Salesforce.com 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

The unrealized losses are attributable to changes in interest rates. None of the investments have been in an unrealized loss position for 12 months or

longer. Management has the ability to hold these investments to maturity and does not believe any of the unrealized losses represent an other-than-temporary

impairment based on its evaluation of available evidence as of January 31, 2005.

At January 31, 2004, the Company had $25,349,000 of short-term marketable securities, consisting of municipal bonds. The cost of these securities

approximated fair value.

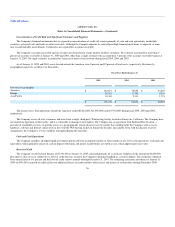

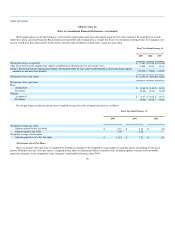

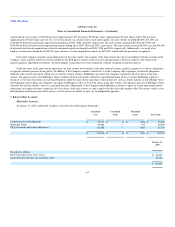

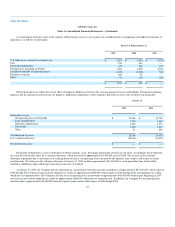

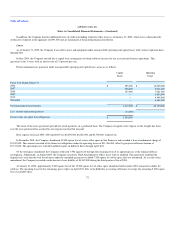

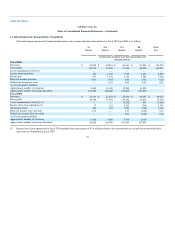

Fixed Assets

Fixed assets consisted of the following (in thousands):

January 31,

2005

January 31,

2004

Computers, equipment and software $ 12,703 $ 8,693

Furniture and fixtures 1,755 1,784

Leasehold improvements 2,708 1,610

17,166 12,087

Less accumulated depreciation and amortization (9,529) (7,018)

$ 7,637 $ 5,069

Depreciation and amortization expense totaled $2,751,000, $2,314,000 and $2,478,000 for fiscal 2005, 2004 and 2003, respectively.

Fixed assets at January 31, 2005 and 2004 included a total of $3,487,000 and $1,788,000, respectively, acquired under capital lease agreements.

Accumulated amortization relating to equipment and software under capital leases totaled $2,142,000 and $1,717,000, respectively, at January 31, 2005 and

2004. Amortization of assets under capital leases is included in depreciation and amortization expense.

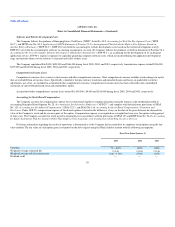

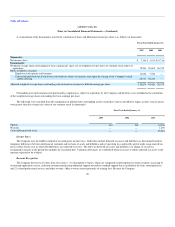

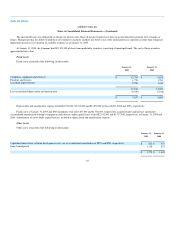

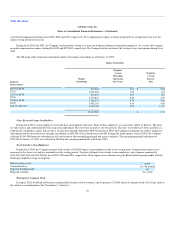

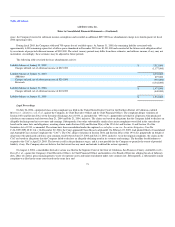

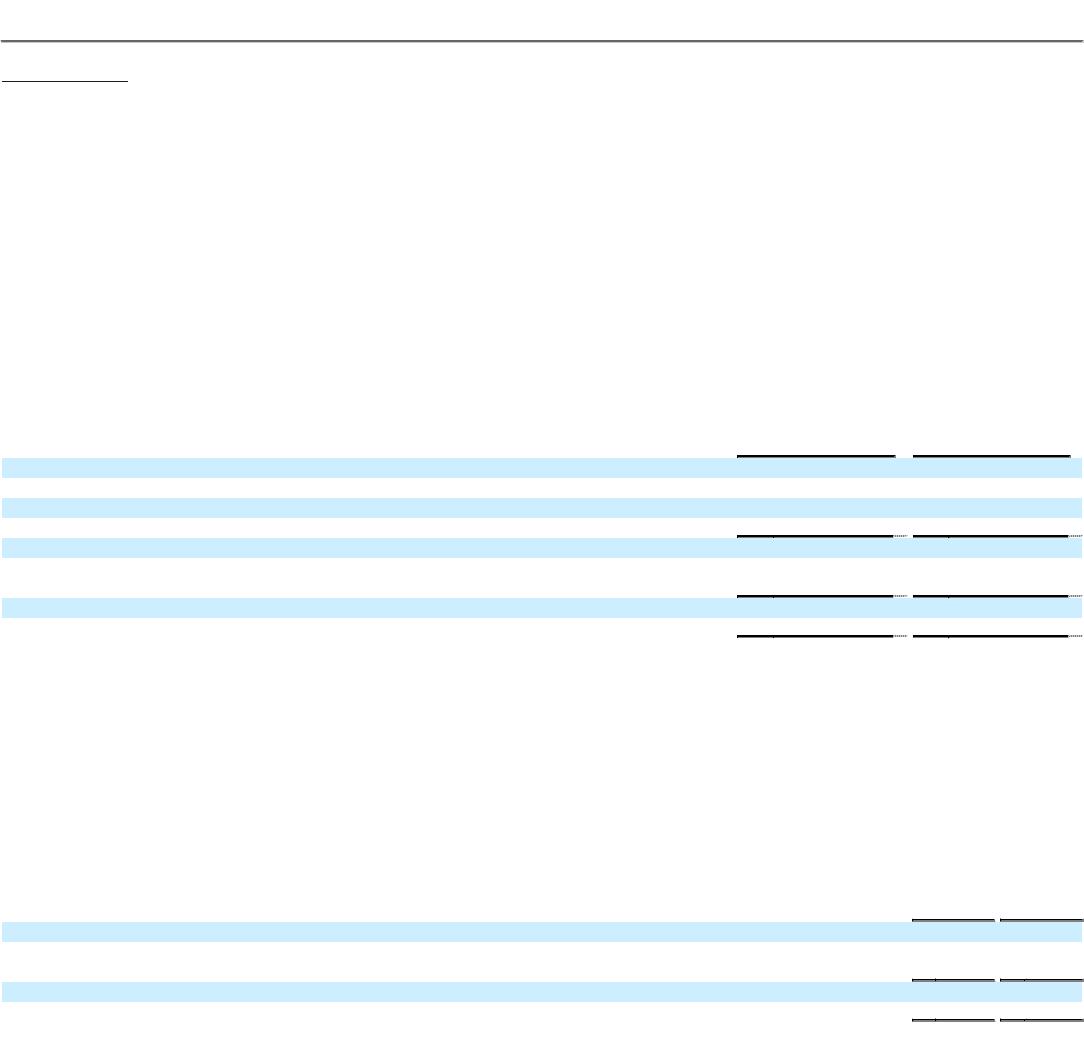

Other Assets

Other assets consisted of the following (in thousands):

January 31,

2005

January 31,

2004

Capitalized internal-use software development costs, net of accumulated amortization of $957 and $561, respectively $ 641 $ 572

Long-term deposits 1,138 922

$ 1,779 $ 1,494

65