Salesforce.com 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

common stock is determined by the trading price of such stock on the New York Stock Exchange. The 1999 Plan provides for grants of immediately

exercisable options; however, the Company has the right to repurchase any unvested common stock upon the termination of employment at the original

exercise price. The Company's right to repurchase unvested shares lapses at the rate of the vesting schedules. Grants made pursuant to the 2004 Equity

Incentive Plan generally do not provide for the immediate exercise of options.

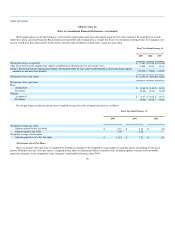

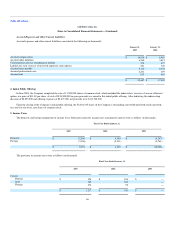

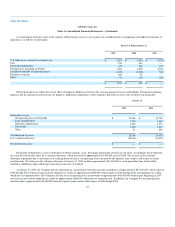

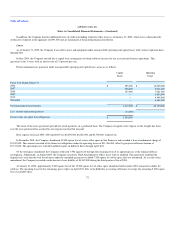

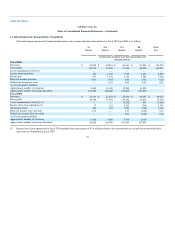

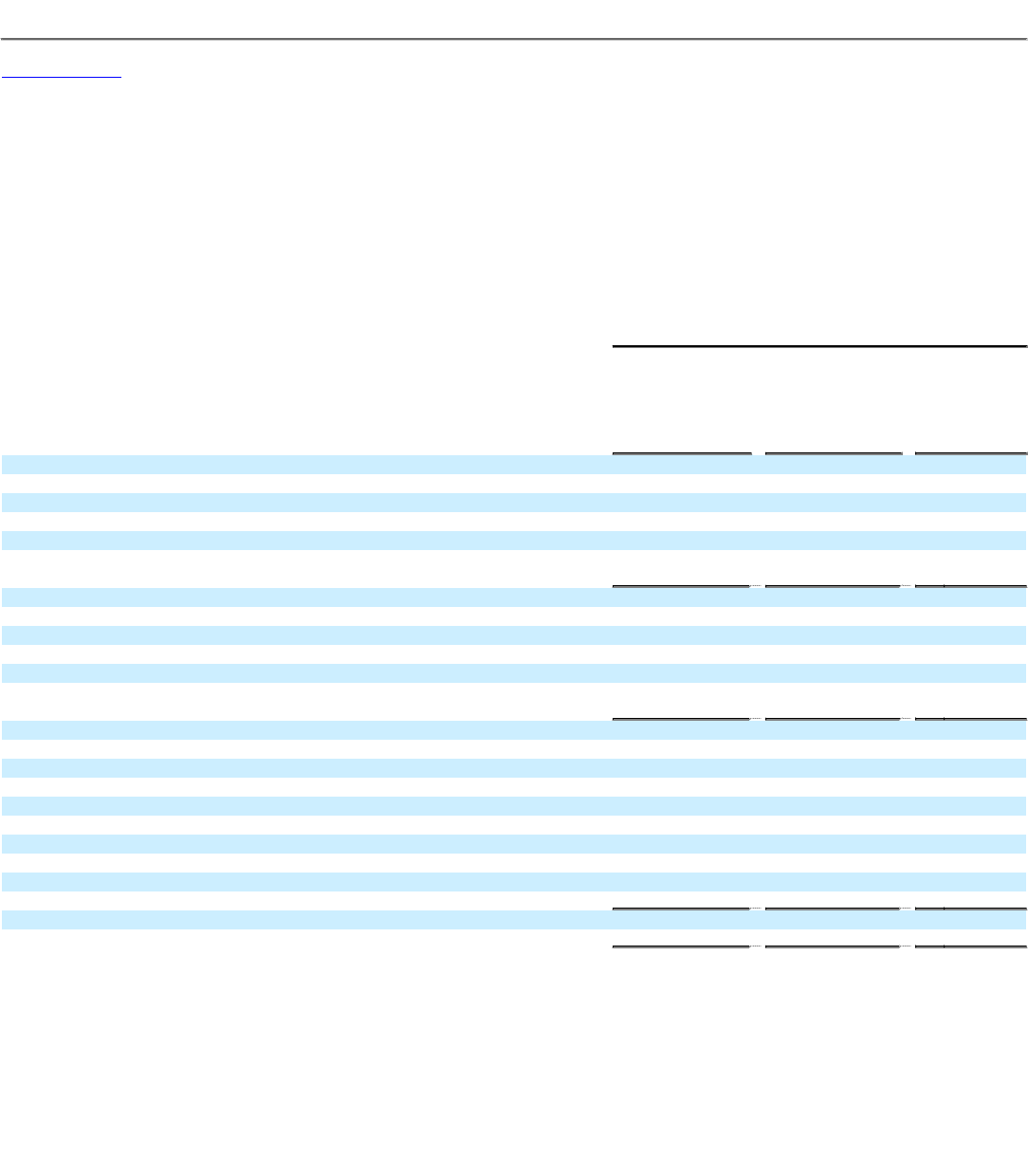

Stock option activity is as follows:

Options Outstanding

Shares

Available for

Grant

Outstanding

Stock

Options

Weighted-

Average

Exercise

Price

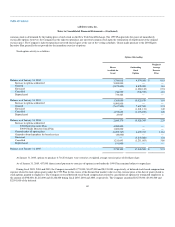

Balance as of January 31, 2002 3,706,018 4,074,560 $ 0.81

Increase in options authorized 5,000,000 — —

Granted (8,878,000) 8,878,000 1.10

Exercised — (1,680,122) 0.94

Cancelled 746,559 (746,559) 1.18

Repurchased 734,482 — —

Balance as of January 31, 2003 1,309,059 10,525,879 1.01

Increase in options authorized 8,000,000 — —

Granted (7,637,500) 7,637,500 3.74

Exercised — (1,041,131) 1.40

Cancelled 1,193,853 (1,193,853) 1.28

