Salesforce.com 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

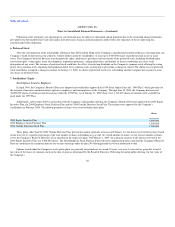

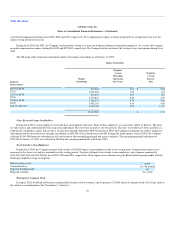

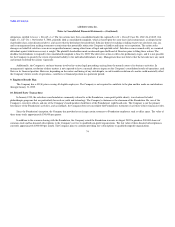

nonprofit related party. The Company's chairman is the chairman of the Foundation. He, one of the Company's executive officers and one of the Company's

board members hold three of the Foundation's eight board seats. The warrants are exercisable for one-year terms beginning on the earlier of the initial public

offering of the Company or August 1 2003, August 1, 2004, August 1, 2005, and August 1, 2006, respectively. The warrants were issued as a charitable

contribution to the Foundation. The warrants were fully vested on the date of grant without any performance obligations by the Foundation.

The fair value of the warrants totaled $656,000 and was recorded as general and administrative expense in fiscal 2003. As of January 31, 2005, the

warrants to purchase an aggregate of 375,000 shares of common stock remain outstanding.

In fiscal year 2003, the Company issued two warrants to purchase 50,000 and 35,000 shares, respectively, of common stock at an exercise price of

$1.10 to an executive recruiting firm. The warrants were fully vested on the date of grant and were exercised in January 2005. The warrants were valued using

the Black-Scholes pricing model with the following assumptions: fair value of the underlying stock of $1.96 and $2.50 per share, respectively; risk-free

interest rate of 5 percent; contractual life of five years; no dividends during the term; and volatility of 100 percent. The fair value of the warrants totaled

$153,000 and was recorded as general and administrative expense.

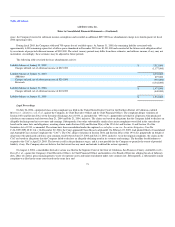

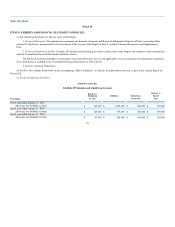

Common Stock

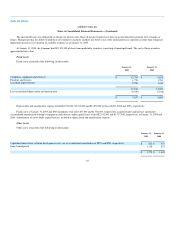

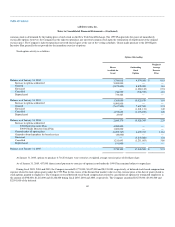

The following shares of common stock are available for future issuance at January 31, 2005:

Options outstanding 17,365,589

Warrants outstanding 1,040,639

Stock available for future grant:

1999 Stock Option Plan 1,139,445

2004 Equity Incentive Plan 632,360

2004 Employee Stock Purchase Plan 1,000,000

2004 Outside Directors Stock Plan 987,500

22,165,533

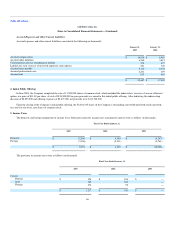

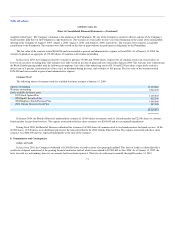

In January 2004, the Board of Directors authorized the issuance of 10,000 shares of common stock to a board member and 22,500 shares to a former

board member for past board services. The expense associated with these share issuances was $260,000 and was recognized immediately.

During fiscal 2005, the Board of Directors authorized the issuance of 40,000 shares of common stock to two board members for board services. Of the

40,000 shares, 12,500 shares were distributed pursuant to the terms described in the 2004 Outside Directors Plan. The expense associated with these share

issuances was $646,000 and was expensed immediately at the time of the issuances.

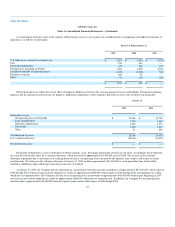

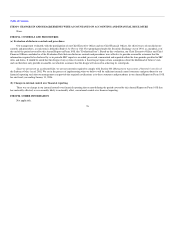

8. Commitments and Contingencies

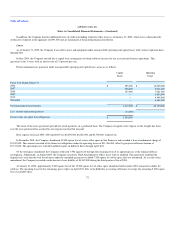

Letters of Credit

In fiscal year 2001, the Company established a $3,500,000 letter of credit in favor of its principal landlord. This letter of credit is collateralized by a

certificate of deposit maintained at the granting financial institution, both of which were reduced to $2,800,000 in June 2004. As of January 31, 2005, the

letter of credit was outstanding; however, no amounts had been drawn against it. The letter of credit renews annually through December 31, 2010.

71