Entergy 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

fuel lease arrangements have varying maturities through September

15, 2011. It is expected that additional nancing under the leases will

be arranged as needed to acquire additional fuel, to pay interest, and

to pay maturing debt. However, if such additional nancing cannot be

arranged, the lessee in each case must repurchase sucient nuclear

fuel to allow the lessor to meet its obligations in accordance with the

fuel lease.

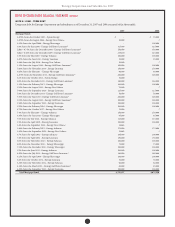

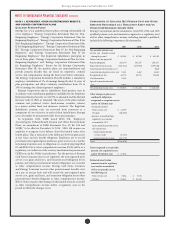

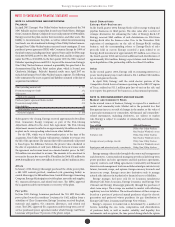

Lease payments are based on nuclear fuel use. e table below

represents the total nuclear fuel lease payments (principal and interest),

as well as the separate interest component charged to operations, in

2007, 2006, and 2005 for the four Registrant Subsidiaries that own

nuclear power plants (in millions):

2007 2006 2005

Lease Lease Lease

Payments Interest Payments Interest Payments Interest

Entergy Arkansas $ 61.7 $ 5.8 $ 55.0 $ 5.0 $ 47.5 $ 3.9

Entergy Gulf

States Louisiana 31.5 2.8 28.1 3.6 27.2 3.5

Entergy Louisiana 44.2 4.0 35.5 2.4 30.9 2.6

System Energy 30.4 4.0 32.8 3.6 30.2 2.9

Total $167.8 $16.6 $151.4 $14.6 $135.8 $12.9

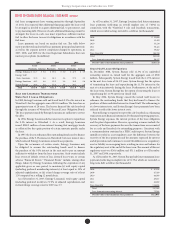

SA L E A N D LE A S E B A C K T R A N S A C T I O N S

Wat er ford 3 L ea se O bl igation s

In 1989, Entergy Louisiana sold and leased back 9.3% of its interest in

Waterford 3 for the aggregate sum of $353.6 million. e lease has an

approximate term of 28 years. e lessors nanced the sale-leaseback

through the issuance of Waterford 3 Secured Lease Obligation Bonds.

e lease payments made by Entergy Louisiana are sucient to service

the debt.

In 1994, Entergy Louisiana did not exercise its option to repurchase

the 9.3% interest in Waterford 3. As a result, Entergy Louisiana

issued $208.2 million of non-interest bearing rst mortgage bonds

as collateral for the equity portion of certain amounts payable under

the lease.

In 1997, the lessors renanced the outstanding bonds used to nance

the purchase of the 9.3% interest in Waterford 3 at lower interest rates,

which reduced Entergy Louisiana’s annual lease payments.

Upon the occurrence of certain events, Entergy Louisiana may

be obligated to assume the outstanding bonds used to nance

the purchase of the 9.3% interest in the unit and to pay an amount

sucient to withdraw from the lease transaction. Such events include

lease events of default, events of loss, deemed loss events, or certain

adverse “Financial Events.” “Financial Events” include, among other

things, failure by Entergy Louisiana, following the expiration of any

applicable grace or cure period, to maintain (i) total equity capital

(including preferred membership interests) at least equal to 30% of

adjusted capitalization, or (ii) a xed charge coverage ratio of at least

1.50 computed on a rolling 12 month basis.

As of December 31, 2007, Entergy Louisiana’s total equity capital

(including preferred stock) was 57.0% of adjusted capitalization and

its xed charge coverage ratio for 2007 was 3.7.

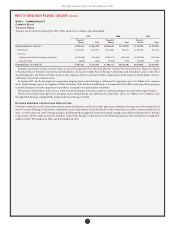

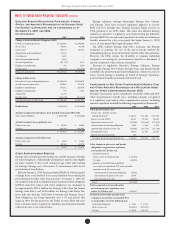

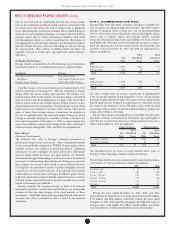

As of December 31, 2007, Entergy Louisiana had future minimum

lease payments (reecting an overall implicit rate of 7.45%) in

connection with the Waterford 3 sale and leaseback transactions,

which are recorded as long-term debt, as follows (in thousands):

2008 $ 22,606

2009 32,452

2010 35,138

2011 50,421

2012 39,067

Years thereaer 164,158

Total 343,842

Less: Amount representing interest 96,117

Present value of net minimum lease payments $247,725

Grand Gulf Lease Obligations

In December 1988, System Energy sold 11.5% of its undivided

ownership interest in Grand Gulf for the aggregate sum of $500

million. Subsequently, System Energy leased back the 11.5% interest

in the unit for a term of 26-1/2 years. System Energy has the option

of terminating the lease and repurchasing the 11.5% interest in the

unit at certain intervals during the lease. Furthermore, at the end of

the lease term, System Energy has the option of renewing the lease or

repurchasing the 11.5% interest in Grand Gulf.

In May 2004, System Energy caused the Grand Gulf lessors to

renance the outstanding bonds that they had issued to nance the

purchase of their undivided interest in Grand Gulf. e renancing is

at a lower interest rate, and System Energy’s lease payments have been

reduced to reect the lower interest costs.

System Energy is required to report the sale-leaseback as a nancing

transaction in its nancial statements. For nancial reporting purposes,

System Energy expenses the interest portion of the lease obligation

and the plant depreciation. However, operating revenues include the

recovery of the lease payments because the transactions are accounted

for as a sale and leaseback for ratemaking purposes. Consistent with

a recommendation contained in a FERC audit report, System Energy

initially recorded as a net regulatory asset the dierence between the

recovery of the lease payments and the amounts expensed for interest

and depreciation and continues to record this dierence as a regulatory

asset or liability on an ongoing basis, resulting in a zero net balance for

the regulatory asset at the end of the lease term. e amount of this net

regulatory asset was $36.6 million and $51.1 million as of December

31, 2007 and 2006, respectively.

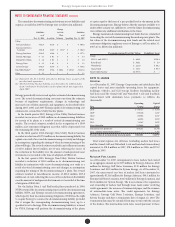

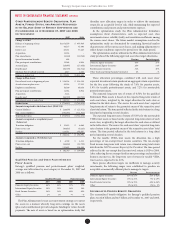

As of December 31, 2007, System Energy had future minimum lease

payments (reecting an implicit rate of 5.13%), which are recorded as

long-term debt as follows (in thousands):

2008 $ 47,128

2009 47,760

2010 48,569

2011 49,437

2012 49,959

Years thereaer 154,436

Total 397,289

Less: Amount representing interest 75,284

Present value of net minimum lease payments $322,005