Entergy 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Entergy Corporation and Subsidiaries 2007

n an increase of $16 million in fossil operating costs due to the

purchase of the Attala plant in January 2006 and the Perryville

plant coming online in July 2005;

n an increase of $12 million related to storm reserves. is increase

does not include costs associated with Hurricanes Katrina and

Rita; and

n an increase of $12 million due to a return to normal expense

patterns in 2006 versus the deferral or capitalization of storm costs

in 2005.

Other operation and maintenance expenses increased for Non-

Utility Nuclear from $588 million in 2005 to $637 million in 2006

primarily due to the timing of refueling outages, increased benet and

insurance costs, and increased NRC fees.

Taxes Other Than Income Taxes

Taxes other than income taxes increased for the Utility from $322

million in 2005 to $361 million in 2006 primarily due to an increase

in city franchise taxes in Arkansas due to a change in 2006 in the

accounting for city franchise tax revenues as directed by the APSC.

e change results in an increase in taxes other than income taxes with

a corresponding increase in rider revenue, resulting in no eect on

net income. Also contributing to the increase was higher franchise tax

expense at Entergy Gulf States, Inc. as a result of higher gross revenues

in 2006 and a customer refund in 2005.

Other Income

Other income increased for the Utility from $111 million in 2005 to

$156 million in 2006 primarily due to carrying charges recorded on

storm restoration costs.

Other income increased for Non-Utility Nuclear primarily due

to miscellaneous income of $27 million ($16.6 million net-of-tax)

resulting from a reduction in the decommissioning liability for a plant

as a result of a revised decommissioning cost study and changes in

assumptions regarding the timing of when decommissioning of a plant

will begin.

Other income increased for Parent & Other primarily due to a gain

related to its Entergy-Koch investment of approximately $55 million

(net-of-tax) in the fourth quarter of 2006. In 2004, Entergy-Koch

sold its energy trading and pipeline businesses to third parties. At

that time, Entergy received $862 million of the sales proceeds in the

form of a cash distribution by Entergy-Koch. Due to the November

2006 expiration of contingencies on the sale of Entergy-Koch’s trading

business, and the corresponding release to Entergy-Koch of sales

proceeds held in escrow, Entergy received additional cash distributions

of approximately $163 million during the fourth quarter of 2006 and

recorded a gain of approximately $55 million (net-of-tax). Entergy

expects future cash distributions upon liquidation of the partnership

will be less than $35 million.

Interest Charges

Interest charges increased for the Utility and Parent & Other primarily

due to additional borrowing to fund the signicant storm restoration

costs associated with Hurricanes Katrina and Rita.

Discontinued Operations

In April 2006, Entergy sold the retail electric portion of the Competitive

Retail Services business operating in the Electric Reliability Council of

Texas (ERCOT) region of Texas, and now reports this portion of the

business as a discontinued operation. Earnings for 2005 were negatively

aected by $44.8 million (net-of-tax) of discontinued operations due

to the planned sale. is amount includes a net charge of $25.8 million

(net-of-tax) related to the impairment reserve for the remaining net

book value of the Competitive Retail Services business’ information

technology systems. Results for 2006 include an $11.1 million gain

(net-of-tax) on the sale of the retail electric portion of the Competitive

Retail Services business operating in the ERCOT region of Texas.

Income Taxes

e eective income tax rates for 2006 and 2005 were 27.6% and

36.6%, respectively. e lower eective income tax rate in 2006 is

primarily due to tax benets, net of reserves, resulting from the tax

capital loss recognized in connection with the liquidation of Entergy

Power International Holdings, Entergy’s holding company for

Entergy-Koch. Also contributing to the lower rate for 2006 is an IRS

audit settlement that allowed Entergy to release from its tax reserves

all settled issues relating to 1996-1998 audit cycle. See Note 3 to the

nancial statements for a reconciliation of the federal statutory rate of

35.0% to the eective income tax rates, and for additional discussion

regarding income taxes.

LIQUIDITY AND CAPITAL RESOURCES

is section discusses Entergy’s capital structure, capital spending

plans and other uses of capital, sources of capital, and the cash ow

activity presented in the cash ow statement.

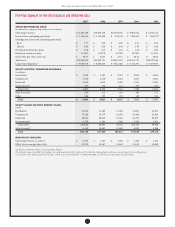

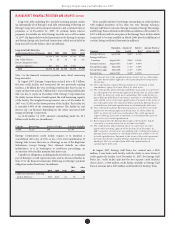

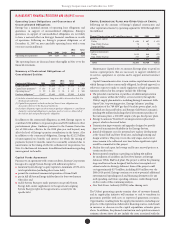

CA P I TA L ST R U C T U R E

Entergy’s capitalization is balanced between equity and debt, as shown

in the following table. e increase in the debt to capital percentage

from 2006 to 2007 is primarily the result of additional borrowings under

Entergy Corporation’s revolving credit facility, along with a decrease in

shareholders’ equity primarily due to repurchases of common stock.

is increase in the debt to capital percentage is in line with Entergy’s

nancial and risk management aspirations. e decrease in the debt

to capital percentage from 2005 to 2006 is the result of an increase in

shareholders’ equity, primarily due to an increase in retained earnings,

partially oset by repurchases of common stock.

2007 2006 2005

Net debt to net capital at the end of the year 54.6% 49.4% 51.5%

Eect of subtracting cash from debt 3.0% 2.9% 1.6%

Debt to capital at the end of the year 57.6% 52.3% 53.1%

Net debt consists of debt less cash and cash equivalents. Debt consists

of notes payable, capital lease obligations, preferred stock with sinking

fund, and long-term debt, including the currently maturing portion.

Capital consists of debt, shareholders’ equity, and preferred stock

without sinking fund. Net capital consists of capital less cash and cash

equivalents. Entergy uses the net debt to net capital ratio in analyzing

its nancial condition and believes it provides useful information to its

investors and creditors in evaluating Entergy’s nancial condition.

Management’s Financial Discussion and Analysis conti nued