative financing on terms acceptable to us, if at all.

We believe that our sources of cash will be sufficient to fund our operations and meet our cash requirements for

at least the next 12 months. Our ability to fund these requirements and comply with the financial covenants under our

debt agreements will depend on our future operations, performance and cash flow and is subject to prevailing

economic conditions and financial, business and other factors, some of which are beyond our control.

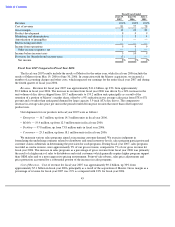

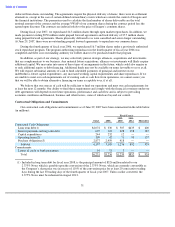

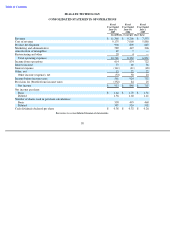

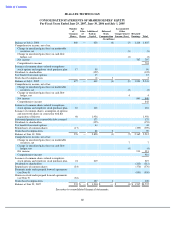

Contractual Obligations and Commitments

Our contractual cash obligations and commitments as of June 29, 2007 have been summarized in the table below

(in millions):

51

Fiscal Year(s)

2009-

2011-

Total

2008

2010

2012

Thereafter

Contractual Cash Obligations:

Long term debt(1)

$

2,072

$

330

$

507

$

635

$

600

Interest payments on long

-

term debt

695

122

228

158

187

Capital expenditures

244

232

12

—

—

Operating leases(2)

309

42

71

59

137

Purchase obligations(3)

2,877

2,459

418

—

—

Subtotal

6,197

3,185

1,236

852

924

Commitments:

Letters of credit or bank guarantees

54

51

3

—

—

Total

$

6,251

$

3,236

$

1,239

$

852

$

924

(1)

Included in long term debt for fiscal year 2008, is the principal amount of $326 million related to our

2.375% Notes which is payable upon the conversion of the 2.375% Notes, which are currently convertible as

the Company’s share price was in excess of 110% of the conversion price for at least 20 consecutive trading

days during the last 30 trading days of the fourth quarter of fiscal year 2007. Unless earlier converted, the

2.375% Notes must be redeemed in August 2012.