Salesforce.com 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

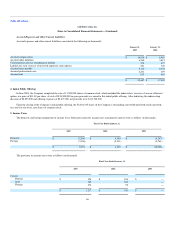

payments to employees, including grants of employee stock options and purchases under employee stock purchase plans, to be recognized as expenses in the

statement of operations based on their fair values and vesting periods. The Company plans to adopt the provisions of SFAS 123R on August 1, 2005, which is

the start of its third fiscal quarter next year. The Company is currently assessing the impact of this prospective change in accounting and believe that it will

have a material and adverse impact on the Company's reported results of operations.

Additionally, SFAS 123R requires the tax benefits from employee stock plans to be classified as a financing activity in the consolidated statement of

cash flows. The Company currently classifies these tax benefits, which totaled $798,000 in fiscal 2005, as a source of cash provided by operating activities.

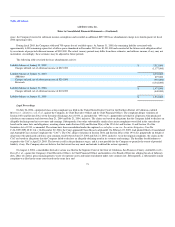

2. Joint Venture

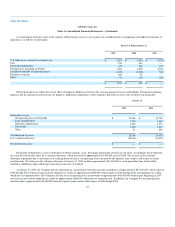

On December 7, 2000, the Company entered into a joint venture agreement with SunBridge, Inc., a Japanese corporation, to establish Salesforce Japan.

In accordance with the agreement, the Company contributed $1,339,000 for 300,000 shares of common stock, which resulted in a 75 percent interest in the

joint venture. Provided that the Company owns at least 30 percent of the outstanding voting shares of the joint venture, the Company has the right to appoint

three of the six board members of the joint venture, and together with SunBridge, may appoint a fourth director.

During fiscal 2002, the joint venture sold 48,400 shares of common stock. As a result of these transactions, the Company's ownership declined from 75

percent to 66.9 percent.

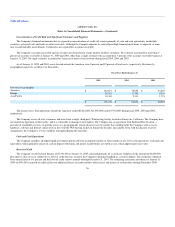

On September 29, 2002 and October 28, 2002, the joint venture sold an additional 9,000 and 8,000 shares of common stock, respectively, at a per share

price of $32.41 for total proceeds of $551,000. As a result, the Company's ownership percentage declined from 66.9 percent to 64.5 percent. The Company's

change in interest in the joint venture resulted in a gain of $355,000, which has been recorded directly to additional paid-in capital. This gain was calculated

based on the Company's proportionate share of the proceeds from the sale.

On September 11, 2003, the joint venture sold an additional 4,750 shares of common stock at a per share price of $35.16 for total proceeds of $167,000.

As a result, the Company's ownership percentage declined from 64.5 percent to 63.8 percent. The Company's change in interest in the joint venture resulted in

a gain of $99,000, which has been recorded directly to additional paid-in capital. This gain was calculated based on the Company's proportionate share of the

proceeds from the sale.

In July 2004, the joint venture sold an additional 9,000 shares of common stock for total proceeds of $40,000. As a result, the Company's ownership

percentage declined from 63.8 percent to 62.6 percent. The Company's change in interest in the joint venture resulted in a gain of $25,000, which has been

recorded directly to additional paid-in capital. This gain was calculated based on the Company's proportionate share of the proceeds from the sale.

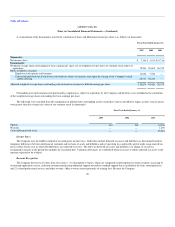

The Japanese Stock Option Plan includes antidilution provisions such that the option holders are allowed additional options if the joint venture issues

additional stock and the exercise price of their options is reduced if the additional stock is issued for an amount less than such exercise price. These provisions

result in variable accounting for the plan, as the number of options awarded is not fixed and no measurement date currently exists.

The Board of Directors of the joint venture authorized options to purchase 40,000 shares to be issued under a new stock option plan.

In fiscal 2005, 2004 and 2003, the joint venture granted options to purchase 10,000, 3,000, and 2,600 shares, respectively, to its employees to purchase

shares of common stock in the joint venture. The stock options were

63