Salesforce.com 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

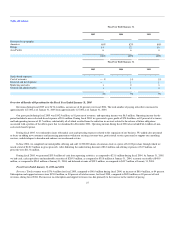

common stock, $0.001 par value, effective on June 22, 2004. The underwriters were Morgan Stanley & Co. Incorporated, Deutsche Bank Securities

Inc., UBS Securities LLC, Wachovia Capital Markets, LLC and William Blair & Company, L.L.C.

Our initial public offering commenced on June 23, 2004. All 11,500,000 shares of common stock registered under the Registration Statement,

which included 1,500,000 shares of common stock covered by an over-allotment option granted to the underwriters, were sold to the public at a price of

$11.00 per share. All of the shares of common stock were sold by us and there were no selling shareholders in the offering. The offering did not

terminate until after the sale of all of the securities registered by the Registration Statement.

The aggregate gross proceeds from the shares of common stock sold were $126.5 million. The aggregate net proceeds to us were $113.8 million

after deducting $8.8 million in underwriting discounts and commissions and $3.9 million in other costs incurred in connection with the offering.

We have not spent any of the net proceeds from our public offering.

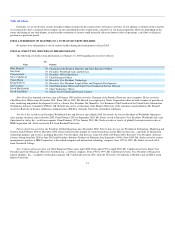

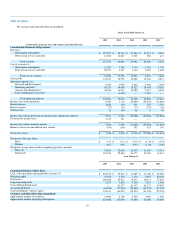

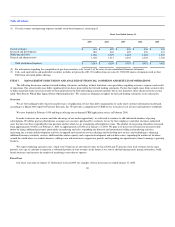

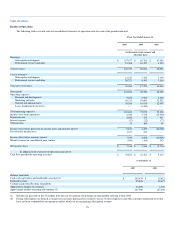

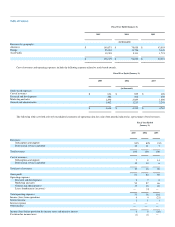

ITEM 6. SELECTED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with our audited consolidated financial statements and related notes

thereto and with Management's Discussion and Analysis of Financial Condition and Results of Operations, which are included elsewhere in this Form 10-K.

The consolidated statement of operations data for the years ended January 31, 2005, 2004 and 2003, and the selected consolidated balance sheet data as of

January 31, 2005 and 2004 are derived from, and are qualified by reference to, the audited consolidated financial statements and are included in this Form 10-

K. The consolidated statement of operations data for the years ended January 31, 2002 and 2001 and the consolidated balance sheet data as of January 31,

2003, 2002 and 2001 are derived from audited consolidated financial statements which are not included in this Form 10-K.

18