Seagate 2006 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

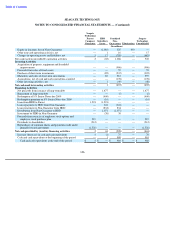

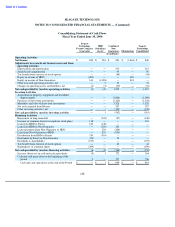

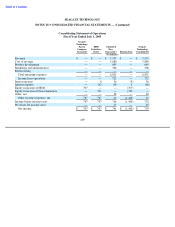

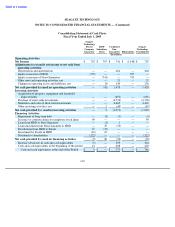

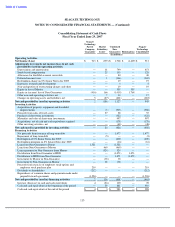

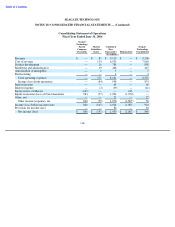

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Consolidating Statement of Cash Flows

Fiscal Year Ended June 29, 2007

115

Seagate

Technology

Parent

Maxtor

Combined

Seagate

Company

Subsidiary

Non

-

Technology

Guarantor

Issuer

Guarantors

Eliminations

Consolidated

(In millions)

Operating Activities

Net Income (Loss)

$

913

$

(359

)

$

1,768

$

(1,409

)

$

913

Adjustments to reconcile net income (loss) to net cash

provided by (used in) operating activities:

Depreciation and amortization

—

61

790

—

851

Stock

-

based compensation

—

25

103

—

128

Allowance for doubtful accounts receivable

—

—

40

—

40

Deferred income taxes

—

1

(366

)

—

(

365

)

Redemption charge on 8% Senior Notes due 2009

—

—

19

—

19

In

-

process research and development

—

—

4

—

4

Non

-

cash portion of restructuring charges and other

—

—

19

—

19

Equity in loss of Maxtor

—

—

359

359

—

Equity in (income) loss of Non

-

Guarantors

(916

)

166

(1,018

)

1,768

—

Other non

-

cash operating activities, net

—

7

10

—

17

Changes in operating assets and liabilities, net

5

(87

)

(601

)

—

(

683

)

Net cash provided by (used in) operating activities

2

(186

)

1,127

—

943

Investing Activities

Acquisition of property, equipment and leasehold

improvements

—

(

3

)

(903

)

—

(

906

)

Proceeds from sales of fixed assets

—

27

28

—

55

Purchase of short

-

term investments

—

—

(

322

)

—

(

322

)

Maturities and sales of short

-

term investments

—

—

997

—

997

Acquisitions, net of cash and cash equivalents acquired

—

—

(

178

)

—

(

178

)

Other investing activities, net

—

—

(

48

)

—

(

48

)

Net cash (used in) provided by investing activities

—

24

(426

)

—

(

402

)

Financing Activities

Net proceeds form issuance of long

-

term debt

—

—

1,477

—

1,477

Repayment of long

-

term debt

—

(

5

)

—

—

(

5

)

Redemption of 8% Senior Notes due 2009

—

—

(

400

)

—

(

400

)

Redemption premium on 8% Senior Notes due 2009

—

—

(

16

)

—

(

16

)

Loan from Non

-

Guarantor to Parent

1,521

—

(

1,521

)

—

—

Loan from Non

-

Guarantor to Maxtor

—

465

(465

)

—

—

Loan repayment to Non

-

Guarantor from Maxtor

—

(

324

)

324

—

—

Distribution from Non

-

Guarantor to HDD

—

—

(

1,071

)

1,071

—

Distribution to HDD from Non

-

Guarantor

—

—

1,071

(1,071

)

—

Investment by Maxtor in Non

-

Guarantor

—

(

38

)

38

—

—

Investment by Non

-

Guarantor in Maxtor

—

38

(38

)

—

—

Proceeds from exercise of employee stock options and

employee stock purchase plan

219

—

—

—

219

Dividends to shareholders

(212

)

—

—

—

(

212

)

Repurchases of common shares and payments made under

prepaid forward agreements

(1,526

)

—

—

—

(

1,526

)

Net cash provided by (used in) financing activities

2

136

(601

)

—

(

463

)

Increase (decrease) in cash and cash equivalents

4

(26

)

100

—

78

Cash and cash equivalents at the beginning of the period

—

29

881

—

910

Cash and cash equivalents at the end of the period

$

4

$

3

$

981

$

—

$

988