Salesforce.com 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

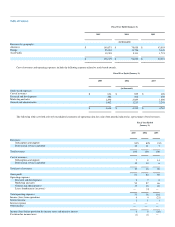

have relatively low research and development expenses as compared to traditional enterprise software companies. We expect that in the future, research and

development expenses will increase in absolute dollars as we upgrade and extend our service offerings and develop new technologies.

We are also in the process of obtaining a development and test data center, which we currently expect will be in place by July 2005. We expect the

annual cost of this data center to be approximately $4.0 million.

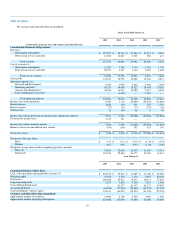

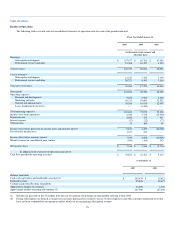

Marketing and Sales. Marketing and sales expenses are our largest cost and consist primarily of salaries and related expenses for our sales and

marketing staff, including commissions, payments to partners, marketing programs and allocated overhead. Marketing programs consist of advertising, events,

corporate communications and brand building and product marketing activities.

As our revenues increase, we plan to continue to invest heavily in marketing and sales by increasing the number of direct sales personnel in order to add

new customers and increase penetration within our existing customer base, expanding our domestic and international selling and marketing activities, building

brand awareness and sponsoring additional marketing events. We expect that in the future, marketing and sales expenses will increase in absolute dollars and

continue to be our largest cost.

General and Administrative. General and administrative expenses consist of salaries and related expenses for executive, finance and accounting, human

resources and management information systems personnel, legal costs, professional fees, other corporate expenses and allocated overhead. We expect that in

the future, general and administrative expenses will increase in absolute dollars as we add personnel and incur additional professional fees and insurance costs

related to the growth of our business, international expansion and operations as a public company.

Stock-Based Expenses. Our cost of revenues and operating expenses include stock-based expenses related to options and warrants issued to non-

employees, option grants to employees in situations where the exercise price was less than the deemed fair value of our common stock at the date of grant and

stock awards to board members for board services. These charges have been significant and are reflected in the historical financial results. Excluding the

incremental costs and operating expenses associated with the new accounting pronouncement to expense stock options, we expect stock-based expenses to be

between $3.0 to $4.0 million in fiscal 2006.

Joint Venture

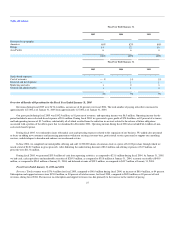

In December 2000, we established a Japanese joint venture, Kabushiki Kaisha salesforce.com, with SunBridge, Inc., a Japanese corporation, to assist us

with our sales efforts in Japan. As of January 31, 2005, we owned a 63 percent interest in the joint venture. Because of this majority interest, we consolidate

the venture's financial results, which are reflected in each revenue, cost of revenues and expense category in our consolidated statement of operations. We

then record minority interest, which reflects the minority investors' interest in the venture's results. Through January 31, 2005, the operating performance and

liquidity requirements of the Japanese joint venture had not been significant. While we plan to expand our selling and marketing activities in Japan in order to

add new customers, we believe the future operating performance and liquidity requirements of the Japanese joint venture will not be significant.

Critical Accounting Policies and Estimates

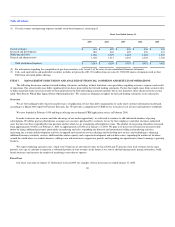

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States. The preparation of

these consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs

and expenses, and related disclosures. On an ongoing basis, we evaluate our estimates and assumptions. Our actual results may differ from these estimates

under different assumptions or conditions.

22