Salesforce.com 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Lease Recovery. The lease recovery of $3.4 million during fiscal 2004 was due to the reduction in accruals associated with the San Francisco, California

office space that we abandoned in December 2001. In August 2003, we entered into an agreement, releasing us from future obligations for some of the space

abandoned, in connection with the landlord's lease of this space to another tenant. Accordingly, we recorded a $3.4 million credit to reflect the reversal of the

accrual that was directly related with this space.

In March 2005, we entered into an agreement with our landlord that would release us from a portion of the future obligations associated with the

remaining space abandoned in our headquarters building in exchange for an agreement to lease additional space elsewhere in the building. The agreement is

contingent upon the occurrence of certain conditions that will affect the final determination of the lease abandonment accrual on our consolidated balance

sheet. If these certain conditions occur, we believe there will be an immaterial reduction in the accrual, which will be reflected as lease recovery during the

first quarter of fiscal 2006.

Because of the March 2005 agreement described above, we are currently evaluating the possibility of consolidating more of our operations in the

headquarters building. If we did this, we would abandon approximately 20,000 square feet of office space located elsewhere in San Francisco, which is under

a long-term operating lease commitment. Such an abandonment would result in a charge against our operating results in the quarter in which the event would

occur.

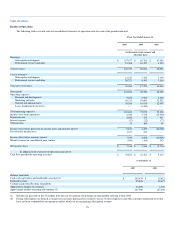

Operating Income. Operating income during fiscal 2005 was $6.5 million. During fiscal 2004, it was $3.7 million, substantially all of which consisted

of the lease recovery described above. The increase in operating income year over year was primarily due to the increase in revenues, most of which was re-

invested in an effort to expand our business.

Income (losses) from operations outside of the Americas was $2.7 million during fiscal 2005 and $(1.1) million during fiscal 2004. The continued

investment outside of the Americas was due to our efforts in expanding the number of locations where we conduct business and expanding our international

selling and marketing activities.

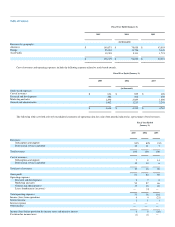

Interest Income. Interest income substantially consists of investment income on cash and marketable securities balances and also includes interest

income on outstanding loans made to individuals who early exercised their stock options. None of these individuals was an executive officer or director of the

Company and all of them repaid their loan balances by February 28, 2005. Interest income was $2.7 million during fiscal 2005 and was $379,000 during fiscal

2004. The increase was primarily due to increased marketable securities balances resulting from the proceeds from the sale of our common stock in our initial

public offering in June 2004.

Provision for Income Taxes. We recorded a provision for income tax expense of $1.2 million for fiscal 2005 as compared to a provision for income tax

expense of $541,000 for fiscal 2004. The fiscal 2005 provision for income taxes consists of amounts accrued for our domestic federal alternative minimum tax

and state income tax liability as well as our foreign income tax expense. The effective tax rate for fiscal 2005 and 2004 was 13 percent. The effective tax rate

differs from the statutory rate primarily due to domestic loss carryovers net of foreign losses with no benefit.

As of January 31, 2005, our deferred tax asset balance was $28.2 million and was fully offset by a valuation allowance of the same amount. Realization

of these deferred tax assets is dependent on future earnings, if any, the timing and amount of which are uncertain. To realize the deferred tax assets, pretax

income must increase sufficiently to allow management to assume that such deferred tax assets will be utilized. Historic profits have proven insufficient to

allow us to absorb deferred tax assets incurred to date. Further, ongoing stock option exercise activity may, as in fiscal 2005, increase the total deferred tax

asset balance. Accordingly, management cannot determine that it is more likely than not that we will be able to utilize our deferred tax assets and therefore we

have fully offset net deferred tax assets by a valuation allowance.

Based on our estimates for fiscal 2006 and beyond, we believe the uncertainty regarding the ability to realize our deferred tax assets may diminish to

the point where deferred tax assets may be realized. If we were to

29