Repurchased 23,967 — —

Balance as of January 31, 2004 2,889,379 15,928,395 2.29

Increase in options authorized:

2004 Equity Incentive Plan 4,000,000 — —

2004 Outside Directors Stock Plan 1,000,000 — —

Granted under all option plans (6,492,767) 6,492,767 11.61

Granted to board members for board services (40,000) — —

Exercised — (3,843,880) 1.24

Cancelled 1,211,693 (1,211,693) 5.80

Repurchased 191,000 — —

Balance as of January 31, 2005 2,759,305 17,365,589 $ 5.74

At January 31, 2005, options to purchase 4,716,234 shares were vested at a weighted average exercise price of $1.88 per share.

As of January 31, 2005, 457,095 shares issued pursuant to exercises of options issued under the 1999 Plan remained subject to repurchase.

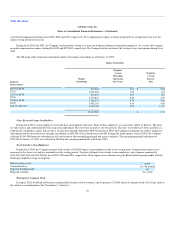

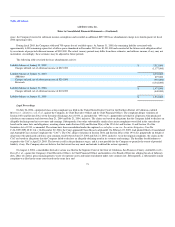

During fiscal 2005, 2004 and 2003, the Company recorded $1,773,000, $3,627,000 and $8,913,000, respectively, of deferred stock-based compensation

expense related to stock option grants under the 1999 Plan for the excess of the deemed fair market value over the exercise price at the date of grant related to

stock options granted to employees. The Company reversed deferred stock-based compensation related to cancellation of options for terminated employees in

the amount of $798,000, $1,212,000 and $1,248,000 during fiscal 2005, 2004 and 2003, respectively. The Company amortized $3,275,000, $3,491,000 and

$2,591,000 of the deferred

69