Seagate 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

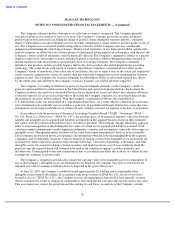

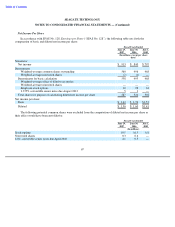

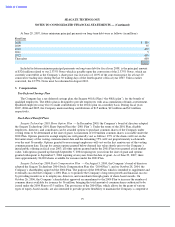

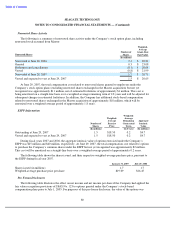

Activity in the allowance for doubtful accounts is as follows:

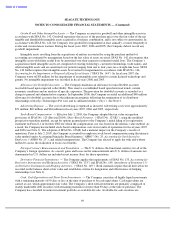

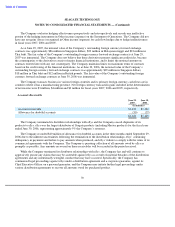

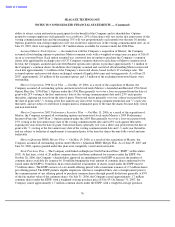

Inventories

Inventories are summarized below:

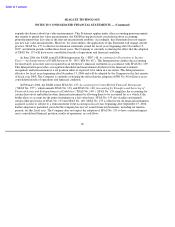

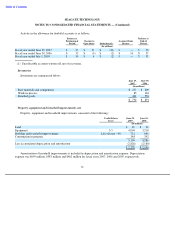

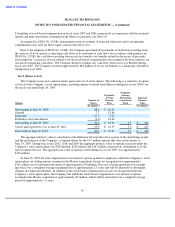

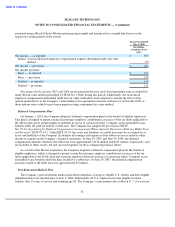

Property, equipment and leasehold improvements, net

Property, equipment and leasehold improvements consisted of the following:

Amortization of leasehold improvements is included in depreciation and amortization expense. Depreciation

expense was $699 million, $583 million and $462 million for fiscal years 2007, 2006 and 2005, respectively.

71

Balance at

Balance at

Beginning of

Charges to

Assumed from

End of

Period

Operations

Deductions(1)

Maxtor

Period

(In millions)

Fiscal year ended June 29, 2007

$

37

$

37

$

(24

)

$

—

$

50

Fiscal year ended June 30, 2006

$

32

$

(3

)

$

(2

)

$

10

$

37

Fiscal year ended July 1, 2005

$

30

$

4

$

(2

)

$

—

$

32

(1)

Uncollectible accounts written off, net of recoveries.

June 29,

June 30,

2007

2006

(In millions)

Raw materials and components

$

277

$

209

Work

-

in

-

process

85

126

Finished goods

432

556

$

794

$

891

Useful Life in

June 29,

June 30,

Years

2007

2006

(In millions)

Land

$

21

$

30

Equipment

3

-

5

4,004

3,218

Building and leasehold improvements

Life of lease

-

48

731

646

Construction in progress

348

392

5,104

4,286

Less accumulated depreciation and amortization

(2,826

)

(2,180

)

$

2,278

$

2,106