Entergy 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

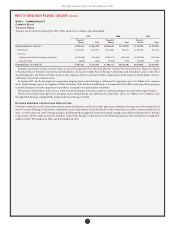

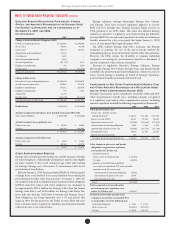

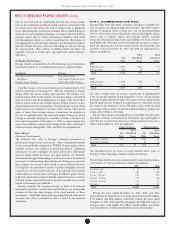

QUA L I F I E D PE N S I O N OB L I G AT I O N S , PL A N AS S E T S , FU N D E D

ST A T U S , A N D AM O U N T S RE C O G N I Z E D IN T H E BA L A N C E SH E E T

F O R EN T E R G Y CO R P O R AT I O N A N D I T S S U B S I D I A R I E S A S O F

DE C E M B E R 31, 2007 A N D 2006

(IN T H O U S A N D S ):

2007 2006

Change in Projected Benet Obligation (PBO)

Balance at beginning of year $3,122,043 $ 2,894,008

Service cost 96,565 92,706

Interest cost 185,170 167,257

Acquisitions and amendments 52,142 –

Curtailments 2,603 –

Special termination benets 4,018 –

Actuarial (gain)/loss (81,757) 4,372

Employee contributions 971 1,003

Benets paid (134,031) (123,272)

Balance at end of year $3,247,724 $3,036,074

Change in Plan Assets

Fair value of assets at beginning of year $2,508,354 $1,994,879

Actual return on plan assets 190,616 270,976

Employer contributions 176,742 318,470

Employee contributions 971 1,003

Acquisition 21,731 –

Benets paid (134,031) (123,272)

Fair value of assets at end of year $2,764,383 $2,462,056

Funded status $ (483,341) $ (574,018)

Amount recognized in the balance sheet (funded status under SFAS 158)

Non-current liabilities $ (483,341) $ (574,018)

Amount recognized as a regulatory asset

Prior service cost $ 16,564 $ 14,388

Net loss 436,789 498,502

$ 453,353 $ 512,890

Amount recognized as OCI (before tax)

Prior service cost $ 2,649 $ 9,544

Net loss 69,581 82,378

$ 72,230 $ 91,922

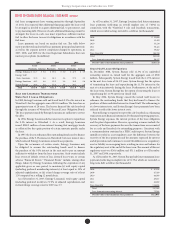

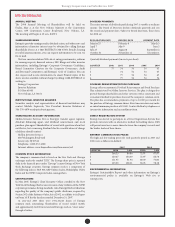

OT H E R PO S T R E T I R E M E N T BE N E F I T S

Entergy also currently provides health care and life insurance benets

for retired employees. Substantially all employees may become eligible

for these benets if they reach retirement age while still working

for Entergy. Entergy uses a December 31 measurement date for its

postretirement benet plans.

Eective January 1, 1993, Entergy adopted SFAS 106, which required

a change from a cash method to an accrual method of accounting for

postretirement benets other than pensions. At January 1, 1993, the

actuarially determined accumulated postretirement benet obligation

(APBO) earned by retirees and active employees was estimated to

be approximately $241.4 million for Entergy (other than the former

Entergy Gulf States) and $128 million for Entergy Gulf States, Inc.

(now split into Entergy Gulf States Louisiana and Entergy Texas.)

Such obligations are being amortized over a 20-year period that

began in 1993. For the most part, the Utility recovers SFAS 106 costs

from customers and is required to contribute postretirement benets

collected in rates to an external trust.

Entergy Arkansas, Entergy Mississippi, Entergy New Orleans,

and Entergy Texas have received regulatory approval to recover

SFAS 106 costs through rates. Entergy Arkansas began recovery in

1998, pursuant to an APSC order. is order also allowed Entergy

Arkansas to amortize a regulatory asset (representing the dierence

between SFAS 106 costs and cash expenditures for other postretirement

benets incurred for a ve-year period that began January 1, 1993)

over a 15-year period that began in January 1998.

e LPSC ordered Entergy Gulf States Louisiana and Entergy

Louisiana to continue the use of the pay-as-you-go method for

ratemaking purposes for postretirement benets other than pensions.

However, the LPSC retains the exibility to examine individual

companies’ accounting for postretirement benets to determine if

special exceptions to this order are warranted.

Pursuant to regulatory directives, Entergy Arkansas, Entergy

Mississippi, Entergy New Orleans, Entergy Texas, and System Energy

contribute the postretirement benet obligations collected in rates to

trusts. System Energy is funding, on behalf of Entergy Operations,

postretirement benets associated with Grand Gulf.

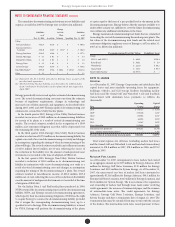

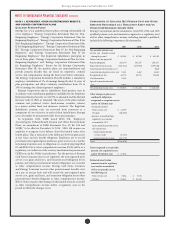

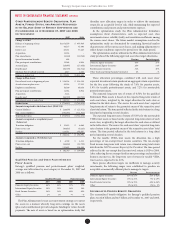

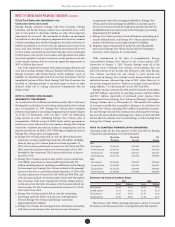

CO M P O N E N T S O F NE T OT H E R PO S T R E T I R E M E N T BE N E F I T CO S T

A N D OT H E R AM O U N T S RE C O G N I Z E D A S A RE G U L A T O R Y AS S E T

A N D /O R OT H E R CO M P R E H E N S I V E IN C O M E (OCI)

Entergy Corporation’s and its subsidiaries’ total 2007, 2006, and 2005

other postretirement benet costs, including amounts recognized

as a regulatory asset and/or other comprehensive income, including

amounts capitalized, included the following components (in thousands):

2007 2006 2005

Other postretirement costs:

Service cost - benets earned

during the period $ 44,137 $ 41,480 $ 37,310

Interest cost on APBO 63,231 57,263 51,883

Expected return on assets (25,298) (19,024) (17,402)

Amortization of transition obligation 3,831 2,169 3,368

Amortization of prior service cost (15,836) (14,751) (13,738)

Recognized net loss 18,972 22,789 22,295

Special termination benets 603 – –

Net other postretirement benet cost $ 89,640 $ 89,926 $ 83,716

Other changes in plan assets and benet

obligations recognized as a regulatory

asset and/or OCI (before tax)

Arising this period:

Prior service credit for period $ (3,520)

Net gain (15,013)

Amounts reclassied from regulatory

asset and/or accumulated OCI to net periodic

pension cost in the current year:

Amortization of transition obligation (3,831)

Amortization of prior service cost 15,836

Amortization of net loss (18,972)

Total $(25,500)

Total recognized as net periodic other

postretirement cost, regulatory asset,

and/or OCI (before tax) $ 64,140

Estimated amortization amounts from

regulatory asset and/or accumulated OCI

to net periodic cost in the following year

Transition obligation $ 3,831 $ 3,831

Prior service cost $(16,417) $(15,837)

Net loss $ 15,676 $ 18,974