Salesforce.com 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

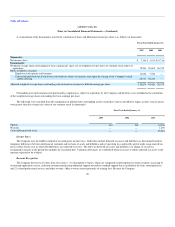

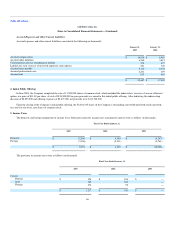

Software and Website Development Costs

The Company follows the guidance of Emerging Issues Task Force ("EITF") Issue No. 00-2, Accounting for Web Site Development Costs ("EITF

00-2"), and EITF Issue No. 00-3, Application of AICPA Statement of Position 97-2 to Arrangements That Include the Right to Use Software Stored on

Another Entity's Hardware ("EITF 00-3"). EITF 00-2 sets forth the accounting for website development costs based on the website development activity.

EITF 00-3 sets forth the accounting for software in a hosting arrangement. As such, the Company follows the guidance set forth in Statement of Position 98-1,

Accounting for the Cost of Computer Software Developed or Obtained for Internal Use ("SOP 98-1"), in accounting for the development of its on-demand

application service. SOP 98-1 requires companies to capitalize qualifying computer software costs, which are incurred during the application development

stage and amortize them over the software's estimated useful life of three years.

The Company capitalized $465,000, $453,000 and $364,000 during fiscal 2005, 2004, and 2003, respectively. Amortization expense totaled $396,000,

$277,000 and $186,000 during fiscal 2005, 2004 and 2003, respectively.

Comprehensive Income (Loss)

Comprehensive income (loss) consists of net income and other comprehensive income. Other comprehensive income includes certain changes in equity

that are excluded from net income (loss). Specifically, cumulative foreign currency translation and unrealized gains and losses on marketable securities

adjustments, net of tax, are included in accumulated other comprehensive income. Comprehensive income (loss) has been reflected in the consolidated

statements of convertible preferred stock and stockholders' equity.

Accumulated other comprehensive income (loss) totaled $(1,009,000), $4,000 and $214,000 during fiscal 2005, 2004 and 2003, respectively.

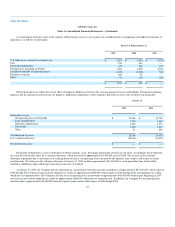

Accounting for Stock-Based Compensation

The Company accounts for compensation expense for its stock-based employee compensation plans using the intrinsic value method prescribed in

Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees ("APB 25"), and complies with the disclosure provisions of SFAS

No. 123, Accounting for Stock-Based Compensation ("SFAS 123"), and SFAS No. 148, Accounting for Stock-Based Compensation—Transition and

Disclosure. Under APB 25, compensation expense of fixed stock options is based on the difference, if any, on the date of the grant between the deemed fair

value of the Company's stock and the exercise price of the option. Compensation expense is recognized on a straight-line basis over the option-vesting period

of four years. The Company accounts for stock issued to nonemployees in accordance with the provisions of SFAS 123 and EITF Issue No. 96-18, Accounting

for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services.

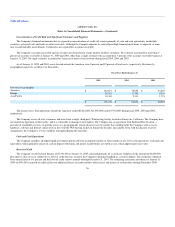

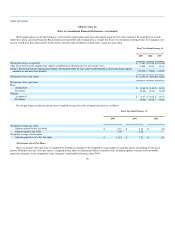

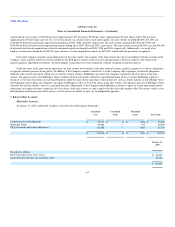

Pro forma information regarding the results of operations is determined as if the Company had accounted for its employee stock options using the fair-

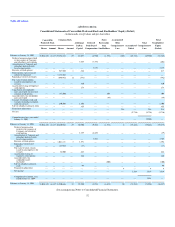

value method. The fair value of each option grant is estimated on the date of grant using the Black-Scholes method with the following assumptions:

Fiscal Year Ended January 31,

2005

2004

2003

Volatility 75—100% 100% 100%

Weighted-average estimated life 4 years 4 years 4 years

Weighted-average risk-free interest rate 2.86—3.70% 2.92% 1.67%

Dividend yield — — —

58