Salesforce.com 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

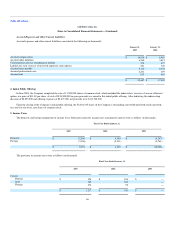

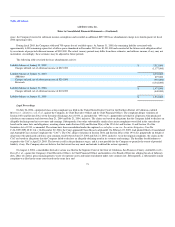

allegations, entitled Johnson v. Benioff, et al. The two actions have been consolidated under the caption Borrelli v. Benioff, Case No. CGC-04-433615 (Cal.

Super. Ct., S.F. Cty.). On October 5, 2004, plaintiffs filed a consolidated complaint, which is based upon the same facts and circumstances as alleged in the

shareholder class action discussed above, and asserts that the defendants breached their fiduciary duties by making or failing to prevent salesforce.com, inc.

and its management from making statements or omissions that potentially subject the Company to liability and injury to its reputation. The action seeks

damages on behalf of salesforce.com in an unspecified amount, among other forms of legal and equitable relief. Salesforce.com is named solely as a nominal

defendant against which no recovery is sought. The plaintiff shareholders made no demand upon the Board of Directors prior to filing these actions. The

deadline for defendants to respond to the consolidated complaint is June 16, 2005. The derivative action is still in the preliminary stages, and it is not possible

for the Company to quantify the extent of potential liability to the individual defendants, if any. Management does not believe that the lawsuits have any merit

and intends to defend the actions vigorously.

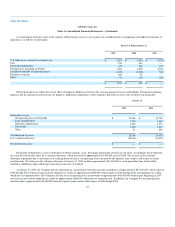

Additionally, the Company is and may become involved in various legal proceedings arising from the normal course of its business activities. In

management's opinion, resolution of these matters is not expected to have a material adverse impact on the Company's consolidated results of operations, cash

flows or its financial position. However, depending on the nature and timing of any such dispute, an unfavorable resolution of a matter could materially affect

the Company's future results of operations, cash flows or financial position in a particular period.

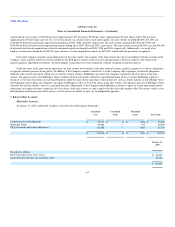

9. Employee Benefit Plan

The Company has a 401(k) plan covering all eligible employees. The Company is not required to contribute to the plan and has made no contributions

through January 31, 2005.

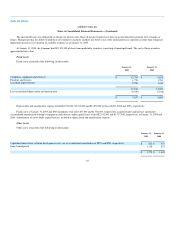

10. Related-Party Transactions

In January 1999, the salesforce.com/foundation, commonly referred to as the Foundation, a non-profit public charity, was chartered to build

philanthropic programs that are particularly focused on youth and technology. The Company's chairman is the chairman of the Foundation. He, one of the

Company's executive officers and one of the Company's board members hold three of the Foundation's eight board seats. The Company is not the primary

beneficiary of the Foundation's activities, and accordingly, the Company does not consolidate the Foundation's statement of activities with its financial results.

Since the Foundation's inception, the Company has provided at no charge certain resources to Foundation employees such as office space. The value of

these items totals approximately $30,000 per quarter.

In addition to the resource sharing with the Foundation, the Company issued the Foundation warrants in August 2002 to purchase 500,000 shares of

common stock and has donated subscriptions to the Company's service to qualified non-profit organizations. The fair value of these donated subscriptions is

currently approximately $300,000 per month. The Company plans to continue providing free subscriptions to qualified nonprofit organizations.

74