Entergy 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Entergy Corporation and Subsidiaries 2007

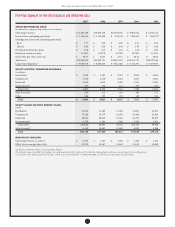

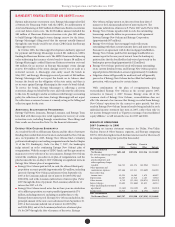

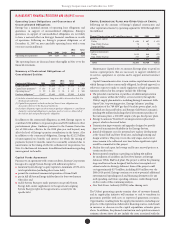

2006 CO M P A R E D T O 2005

Following are income statement variances for Utility, Non-Utility

Nuclear, Parent & Other business segments, and Entergy comparing

2006 to 2005 showing how much the line item increased or (decreased)

in comparison to the prior period (in thousands):

Non-Utility Parent &

Utility Nuclear Other Entergy

2005 Consolidated

Net Income (Loss) $659,760 $282,623 $ (44,052) $ 898,331

Net revenue (operating revenue

less fuel expense,

purchased power, and

other regulatory charges

(credits) – net) 195,681 114,028 3,952 313,661

Other operation and

maintenance expenses 177,725 49,264 (13,831) 213,158

Taxes other than

income taxes 38,662 8,489 (1,111) 46,040

Depreciation 19,780 13,215 (1,580) 31,415

Other income 44,465 27,622 65,049 137,136

Interest charges 41,990 (3,450) 38,234 76,774

Other (including discontinued

operations) (3,146) (6,465) 44,232 34,621

Income taxes (72,557) 40,794 (84,477) (116,240)

2006 Consolidated

Net Income $691,160 $309,496 $131,946 $1,132,602

Net Revenue

Utility

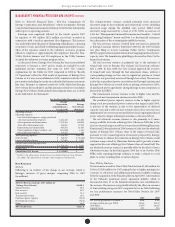

Following is an analysis of the change in net revenue comparing 2006

to 2005 (in millions):

2005 Net Revenue $4,075.4

Base revenues/Attala costs 143.2

Fuel recovery 39.6

Pass-through rider revenue 35.5

Transmission revenue 20.8

Storm cost recovery 12.3

Volume/weather 10.6

Price applied to unbilled electric sales (43.7)

Purchased power capacity (34.5)

Other 11.9

2006 Net Revenue $4,271.1

e base revenues variance resulted primarily from increases

eective October 2005 for Entergy Gulf States Louisiana for the 2004

formula rate plan ling and the annual revenue requirement related

to the purchase of power from the Perryville generating station, and

increases for Entergy Texas related to an incremental purchased

capacity recovery rider that began in December 2005 and a transition

to competition rider that began in March 2006. e Attala costs

variance is due to the recovery of Attala power plant costs at Entergy

Mississippi through the power management rider. e net income

eect of the Attala cost recovery is partially oset by Attala costs in

other operation and maintenance expenses, depreciation expense, and

taxes other than income taxes.

e fuel recovery variance resulted primarily from adjustments of

fuel clause recoveries for Entergy Gulf States Louisiana and increased

recovery in 2006 of fuel costs from retail and special rate customers.

e pass-through rider revenue variance is due to a change in 2006 in

the accounting for city franchise tax revenues in Arkansas as directed by

the Arkansas Public Service Commission (APSC). e change results in

an increase in rider revenue with a corresponding increase in taxes other

than income taxes, resulting in no eect on net income.

e transmission revenue variance is primarily due to new

transmission customers in 2006. Also contributing to the increase was

an increase in rates eective June 2006.

e storm cost recovery variance is due to the return earned on

the interim recovery of storm-related costs at Entergy Louisiana and

Entergy Gulf States Louisiana in 2006 as allowed by the LPSC. e

storm cost recovery lings are discussed in Note 2 to the nancial

statements.

e volume/weather variance resulted from an increase of 1.7% in

electricity usage primarily in the industrial sector. e increase was

partially oset by the eect of less favorable weather on billed sales

in the residential sector, compared to the same period in 2005, and a

decrease in usage during the unbilled period.

e price applied to unbilled sales variance is due to the exclusion in

2006 of the fuel cost component in the calculation of the price applied

to unbilled sales. Eective January 1, 2006, the fuel cost component

is no longer included in the unbilled revenue calculation at Entergy

Louisiana and Entergy Gulf States Louisiana, which is in accordance

with regulatory treatment. See “Management’s Financial Discussion

And Analysis - Critical Accounting Estimates” herein.

e purchased power capacity variance is primarily due to higher

capacity charges and new purchased power contracts in 2006. A portion

of the variance is due to the amortization of deferred capacity costs and

is oset in base revenues due to base rate increases implemented to

recover incremental deferred and ongoing purchased power capacity

charges, as discussed above.

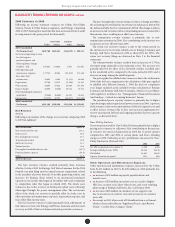

Non-Utility Nuclear

Net revenue increased for Non-Utility Nuclear primarily due to higher

pricing in its contracts to sell power. Also contributing to the increase

in revenues was increased generation in 2006 due to power uprates

completed in 2005 and 2006 at certain plants and fewer refueling

outages in 2006. Following are key performance measures for Non-

Utility Nuclear for 2006 and 2005:

2006 2005

Net MW in operation at December 31 4,200 4,105

Average realized price per MWh $44.33 $42.26

GWh billed 34,847 33,641

Capacity factor for the period 95% 93%

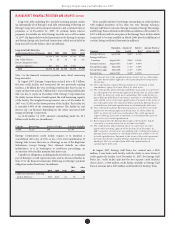

Other Operation and Maintenance Expenses

Other operation and maintenance expenses increased for the Utility

from $1,471 million in 2005 to $1,649 million in 2006 primarily due

to the following:

n an increase of $52 million in payroll, payroll-related, and

benets costs;

n an increase of $20 million in nuclear costs as a result of higher

NRC fees, security costs, labor-related costs, and a non-refueling

plant outage at Entergy Gulf States, Inc. in February 2006;

n an increase of $16 million in customer service support costs

due to an increase in contract costs and an increase in customer

write-os;

n the receipt in 2005 of proceeds of $16 million from a settlement,

which is discussed further in “Signicant Factors And Known

Trends - Central States Compact Claim;”

Management’s Financial Discussion and Analysis conti nued