Entergy 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

s humans, we created the climate change mess and as humans,

we have the potential within us to x it. Entergy believes the

debate on the science behind climate change is over and that

climate change is real. Going forward, ve key principles should guide

us as we – as a nation and an industry – develop a carbon policy to

address the climate change issue: take meaningful action now, use

market forces intelligently, be realistic about carbon prices, support

research and development and understand the social eects.

In 2006, the debate on climate change centered largely on whether

the science behind the issue was fact or ction. In our 2006 annual

report, we said the science behind climate change was real. We presented

opinions of well-respected climate change experts and we asked you

to form your own opinion and support action on the issue.

Today, the debate has shied dramatically. e science has now been

accepted as reality by most informed constituents. Now questions on

how to address the issue are taking center stage. Our view at Entergy

is there are ve guiding principles that we should follow in order to

develop a smart and eective carbon policy. ey are:

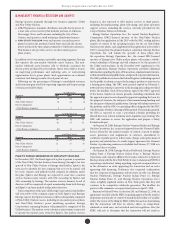

1. MEANINGFUL ACTION I S NEEDED N OW

Time is of the essence. To reduce future climate change impacts,

we must stabilize the growing concentration of greenhouse gases

in the atmosphere. Because of inertia in the system, greenhouse

gas concentrations will continue to rise even aer emissions have

been reduced. So, global greenhouse gas emissions rst must peak

and then decline thereaer, ultimately achieving stabilization. e

lower the stabilization level, the more quickly this peak and decline

in emissions will need to occur. Bottom line, the longer we wait, the

more dicult and costly it will be to achieve stabilization.

2. U SE MARKET FORCES INTELLIGENTLY

At present, there is no “silver bullet” to reduce carbon emissions at

low cost, and we need to face up to that. Carbon control will not be

cheap. We have to be as smart as possible about how we go about it,

so that we do not cripple the economy. Because it will be expensive,

we should rely on the most ecient method for resource allocation

and that is the market.

ere are two main forms of market-based greenhouse gas

regulation – a cap-and-trade system or a carbon tax. Cap-and-trade

limits greenhouse gas emissions at a dened level and tradable allowances

to emit are either freely allocated or auctioned o at an allowance

price set by the market. A carbon tax is levied on emitters based on

the amount of greenhouse gases they emit.

Entergy supports a cap-and-trade plan as it provides impetus for

companies to seek cleaner technologies and provides a revenue stream

for research and development investment in clean generation. Under

any cap-and-trade system implemented to reduce greenhouse gas

emissions, allowances should not be fully allocated. Selling at least

some allowances is essential in order to generate a revenue stream to

fund investment in necessary R&D and to help mitigate the regressive

impact of a carbon policy on low-income households.

Using market forces intelligently also means looking at the whole

picture. According to the 2007 U.S. Greenhouse Gas Inventory Report,

the electric sector emitted 2.38 billion metric tons of CO2 in 2005,

a third of total U.S. greenhouse gas emissions and only 5 percent of

the world total. e electric sector by itself cannot achieve the global

greenhouse gas emission reductions required for stabilization targets.

So it’s important not only to look at the cost, benets, eciency and

equity of the U.S. carbon policy, but also to consider how the policy

will interact with international policy. Bottom line, we need a market-

based approach with the broadest possible reach.

3. BE R EALISTIC ABOUT CARBON PRICES

We must be prepared for, and willing to accept, signicant carbon

prices that are high enough to encourage clean generating

technologies to enter the market. If we are lucky, under a cap-and-

trade model, CO2 allowance prices will not be more than $50 per

ton – but they could go higher. Whether we are lucky or not depends

principally on successful development of coal retrot technology.

Eighty percent of the U.S. electric sector’s CO2 emissions are from

existing coal plants. ere is presently no cost-eective technology for

post-combustion capture from conventional coal plants and experts

tell us that secure, long-term geologic storage of CO2 emissions is 10

years away. We need clean coal as a part of our future energy mix. For

that to happen, we need a carbon price that allows carbon capture

and storage to become a viable option. Unless and until we have that

technology, the only way to achieve the emission reductions needed

to meet stabilization targets would be a carbon price high enough to

induce the retirement of conventional coal plants. Our analysis also

shows that it would take a carbon price greater than $70 per ton to

achieve this outcome. is is not an acceptable outcome. Clean coal

needs to be part of our secure energy future. A cap-and-trade policy

that allows a price ceiling to rise to $50 per ton over a 10-year period

will stimulate innovation and help bring cost-eective, clean

Guiding Principles for a Carbon Policy

Entergy Environmental

climate change is real. Going forward, ve key principles should guide

A

Entergy Corporation and Subsidiaries 2007

21