Entergy 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Entergy Corporation and Subsidiaries 2007

Management’s Financial Discussion and Analysis conti nued

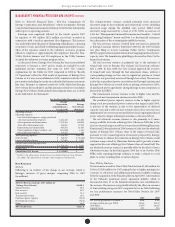

Company Authorized ROE Pending Proceedings/Events

Entergy Arkansas 9.9% n In August 2006, Entergy Arkansas led with the APSC a request for a change in base rates. Entergy Arkansas requested a general base rate increase (using

an ROE of 11.25%), which it subsequently adjusted to a request for a $106.5 million annual increase. In June 2007, after hearings on the ling, the APSC

ordered Entergy Arkansas to reduce its annual rates by $5 million, and set a return on common equity of 9.9% with a hypothetical common equity level

lower than Entergy Arkansas’ actual capital structure. The base rate change was implemented August 29, 2007, effective for bills rendered after June 15,

2007. Entergy Arkansas has appealed the rate case order.

n Base rates at the previous level had been in effect since 1998.

Entergy Texas 10.95% n Base rates are currently set at rates approved by the PUCT in June 1999.

n

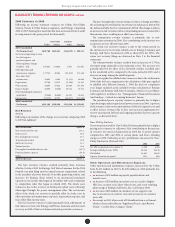

Entergy Texas made a rate ling in September 2007 with the PUCT requesting an annual rate increase totaling $107.5 million, including a base rate

increase of $64.3 million and special riders totaling $43.2 million. The base rate increase includes $12.2 million for the storm damage reserve. Entergy

Texas is requesting an 11% return on common equity. In December 2007 the PUCT issued an order setting September 26, 2008 as the effective date for

the rate change from the rate ling. The hearing on the rate case is scheduled for May 2008.

n Legislation enacted in June 2005 allowed Entergy Texas to le for rate relief through riders for incremental capacity costs (IPCR) and transition costs. In

December 2005, the PUCT approved the recovery of $18 million annual capacity costs, subject to reconciliation from September 2005. In January 2008,

an agreement was led with the PUCT to increase the IPCR to $21 million and to add a surcharge for $10.3 million of under-recovered costs, which the

PUCT approved. In June 2006, the PUCT approved a settlement in the transition to competition (TTC) cost recovery case, allowing Entergy Texas to

recover $14.5 million per year in TTC costs over a 15-year period.

n On June 29, 2007, Entergy Gulf States Reconstruction Funding I, LLC, a company wholly-owned and consolidated by Entergy Texas, issued $329.5

million of senior secured transition (securitization) bonds. Entergy Texas began cost recovery through a transition charge in July 2007, and the transition

charge is expected to remain in place over a 15-year period.

Entergy 9.9% – 11.4% n A three-year formula rate plan is in place with an ROE mid-point of 10.65% for the initial three-year term of the plan. Entergy Gulf

Gulf States States Louisiana made its rst formula rate plan (FRP) ling in June 2005 for the 2004 test year.

Louisiana n On December 13, 2007, the LPSC Staff issued a nal report on Entergy Gulf States Louisiana’s FRP ling for the 2006 test year, indicating a $1.6

million decrease in revenues for which interim rates were already in effect. In addition the Staff recommended that the LPSC agree to a one-year

extension of the FRP to synchronize with the nal year of Entergy Louisiana’s FRP, or alternatively extend for a longer period. Entergy Gulf States

Louisiana indicated it is amenable to a one-year extension. An uncontested stipulated settlement was led in February 2008 that will leave the current

base rates in place.

n In August 2007, the LPSC approved $187 million as the balance of storm restoration costs for recovery and established $87 million as a reserve for future

storms, both to be securitized in the same amounts. In May 2006, Entergy Gulf States Louisiana completed the $6 million interim recovery of storm costs

through the fuel adjustment clause pursuant to an LPSC order. Beginning in September 2006, interim recovery shifted to the FRP at the rate of $0.85

million per month. Interim recovery and carrying charges will continue until the securitization process is complete.

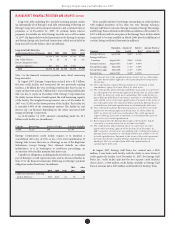

Entergy 9.45% – 11.05% n A three-year formula rate plan is in place with an ROE mid-point of 10.25% for the initial three-year term of the plan. Entergy Louisiana made its

Louisiana rst formula rate plan (FRP) ling under this plan in May 2006 based on a 2005 test year.

n Entergy Louisiana continues to seek resolution of its 2006 and 2005 test year FRP lings. A hearing on the 2006 test year ling is

scheduled for August 2008.

n The 2005 test year ling made in May 2006 indicated a 9.45% ROE, which is within the allowed bandwidth. Rates were implemented on September 28,

2006 subject to refund consisting of $119 million for deferred and ongoing capacity costs and $24 million for interim storm cost recovery. This increase

reects certain adjustments proposed by the LPSC Staff with which Entergy Louisiana agrees.

n The 2006 test year ling made in May 2007 indicated a 7.6% ROE. On September 27, 2007, Entergy Louisiana implemented an $18.4 million increase,

subject to refund, $23.8 million representing a 60% adjustment to reach the bottom of the FRP band, net of $5.4 million for reduced capacity costs. The

