HSBC 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Footnotes // Risk > Risk profile

122

Reconciliation of RoRWA measures

66 Risk-weighted assets (‘RWA’s) and pre-tax return on average risk-weighted assets (‘RoRWA’).

67 Underlying RoRWA is calculated using underlying pre-tax return and reported average RWAs at constant currency and adjusted for the

effects of business disposals.

68 ‘Other’ includes treasury services related to the US Consumer and Mortgage Lending business and commercial operations in run-off.

US CML includes loan portfolios within the run-off business that are designated held for sale.

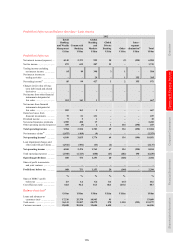

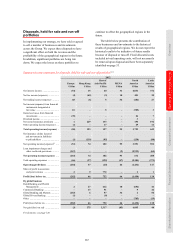

Disposals, held for sale and run-off portfolios

69 The results of operations of disposed businesses are stated up to and including the date of disposal. The results of operations of

businesses held for sale and run-off portfolios are for 2012.

70 The summary income statements present the historical results of disposals, held-for-sale and run-off portfolios to provide information

on trends. The historical results are those which appear in the Group IFRS income statement and include fixed allocated costs which

will not necessarily be removed or reduced upon disposal or run-off. Fixed allocated costs included in total operating expenses are

disclosed separately on page 38. The results of disposed businesses exclude gains on sale and post disposal income and expenditure

items; for example, restructuring costs. The results of businesses held for sale exclude losses recognised upon reclassification to the

held-for-sale category. These losses are disclosed in Note 26 on the Financial Statements.

71 ‘US CML’ includes non-real estate personal loans that were reclassified to ‘Assets held for sale’ during 2012. At 31 December 2012, the

carrying value of this portfolio, net of transferred impairment allowances, was US$3.4bn. The portfolio contributed interest income of

US$813m and loan impairment charges of US$347m to profit before tax in 2012. ‘Other’ includes treasury services related to the US

Consumer and Mortgage Lending business and commercial operations in run-off.

72 ‘Reduction in RWAs on disposal’ for disposal and held-for-sale portfolios are shown exclusive of operational risk RWAs as these are not

immediately released on disposal. RWAs for held-for-sale and run-off portfolios are shown inclusive of operational risk RWAs.

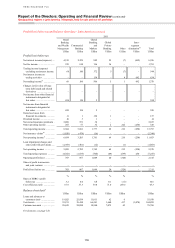

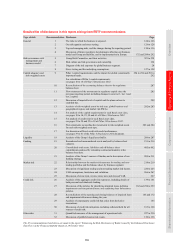

Global businesses and geographical regions

73 The main items reported under ‘Other’ are certain property activities, unallocated investment activities, centrally held investment

companies, gains arising from the dilution of interests in associates and joint ventures, part of the movement in the fair value of our

long-term debt designated at fair value (the remainder of the Group’s movement on own debt is included in GB&M) and HSBC’s

holding company and financing operations. The results also include net interest earned on free capital held centrally, operating costs

incurred by the head office operations in providing stewardship and central management services to HSBC, and costs incurred by the

Group Service Centres and Shared Service Organisations and associated recoveries. In addition, fines and penalties as part of the

settlement of investigations into past inadequate compliance with anti-money laundering and sanctions laws together with the UK bank

levy are recorded in ‘Other’.

74 Assets by geographical region and global businesses include intra-HSBC items. These items are eliminated, where appropriate, under

the heading ‘Intra-HSBC items’ or ‘inter-segment elimination’, as appropriate.

75 For divested businesses, this includes the gain or loss on disposal and material results of operations as described on page 26.

76 Loan impairment charges and other credit risk provisions.

77 Share of profit in associates and joint ventures.

78 In the analysis of global businesses, net trading income comprises all gains and losses from changes in the fair value of financial assets

and financial liabilities classified as held for trading, together with related external and internal interest income and interest expense,

and dividends received; in the statutory presentation internal interest income and expense are eliminated.

79 In 2012, Global Markets included an adverse fair value movement of US$629m on the widening of credit spreads on structured

liabilities (2011: favourable fair value movement of US$458m; 2010: favourable fair value movement of US$23m).

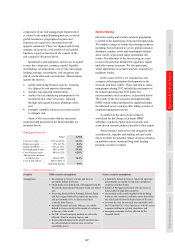

80 Total income earned on payments and cash management products in the Group amounted to US$6.2bn (2011: US$5.6bn; 2010:

US$4.4bn), of which US$4.5bn was in CMB (2011: US$4.0bn; 2010: US$3.3bn) and US$1.7bn was in GB&M (2011: US$1.5bn; 2010:

US$1.1bn).

81 Total income earned on other transaction services in the Group amounted to US$3.6bn (2011: US$3.2bn; 2010: US$2.7bn), of which

US$2.8bn was in CMB relating to trade and receivables finance (2011: US$2.6bn; 2010: US$2.1bn) and US$753m was in GB&M of

which US$738m related to trade and receivables finance (2011: US$601m; 2010: US$523m) and US$15m related to banknotes and

other (2011: US$33m; 2010: US$113m).

82 In each Group entity, Balance Sheet Management is responsible for managing liquidity and funding under the supervision of the local

Asset and Liability Management Committee. Balance Sheet Management also manages the non-trading interest rate positions of the

entity transferred to it within a Global Markets limit structure. Balance Sheet Management revenues include notional tax credits on

income earned from tax-exempt investments of US$116m in 2012, US$85m in 2011 and US$50m in 2010, which are offset within

‘Other’.

83 ‘Other’ in GB&M includes net interest earned on free capital held in the global business not assigned to products, allocated funding

costs and gains resulting from business disposals. Within the management view of total operating income, notional tax credits are

allocated to the businesses to reflect the economic benefit generated by certain activities which is not reflected within operating income,

for example notional credits on income earned from tax-exempt investments where the economic benefit of the activity is reflected in tax

expense. In order to reflect the total operating income on an IFRS basis, the offset to these tax credits are included within ‘Other’.

84 ‘Client assets’ are translated at the rates of exchange applicable for their respective period-ends, with the effects of currency translation

reported separately. The main components of client assets are funds under management, which are not reported on the Group’s balance

sheet, and customer deposits, which are reported on the Group’s balance sheet.

85 Inter-segment elimination comprises (i) the costs of shared services and Group Service Centres included within ‘Other’ which are

recovered from global businesses, and (ii) the intra-segment funding costs of trading activities undertaken within GB&M. HSBC’s

Balance Sheet Management business, reported within GB&M, provides funding to the trading businesses. To report GB&M’s ‘Net

trading income’ on a fully funded basis, ‘Net interest income’ and ‘Net interest income/(expense) on trading activities’ are grossed up to

reflect internal funding transactions prior to their elimination in the inter-segment column.

86 Net insurance claims incurred and movement in liabilities to policyholders.

87 ‘Employee expenses’ comprise costs directly incurred by each global business. The reallocation and recharging of employee and other

expenses directly incurred in the ‘Other’ category are shown in ‘Other operating expenses’.

88 RWAs are non-additive across geographical regions due to market risk diversification effects within the Group.

89 CMB results include US$128m (2011: US$110m) of net operating income and US$43m (2011: US$23m) of profit before tax, related to

low income housing tax credit investments in the US which are offset within the ‘Other’ segment.