Entergy 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

Entergy Corporation and Subsidiaries 2007

may be exercised and the relationship between the current market

price of the underlying instrument and the option’s contractual strike

or exercise price also aects the level of market risk. A signicant

factor inuencing the overall level of market risk to which Entergy is

exposed is its use of hedging techniques to mitigate such risk. Entergy

manages market risk by actively monitoring compliance with stated

risk management policies as well as monitoring the eectiveness of

its hedging policies and strategies. Entergy’s risk management policies

limit the amount of total net exposure and rolling net exposure during

the stated periods. ese policies, including related risk limits, are

regularly assessed to ensure their appropriateness given Entergy’s

objectives.

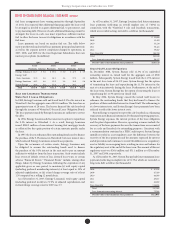

Hedging Derivatives

Entergy classies substantially all of the following types of derivative

instruments held by its consolidated businesses as cash ow hedges:

Instrument Business

Natural gas and electricity futures, forwards, Non-Utility Nuclear,

and options Non-Nuclear Wholesale Assets

Foreign currency forwards Utility, Non-Utility Nuclear

Cash ow hedges with net unrealized gains of approximately $5.4

million (net-of-tax) at December 31, 2007 are scheduled to mature

during 2008. Net losses totaling approximately $63 million were

realized during 2007 on the maturity of cash ow hedges. Unrealized

gains or losses result from hedging power output at the Non-Utility

Nuclear power stations and foreign currency hedges related to Euro-

denominated nuclear fuel acquisitions. The related gains or losses from

hedging power are included in revenues when realized. The realized

gains or losses from foreign currency transactions are included in

the cost of capitalized fuel. The maximum length of time over which

Entergy is currently hedging the variability in future cash ows for

forecasted transactions at December 31, 2007 is approximately ve

years. The ineffective portion of the change in the value of Entergy’s

cash ow hedges during 2007, 2006, and 2005 was insignicant.

Fair Values

Financial Instruments

e estimated fair value of Entergy’s nancial instruments is

determined using forward mid curves. ese independent market

curves are periodically compared to NYMEX Clearport prices where

available and have been found to be materially identical. Additional

adjustments for unit contingent discounts and/or price dierentials

between liquid market locations and plant busbars are internally

determined and applied depending on settlement terms of the nancial

instrument. In determining these adjustments, Entergy uses a process

that estimates the forward values based on recent observed history.

Due largely to the potential for market or product illiquidity, forward

estimates are not necessarily indicative of the amounts that Entergy

could realize in a current market exchange. In addition, gains or losses

realized on nancial instruments held by regulated businesses may be

reected in future rates and therefore do not necessarily accrue to the

benet or detriment of stockholders.

Entergy considers the carrying amounts of most of its nancial

instruments classied as current assets and liabilities to be a reasonable

estimate of their fair value because of the short maturity of these

instruments. Additional information regarding nancial instruments

and their fair values is included in Notes 5 and 6 to the nancial

statements.

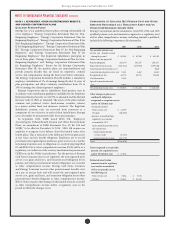

NOTE 17. DECOMMISSIONING TRUST FUNDS

Entergy holds debt and equity securities, classied as available-for-

sale, in nuclear decommissioning trust accounts. e NRC requires

Entergy to maintain trusts to fund the costs of decommissioning

ANO 1, ANO 2, River Bend, Waterford 3, Grand Gulf, Pilgrim, Indian

Point 1 and 2, Vermont Yankee, and Palisades (NYPA currently

retains the decommissioning trusts and liabilities for Indian Point 3

and FitzPatrick). e funds are invested primarily in equity securities;

xed-rate, xed-income securities; and cash and cash equivalents. e

securities held at December 31, 2007 and 2006 are summarized as

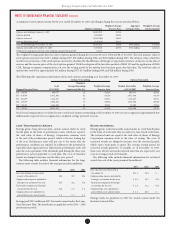

follows (in millions):

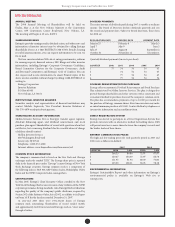

Total Total

Fair Unrealized Unrealized

Value Gains Losses

2007

Equity Securities $1,928 $466 $ 9

Debt Securities 1,380 40 3

Total $3,308 $506 $12

2006

Equity Securities $1,706 $418 $ 2

Debt Securities 1,153 17 11

Total $2,859 $435 $13

e debt securities have an average coupon rate of approximately

5.2%, an average duration of approximately 5.5 years, and an average

maturity of approximately 8.9 years. e equity securities are generally

held in funds that are designed to approximate or somewhat exceed

the return of the Standard & Poor’s 500 Index, and a relatively small

percentage of the securities are held in a fund intended to replicate the

return of the Wilshire 4500 Index.

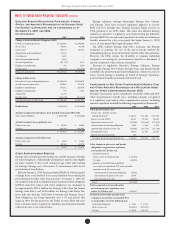

e fair value and gross unrealized losses of available-for-sale equity

and debt securities, summarized by investment type and length of

time that the securities have been in a continuous loss position, are as

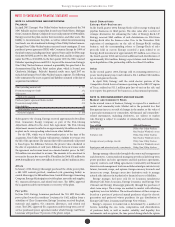

follows at December 31, 2007 (in millions):

Equity Securities Debt Securities

Gross Gross

Fair Unrealized Fair Unrealized

Value Losses Value Losses

Less than 12 months $170 $9 $124 $2

More than 12 months – – 35 1

Total $170 $9 $159 $3

e unrealized losses in excess of twelve months above relate to

Entergy’s Utility operating companies and System Energy.

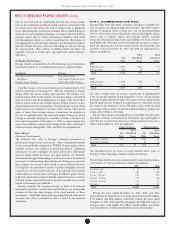

e fair value of debt securities, summarized by contractual maturities,

at December 31, 2007 and 2006 are as follows (in millions):

2007 2006

less than 1 year $ 83 $ 82

1 year – 5 years 388 309

5 years – 10 years 535 472

10 years – 15 years 127 106

15 years – 20 years 81 72

20 years+ 166 112

Total $1,380 $1,153

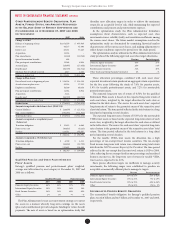

During the years ended December 31, 2007, 2006, and 2005,

proceeds from the dispositions of securities amounted to $1,583 million,

$778 million, and $944 million, respectively. During the years ended

December 31, 2007, 2006, and 2005, gross gains of $5 million in each year

and gross losses of $4 million, $10 million, and $8 million, respectively,

were reclassied out of other comprehensive income into earnings.

Notes to Consolidated Financial Statements continued