Entergy 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

NU C L E A R RE F U E L I N G OU TA G E CO S T S

Nuclear refueling outage costs are deferred during the outage and

amortized over the estimated period to the next outage because these

refueling outage expenses are incurred to prepare the units to operate

for the next operating cycle without having to be taken o line. Prior

to 2006, River Bend’s costs were accrued in advance of the outage and

included in the cost of service used to establish retail rates. Entergy

Gulf States Louisiana relieved the accrued liability when it incurred

costs during the next River Bend outage. In 2006, Entergy Gulf States

Louisiana adopted FSP No. AUG AIR-1, “Accounting for Planned

Major Maintenance Activities,” for its River Bend nuclear refueling

outage costs and now accounts for these costs in the same manner as

Entergy’s other subsidiaries. Adoption of FSP No. AUG AIR-1 resulted

in an immaterial retrospective adjustment to Entergy’s and Entergy

Gulf States Louisiana’s retained earnings balance.

AL L O W A N C E F O R FU N D S US E D DURING CO N S T R U C T I O N

(AFUDC)

AFUDC represents the approximate net composite interest cost of

borrowed funds and a reasonable return on the equity funds used for

construction by the Utility operating companies and System Energy.

AFUDC increases both the plant balance and earnings, and is realized

in cash through depreciation provisions included in rates.

IN C O M E T A X E S

Entergy Corporation and the majority of its subsidiaries le a United

States consolidated federal income tax return. Entergy Louisiana,

formed December 31, 2005, is not a member of the consolidated

group and les a separate federal income tax return. Income taxes

are allocated to the subsidiaries in proportion to their contribution

to consolidated taxable income. In accordance with SFAS 109,

“Accounting for Income Taxes,” deferred income taxes are recorded

for all temporary dierences between the book and tax basis of assets

and liabilities, and for certain credits available for carryforward.

Deferred tax assets are reduced by a valuation allowance when,

in the opinion of management, it is more likely than not that some

portion of the deferred tax assets will not be realized. Deferred tax

assets and liabilities are adjusted for the eects of changes in tax laws

and rates in the period in which the tax or rate was enacted.

Investment tax credits are deferred and amortized based upon

the average useful life of the related property, in accordance with

ratemaking treatment.

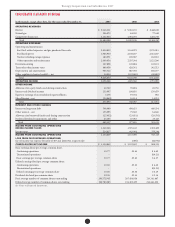

EA R N I N G S PER SH A R E

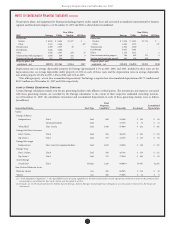

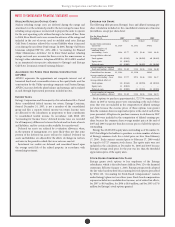

e following table presents Entergy’s basic and diluted earnings per

share calculation included on the consolidated statements of income

(in millions, except per share data):

Stock options to purchase approximately 1,727,579 common stock

shares in 2005 at various prices were outstanding at the end of those

years that were not included in the computation of diluted earnings

per share because the exercise prices of those options were greater

than the common share average market price at the end of each of the

years presented. All options to purchase common stock shares in 2007

and 2006 were included in the computation of diluted earnings per

share because the common share average market price at the end of

2007 and 2006 was greater than the exercise prices of all of the options

outstanding.

Entergy has 10,000,000 equity units outstanding as of December 31,

2007 that obligate the holders to purchase a certain number of shares

of Entergy common stock for a stated price no later than February

17, 2009. Each contract executed prior to February 17, 2009 would

be equal to 0.5727 common stock shares. e equity units were not

included in the calculation at December 31, 2006 and 2005 because

Entergy’s average stock price for the year was less than the threshold

appreciation price of the equity units.

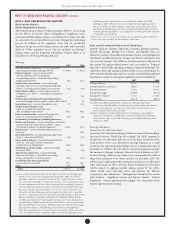

ST O C K -BA S E D CO M P E N S AT I O N PL A N S

Entergy grants stock options to key employees of the Entergy

subsidiaries, which is described more fully in Note 12 to the nancial

statements. Eective January 1, 2003, Entergy prospectively adopted

the fair value based method of accounting for stock options prescribed

by SFAS 123, “Accounting for Stock-Based Compensation.” Awards

under Entergy’s plans vest over three years. Stock-based compensation

expense included in consolidated net income, net of related tax eects,

for 2007 is $8.9 million, for 2006 is $6.8 million, and for 2005 is $7.8

million for Entergy’s stock options granted.

For the Years Ended

December 31, 2007 2006 2005

$/share $/share $/share

Income from continuing

operations $1,134.8 $1,133.1 $943.1

Average numbers of

common shares

outstanding – basic 196.6 $5.77 207.5 $5.46 210.1 $4.49

Average dilutive eect of:

Stock options 5.0 (0.142) 3.8 (0.098) 4.0 (0.085)

Equity units 1.1 (0.033) – – – –

Deferred units 0.1 (0.003) 0.2 (0.005) 0.3 (0.006)

Average number of common

shares outstanding – diluted 202.8 $5.60 211.5 $5.36 214.4 $4.40

Consolidated net income $1,134.8 $1,132.6 $898.3

Average number of common

shares outstanding – basic 196.6 $5.77 207.5 $5.46 210.1 $4.27

Average diluted eect of:

Stock options 5.0 (0.142) 3.8 (0.098) 4.0 (0.081)

Equity units 1.1 (0.033) – – – –

Deferred units 0.1 (0.003) 0.2 (0.005) 0.3 (0.005)

Average number of common

shares outstanding – diluted 202.8 $5.60 211.5 $5.36 214.4 $4.19