Salesforce.com 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our office lease agreements provide us with the option to renew. Our future operating lease obligations would change if we exercised these options and

if we entered into additional operating lease agreements as we expand our operations.

In February 2005, we obtained additional software licenses for use in our business operations at a cost of $8.8 million. Additionally, we are currently in

the process of obtaining additional business continuity services, additional data center capacity and a development and test data center. We expect these

resources to be in place at various dates during fiscal 2006. While the costs for these will be significant, we believe that most of the capital expenditures for

the additional business continuity services, additional data center capacity and development and test data center will be leased so there will not be a significant

impact on our liquidity during fiscal 2006.

Purchase orders are not included in the table above. Our purchase orders represent authorizations to purchase rather than binding agreements. The

contractual commitment amounts in the table above are associated with agreements that are enforceable and legally binding and that specify all significant

terms, including: fixed or minimum services to be used; fixed, minimum or variable price provisions; and the approximate timing of the transaction.

Obligations under contracts that we can cancel without a significant penalty are not included in the table above.

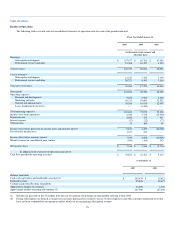

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by operating activities will be sufficient to meet

our working capital and capital expenditure needs over the next 12 months. Our future capital requirements will depend on many factors, including our rate of

revenue growth, the expansion of our marketing and sales activities, the timing and extent of spending to support product development efforts and expansion

into new territories, the timing of introductions of new services and enhancements to existing services, the timing of capital expenditures and expenses

associated with Web hosting and the continuing market acceptance of our services. To the extent that available funds are insufficient to fund our future

activities, we may need to raise additional funds through public or private equity or debt financing. Although we are currently not a party to any agreement or

letter of intent with respect to potential investments in, or acquisitions of, complementary businesses, services or technologies, we may enter into these types

of arrangements in the future, which could also require us to seek additional equity or debt financing. Additional funds may not be available on terms

favorable to us or at all.

Recent Accounting Pronouncement

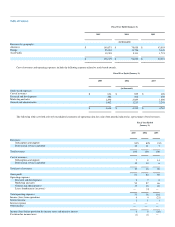

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 123 (revised 2004), Share-

Based Payment, or SFAS 123R, which requires all share-based payments to employees, including grants of employee stock options and purchases under

employee stock purchase plans, to be recognized as expenses in the statement of operations based on their fair values and vesting periods. We plan to adopt

the provisions of SFAS 123R on August 1, 2005, which is the start of our third fiscal quarter next year. We are currently assessing the impact this prospective

change in accounting will have but believe that it will have a material and adverse impact on our reported results of operations.

Additionally, SFAS 123R requires the tax benefits from employee stock plans to be classified as a financing activity in the consolidated statement of

cash flows. We currently classify these tax benefits, which totaled $798,000 in fiscal 2005, as a source of cash provided by operating activities.

33