Salesforce.com 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

space, the Company lowered its subtenant income assumptions and recorded an additional $897,000 lease abandonment charge in its fourth quarter of fiscal

2004 operating results.

During fiscal 2005, the Company subleased 700 square feet of available space. At January 31, 2005, the remaining liability associated with

approximately 4,000 remaining square feet of office space abandoned in December 2001 was $1,531,000 and consisted of the future rental obligation offset

by an estimate of projected subtenant income of $919,000. The actual vacancy periods may differ from these estimates, and sublease income, if any, may not

materialize. Accordingly, these estimates may be adjusted in future periods.

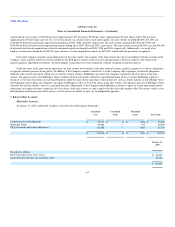

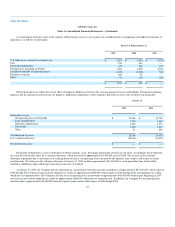

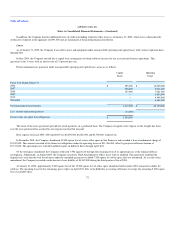

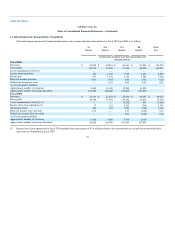

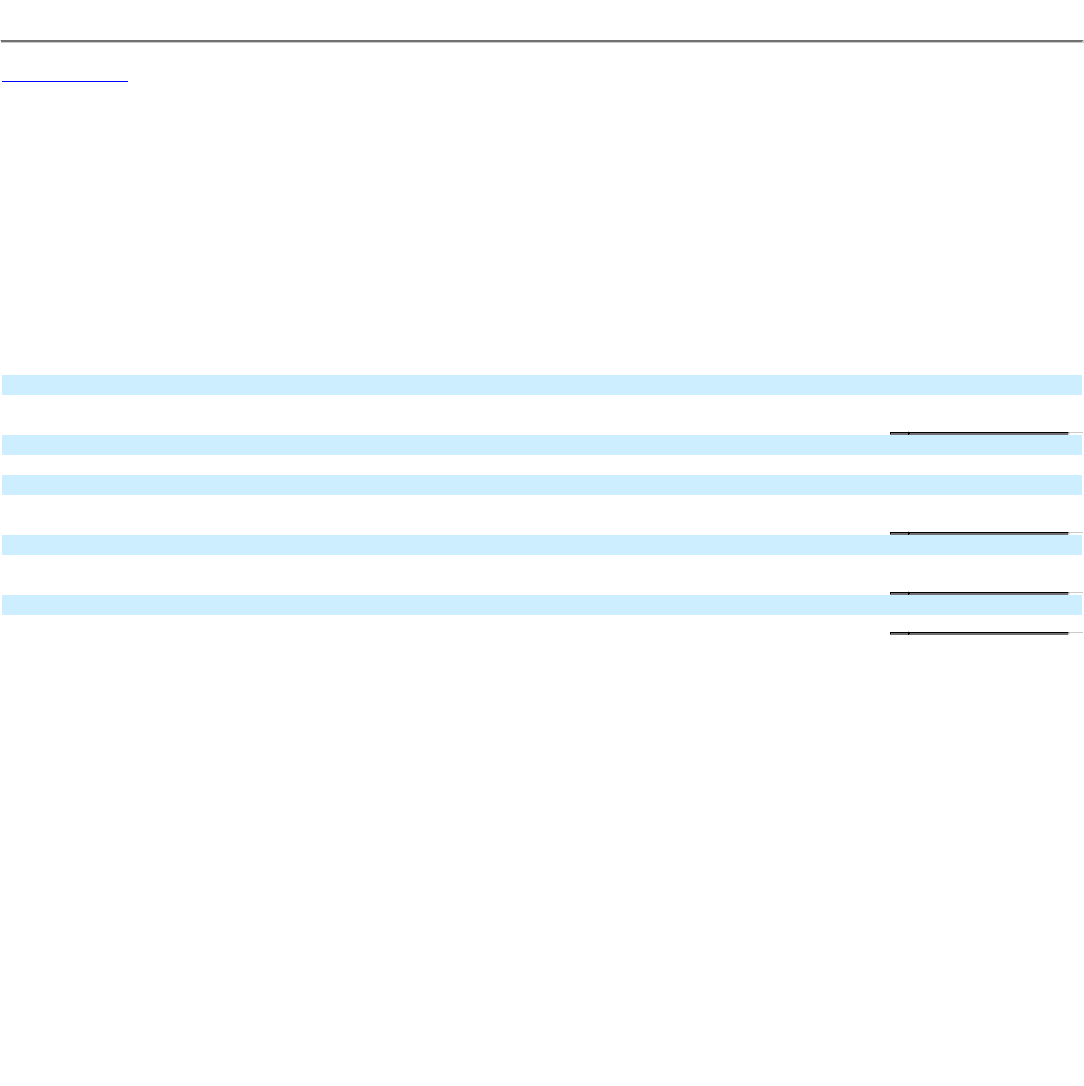

The following table sets forth the lease abandonment activity:

Liability balance at January 31, 2002 $ 7,512,000

Charges utilized, net of subtenant income of $219,000 (1,177,000)

Liability balance at January 31, 2003 6,335,000

Additions 897,000

Charges utilized, net of subtenant income of $219,000 (919,000)

Reversals (4,342,000)

Liability balance at January 31, 2004 $ 1,971,000

Charges utilized, net of subtenant income of $124,000 (440,000)

Liability balance at January 31, 2005 $ 1,531,000

Legal Proceedings

On July 26, 2004, a purported class action complaint was filed in the United States District Court for the Northern District of California, entitled

Morrison v. salesforce.com, et al., against the Company, its Chief Executive Officer and its Chief Financial Officer. The complaint alleges violations of

Section 10(b) and Section 20(a) of the Securities Exchange Act of 1934, as amended (the "1934 Act"), purportedly on behalf of all persons who purchased

