Seagate 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

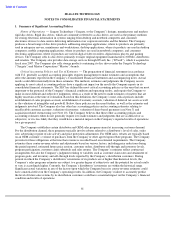

We are required to periodically evaluate the carrying values of our intangible assets for impairment. If any of

our intangible assets are determined to be impaired, we may have to write down the impaired asset and our earnings

would be adversely impacted in the period that occurs.

At June 29, 2007, our goodwill totaled approximately $2.3 billion and our identifiable other intangible assets

totaled $188 million. In accordance with the provisions of SFAS No. 142, Goodwill and Other Intangible Assets

(“SFAS No. 142”), we assess the impairment of goodwill at least annually, or more often if warranted by events or

changes in circumstances indicating that the carrying value may exceed its fair value. This assessment may require

the projection and discounting of cash flows, analysis of our market capitalization and estimating the fair values of

tangible and intangible assets and liabilities. Estimates of cash flow are based upon, among other things, certain

assumptions about expected future operating performance; judgment is also exercised in determining an appropriate

discount rate. Our estimates of discounted cash flows may differ from actual cash flows due to, among other things,

economic conditions, changes to the business model, or changes in operating performance. Significant differences

between these estimates and actual cash flows could materially affect our future financial results.

Recent Accounting Pronouncements

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities

— Including an Amendment of FASB Statement No. 115 (“SFAS No. 159”). SFAS No. 159 permits

entities to choose to measure many financial instruments and certain other items at fair value. Unrealized gains and

losses on items for which the fair value option has been elected will be recognized in earnings at each subsequent

reporting date. SFAS No. 159 is effective for financial statements issued for fiscal years beginning after

November 15, 2007. We are currently evaluating the impact that the adoption of SFAS No. 159 will have on our

consolidated results of operations and financial condition.

In September 2006, the FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans — An Amendment of FASB No. 87, 88, 106 and 132(R) (“SFAS No. 158”).

SFAS No. 158 requires that the funded status of defined benefit postretirement plans be recognized on a company’s

balance sheet, and changes in the funded status be reflected in comprehensive income, effective fiscal years ending

after December 15, 2006, which we adopted in our fiscal year ended June 29, 2007 and did not have a material

impact on our consolidated results of operations or financial condition. SFAS No. 158 also requires companies to

measure the funded status of the plan as of the date of its fiscal year-end, effective for fiscal years ending after

December 15, 2008. We expect to adopt the measurement provisions of SFAS No. 158 in our fiscal year 2010,

effective June 30, 2009. We do not expect the adoption of SFAS No. 158 to have a material impact on our

consolidated results of operations or financial condition.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS No. 157”) which

defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and

expands disclosures about fair value measurements. This Statement applies under other accounting pronouncements

that require or permit fair value measurements, the FASB having previously concluded in those accounting

pronouncements that fair value is the relevant measurement attribute. Accordingly, this Statement does not require

any new fair value measurements. However, for some entities, the application of this Statement will change current

practice. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15,

2007, and interim periods within those fiscal years. We are currently evaluating the effect that the adoption of

SFAS No. 157 will have on our consolidated results of operations and financial condition.

In June 2006, the FASB issued FASB Interpretation No. (FIN) 48, Accounting for Uncertainty in Income

Taxes — An Interpretation of FASB Statement No. 109 (“FIN No. 48”). This Interpretation clarifies the accounting

for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with SFAS No. 109.

This Interpretation prescribes a recognition threshold and measurement attribute for the financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return. This Interpretation is

effective for fiscal years beginning after December 15, 2006 and will be adopted by us in the first quarter of fiscal

year 2008. We are currently evaluating the effect that the adoption of FIN No. 48 will have on our consolidated

results of operations and financial condition.

54