Salesforce.com 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

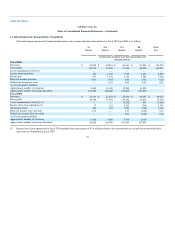

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

stock-based compensation during fiscal 2005, 2004 and 2003, respectively. The compensation expense is being recognized on a straight-line basis over the

option-vesting period of four years.

During fiscal 2004 and 2003, the Company accelerated the vesting of certain stock options relating to terminated employees. As a result, the Company

recorded compensation expense totaling $146,000 and $178,000, respectively. The Company did not accelerate the vesting of any stock options during fiscal

2005.

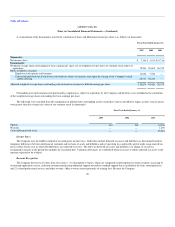

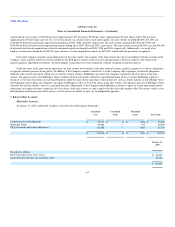

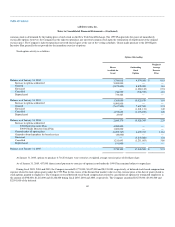

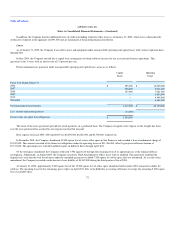

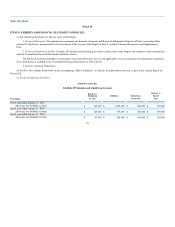

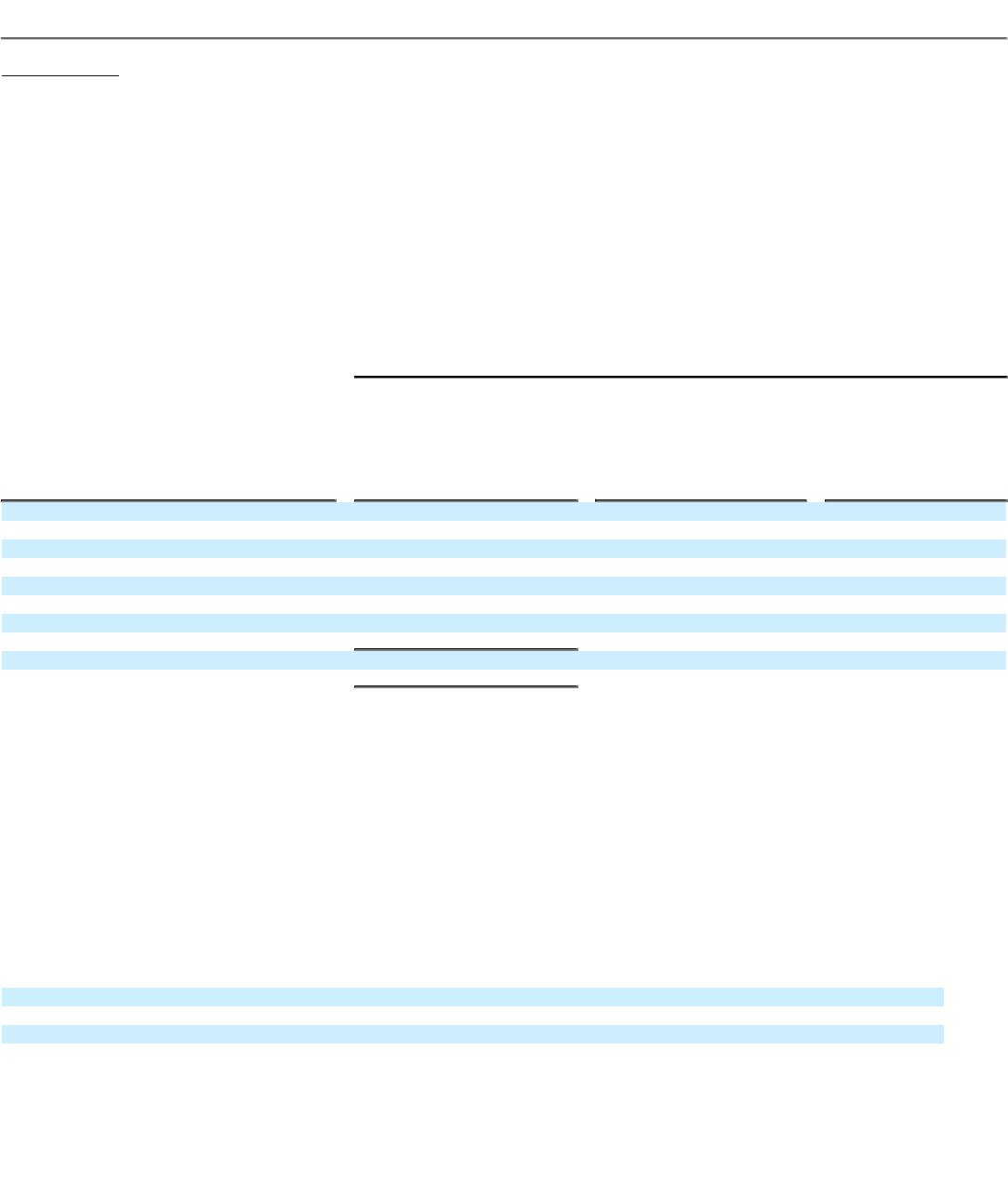

The following table summarizes information about stock options outstanding as of January 31, 2005:

Options Outstanding

Range of

Exercise Prices

Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life (Years)

Weighted-

Average

Exercise

Price

$0.03 to $0.95 919,043 5.66 $ 0.04

$1.10 3,927,492 7.56 1.10

$1.25 to $2.00 234,672 5.84 1.85

$2.50 4,210,857 8.40 2.50

$4.00 to $6.00 1,141,275 8.74 4.86

$8.00 3,592,110 9.14 8.00

$12.77 to $18.45 3,340,140 9.79 14.93

17,365,589 $ 5.74

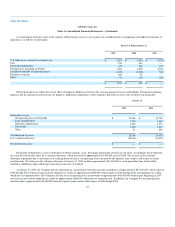

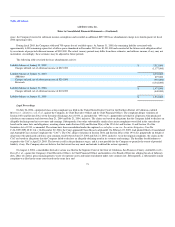

Notes Receivable from Stockholders

During fiscal 2001, certain employees exercised their stock options with notes. None of these employees is an executive officer or director. The notes