salesforce.com common stock between June 21, 2004 and July 21, 2004, inclusive. The claims are based on allegations that the Company failed to disclose an

allegedly declining trend in its revenues and earnings. Subsequently, four other substantially similar class action complaints were filed in the same district

based on the same facts and allegations, asserting claims under Section 10(b) and Section 20(a) of the 1934 Act and Section 11 and Section 15 of the

Securities Act of 1933, as amended. The actions have been consolidated under the caption In re salesforce.com, inc. Securities Litigation, Case No.

C-04-3009 JSW (N.D. Cal.). On December 22, 2004, the Court appointed Chuo Zhu as lead plaintiff. On February 22, 2005, lead plaintiff filed a Consolidated

and Amended Class Action Complaint (the "CAC"). The CAC alleges violations of Section 10(b) and Section 20(a) of the 1934 Act, purportedly on behalf of

all persons who purchased salesforce.com common stock between June 23, 2004 and July 21, 2004, inclusive. As in the original complaints, the claims in the

CAC are based on allegations that the Company failed to disclose an allegedly declining trend in its revenues and earnings. The deadline for defendants to

respond to the CAC is April 25, 2005. The lawsuit is still in the preliminary stages, and it is not possible for the Company to quantify the extent of potential

liability, if any. The Company does not believe that the lawsuit has any merit and intends to defend the action vigorously.

On August 6, 2004, a shareholder derivative action was filed in the Superior Court of the State of California, San Francisco County, entitled Borrelli v.

Benioff, et al., against the Company's Chief Executive Officer, its Chief Financial Officer and members of its Board of Directors alleging breach of fiduciary

duty, abuse of control, gross mismanagement, waste of corporate assets and unjust enrichment under state common law. Subsequently, a substantially similar

complaint was filed in the same court based on the same facts and

73