Salesforce.com 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

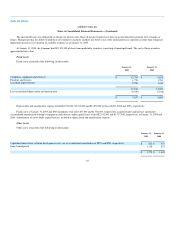

Marketable Securities

Management determines the appropriate classification of investments in marketable securities at the time of purchase in accordance with Statement of

Financial Accounting Standards No. 115, Accounting for Certain Investments in Debt and Equity Securities and reevaluates such determination at each

balance sheet date. Securities, which are classified as available for sale at January 31, 2005, are carried at fair value, with the unrealized gains and losses, net

of tax, reported as a separate component of stockholders' equity. Fair value is determined based on quoted market rates. Realized gains and losses and declines

in value judged to be other-than-temporary on securities available for sale are included as a component of interest income. The cost of securities sold is based

on the specific-identification method. Interest on securities classified as available for sale is also included as a component of interest income.

Fair Value of Financial Instruments

The carrying amounts of the Company's financial instruments, which include cash and cash equivalents, short term marketable securities, restricted

cash, accounts receivable, accounts payable, and other accrued expenses, approximate their fair values due to their short maturities. Based on borrowing rates

currently available to the Company for loans with similar terms, the carrying value of capital lease obligations approximates fair value.

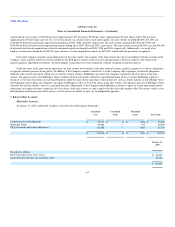

Fixed Assets

Fixed assets are stated at cost. Depreciation is calculated on a straight-line basis over the estimated useful lives of those assets as follows:

Computers, equipment, and software 3 to 5 years

Furniture and fixtures 5 to 7 years

Leasehold improvements Shorter of the estimated useful life of 5 years or the lease term

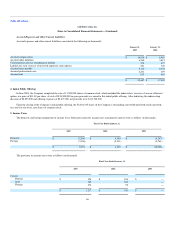

When assets are retired, the cost and accumulated depreciation and amortization are removed from their respective accounts and any loss on such

retirement is reflected in operating expenses. When assets are otherwise disposed of, the cost and related accumulated depreciation and amortization are

removed from their respective accounts and any gain or loss on such sale or disposal is reflected in other income.

During fiscal 2005, 2004 and 2003, the Company retired certain fixed assets, which had a total net book value of $223,000, $68,000 and $589,000,

respectively. These amounts were expensed and are reflected in operating expenses in the accompanying Consolidated Statements of Operations.

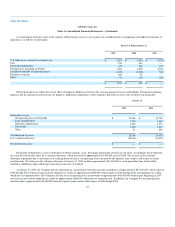

Impairment of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets in accordance with SFAS No. 144, Accounting for the Impairment or Disposal of

Long-Lived Assets ("SFAS 144"). Long-lived assets are reviewed for possible impairment whenever events or circumstances indicate that the carrying amount

of such assets may not be recoverable. If such review indicates that the carrying amount of long-lived assets is not recoverable, the carrying amount of such

assets is reduced to fair value.

In addition to the recoverability assessment, the Company routinely reviews the remaining estimated lives of its long-lived assets. Any reduction in the

useful life assumption will result in increased depreciation and amortization expense in the period when such determinations are made, as well as in

subsequent periods.

57