Salesforce.com 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

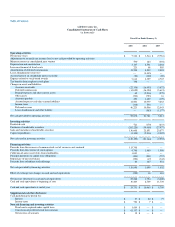

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

provides its application as a service, the Company follows the provisions of Securities and Exchange Commission Staff Accounting Bulletin No. 104,

Revenue Recognition. On August 1, 2003, the Company adopted Emerging Issues Task Force Issue No. 00-21, Revenue Arrangements with Multiple

Deliverables. The Company recognizes revenue when all of the following conditions are met:

• There is persuasive evidence of an arrangement;

• The service has been provided to the customer;

• The collection of the fees is probable; and

• The amount of fees to be paid by the customer is fixed or determinable.

The Company's arrangements do not contain general rights of return.

Subscription and support revenues are recognized ratably over the contract terms beginning on the commencement date of each contract. Amounts that

have been invoiced are recorded in accounts receivable and in deferred revenue or revenue, depending on whether the revenue recognition criteria have been

met.

Professional services and other revenues, when sold with subscription and support offerings, are accounted for separately when these services have

value to the customer on a standalone basis and there is objective and reliable evidence of fair value of each deliverable. When accounted for separately,

consulting revenues are recognized as the services are rendered for time and material contracts, and when the milestones are achieved and accepted by the

customer for fixed price contracts. The majority of the Company's consulting contracts are on a time and material basis. Training revenues are recognized

after the services are performed.

In determining whether the consulting services can be accounted for separately from subscription and support revenues, the Company considers the

following factors for each consulting agreement: availability of the consulting services from other vendors, whether objective and reliable evidence for fair

value exists of the undelivered elements, the nature of the consulting services, the timing of when the consulting contract was signed in comparison to the

subscription service start date, and the contractual dependence of the subscription service on the customer's satisfaction with the consulting work. If a

consulting arrangement does not qualify for separate accounting, the Company recognizes the consulting revenue ratably over the remaining term of the

subscription contract. Additionally, in these situations the Company defers only the direct and incremental costs of the consulting arrangement and amortizes

those costs over the same time period as the consulting revenue is recognized. As of January 31, 2005 and 2004, the deferred cost on the accompanying

consolidated balance sheet totaled $874,000 and $32,000, respectively.

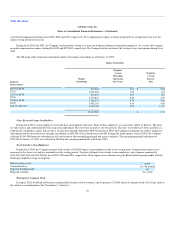

On occasion, the Company has purchased from its suppliers goods or services for the Company's use in its operations at or around the same time these

same businesses entered into subscription and/or consulting agreements. The Company generally defines "at or around the same time" as within six months.

Revenues recognized from customers who were also suppliers were not significant during fiscal 2005, 2004 and 2003. Both the procurement and revenue

agreements are separately negotiated, settled ultimately in cash, and recorded at what the Company considers to be fair value. When any of these factors is not

present, the Company does not recognize the revenue from the underlying sale agreements; rather, the revenue is netted with expenses.

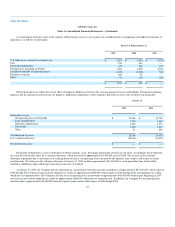

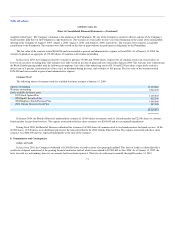

Deferred Revenue

Deferred revenue primarily consists of billings or payments received in advance of revenue recognition from the Company's subscription service

described above and is recognized as revenue recognition criteria are

61