LPSC will allow Entergy Louisiana to defer the difference between the $39.8 million requested for unrecovered xed costs for extraordinary customer losses

associated with Hurricane Katrina and the $23.8 million 60% adjustment as a regulatory asset, pending ultimate LPSC resolution of the 2006 FRP ling.

n On October 29, 2007, Entergy Louisiana implemented a $7.1 million FRP decrease which is primarily due to the reclassication of certain franchise fees

from base rates to collection via a line item on customers’ bills pursuant to a LPSC order.

n In August 2007, the LPSC approved $545 million as the balance of storm restoration costs for recovery and established $152 million as a reserve for

future storms, both to be securitized in the same amounts. In April 2006, Entergy Louisiana completed the $14 million interim recovery of storm costs

through the fuel adjustment clause pursuant to an LPSC order. Beginning in September 2006, interim recovery shifted to the FRP at the rate of $2 million

per month. Interim recovery and carrying charges will continue until the securitization process is complete.

Entergy 9.46% – 12.24% n An annual formula rate plan (FRP) is in place. The FRP allows Entergy Mississippi’s earned ROE to increase or decrease within a

Mississippi bandwidth with no change in rates; earnings outside the bandwidth are allocated 50% to customers and 50% to Entergy Mississippi, but on a

prospective basis only. The plan also provides for performance incentives that can increase or decrease the benchmark ROE by as much as 100 basis points.

n The MPSC approved a joint stipulation between Entergy Mississippi and the Mississippi Public Utilities Staff on June 6, 2007, calling for a $10.5 million

increase effective with July billings for Entergy Mississippi’s 2006 test year FRP ling.

n In December 2005, the MPSC approved the purchase of the Attala power plant and ordered interim recovery. In October 2006, the MPSC approved

Entergy Mississippi’s ling to revise the Power Management Rider Schedule to extend beyond 2006 recovery of Entergy Mississippi’s Attala costs. In

December 2006, the MPSC approved Entergy Mississippi’s request to increase several fees (connect, reconnect, late payment and returned check) effective

January 1, 2007.

n The Mississippi Development Corporation, an entity created by the state, issued securitization bonds. Entergy Mississippi received proceeds in the

amount of $48 million on May 31, 2007, reecting recovery of $8 million of storm restoration costs and $40 million to increase Entergy Mississippi’s

storm reserve. To service the bonds, Entergy Mississippi is collecting a system restoration charge on behalf of the state and remitting collections to the

state. In October 2006, Entergy Mississippi received $81 million in CDBG funding, pursuant to MPSC orders approving recovery of $89 million storm

restoration costs.

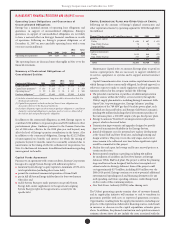

Entergy 10.75% – Electric; n In June 2006, Entergy New Orleans made its annual formula rate plan lings with the City Council. At the same time as it made its formula rate plan

New Orleans 10.75% – Gas lings, Entergy New Orleans also led with the City Council a request to implement two storm-related riders. With the rst rider, Entergy New Orleans

sought to recover the electric and gas restoration costs that it had actually spent through March 31, 2006. With the second rider, Entergy New Orleans

sought to establish a storm reserve to provide for the risk of another storm.

n In October 2006, the City Council approved a settlement agreement that resolves Entergy New Orleans’ rate and storm-related rider lings by providing

for phased-in rate increases, while taking into account with respect to storm restoration costs the anticipated receipt of CDBG funding. The settlement

provides for a 0% increase in electric base rates through December 2007, with a $3.9 million increase implemented in January 2008. Recovery of all

Grand Gulf costs through the fuel adjustment clause will continue. Gas base rates increased by $4.75 million in November 2006 and increased by

additional $1.5 million in March 2007 and an additional $4.75 million in November 2007. The settlement calls for Entergy New Orleans to le a base

rate case by July 31, 2008.

n The settlement agreement discontinues the formula rate plan and the generation performance-based plan but permits Entergy New Orleans to le an

application to seek authority to implement formula rate plan mechanisms no sooner than six months following the effective date of the implementation

of the base rates resulting from the July 31, 2008 base rate case. Any storm costs in excess of CDBG funding and insurance proceeds will be addressed in

that base rate case.

n The settlement also authorizes a $75 million storm reserve for damage from future storms, which will be created over a ten-year period through a storm

reserve rider beginning in March 2007. These storm reserve funds will be held in a restricted escrow account.

n In January 2008, Entergy New Orleans voluntarily implemented a 6.15% base rate credit for electric customers, which Entergy New Orleans estimates

will return $10.6 million to electric customers in 2008. Entergy New Orleans was able to implement this credit because the recovery of New Orleans

after Hurricane Katrina has been occurring faster than expected.

n In April 2007, Entergy New Orleans executed an agreement with the Louisiana Ofce of Community Development under which $200 million of CDBG

funds will be made available to Entergy New Orleans. Entergy New Orleans has received $180.8 million of the funds as of December 31, 2007, and

under the agreement with the OCD, Entergy New Orleans expects to receive the remainder as it incurs and submits additional eligible costs.

System Energy 10.94% n ROE approved by July 2001 FERC order. No cases pending before the FERC.