are full recourse and collateralized by the stock of the individuals. The notes bear an interest rate of 6 percent. The notes receivable have been classified as a

reduction of stockholders' equity and are due at various dates through September 2005. During fiscal 2003, the Company terminated one of these employees

and repurchased the unvested shares through cancellation of $109,000 of the related note receivable. During the fourth quarter of fiscal 2005, the Company

collected $1,043,000 from two individuals in full satisfaction of the outstanding principal and interest balances. The remaining principal and interest of

$727,000 at January 31, 2005 was collected in full from the remaining individuals in February 2005.

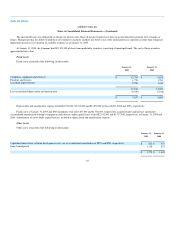

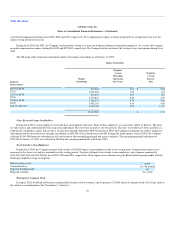

Stock Awards to Non-Employees

During fiscal 2004, the Company granted stock awards of 100,000 shares to non-employees with 4 year vesting terms. Compensation expense is re-

measured as the shares vest and was recorded over the vesting periods. Together with past stock awards to non-employees, such expenses amounted to

$167,000, $162,000 and $310,000 for fiscal 2005, 2004 and 2003, respectively. Such expense was estimated using the Black-Scholes pricing model with the

following weighted-average assumptions:

Risk-free interest rate 6.00%

Contractual lives 18—48 months

Expected dividend yield 0%

Expected volatility 75—100%

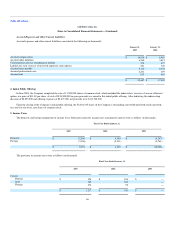

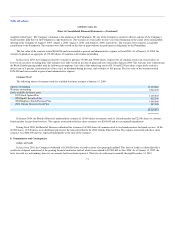

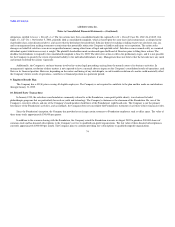

Warrants for Common Stock

In August 2002, the Board of Directors authorized the issuance of four warrants, each to purchase 125,000 shares of common stock at $1.10 per share to

the salesforce.com/foundation (the "Foundation"), which is a

70