Salesforce.com 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

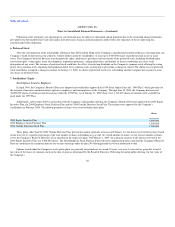

met. The Company generally invoices its customers in annual or quarterly installments. Accordingly, the deferred revenue balance does not represent the total

contract value of annual or multi-year, noncancelable subscription agreements.

Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with noncancelable subscription contracts with customers and consist of

sales commissions paid to the Company's direct sales force. The commissions are deferred and amortized over the noncancelable terms of the related customer

contracts, which are typically 12 to 24 months. The commission payments are paid in full the month after the customer's service commences. The deferred

commission amounts are recoverable through the future revenue streams under the noncancelable customer contracts. The Company believes this is the

preferable method of accounting as the commission charges are so closely related to the revenue from the noncancelable customer contracts that they should

be recorded as an asset and charged to expense over the same period that the subscription revenue is recognized. Amortization of deferred commissions is

included in marketing and sales expense in the accompanying consolidated statements of operations.

Warranties and Indemnification

The Company's on-demand application service is typically warranted to perform in a manner consistent with general industry standards that are

reasonably applicable and materially in accordance with the Company's online help documentation under normal use and circumstances.

The Company's arrangements generally include certain provisions for indemnifying customers against liabilities if its products or services infringe a

third-party's intellectual property rights. To date, the Company has not incurred any material costs as a result of such indemnifications and has not accrued any

liabilities related to such obligations in the accompanying consolidated financial statements.

The Company has entered into service level agreements with a small number of its customers warranting certain levels of uptime reliability and

performance and permitting those customers to receive credits or terminate their agreements in the event that the Company fails to meet those levels. During

fiscal 2005, the Company recorded a provision of approximately $800,000 for potential credits, and paid out $500,000.

The Company has also agreed to indemnify its directors and executive officers for costs associated with any fees, expenses, judgments, fines and

settlement amounts incurred by any of these persons in any action or proceeding to which any of those persons is, or is threatened to be, made a party by

reason of the person's service as a director or officer, including any action by the Company, arising out of that person's services as the Company's director or

officer or that person's services provided to any other company or enterprise at the Company's request. The Company maintains director and officer insurance

coverage that would generally enable the Company to recover a portion of any future amounts paid.

Advertising Expenses

Advertising is expensed as incurred. Advertising expense was $6,908,000, $5,048,000 and $3,997,000 for fiscal 2005, 2004 and 2003, respectively.

Recent Accounting Pronouncement

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 123 (revised 2004), Share-

Based Payment, or SFAS 123R, which requires all share-based

62