Entergy 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

Entergy Corporation and Subsidiaries 2007

Katrina infrastructure restoration costs. Entergy Mississippi also led

a Petition for Financing Order with the MPSC for authorization of

state bond nancing of $169 million for Hurricane Katrina restoration

costs and future storm costs. e $169 million amount included the

$89 million of Hurricane Katrina restoration costs plus $80 million

to build Entergy Mississippi’s storm damage reserve for the future.

Entergy Mississippi’s ling stated that the amount actually nanced

through the state bonds would be net of any CDBG funds that Entergy

Mississippi received.

In October 2006, the Mississippi Development Authority approved

for payment and Entergy Mississippi received $81 million in CDBG

funding for Hurricane Katrina costs. e MPSC then issued a nancing

order authorizing the issuance of state bonds to nance $8 million of

Entergy Mississippi’s certied Hurricane Katrina restoration costs and

$40 million for an increase in Entergy Mississippi’s storm damage

reserve. $30 million of the storm damage reserve was set aside in a

restricted account. A Mississippi state entity issued the bonds in

May 2007, and Entergy Mississippi received proceeds of $48 million.

Entergy Mississippi will not report the bonds on its balance sheet

because the bonds are the obligation of the state entity, and there is

no recourse against Entergy Mississippi in the event of a bond default.

To service the bonds, Entergy Mississippi is collecting a system

restoration charge on behalf of the state, and will remit the collections

to the state. By analogy to and in accordance with Entergy’s accounting

policy for collection of sales taxes, Entergy Mississippi will not report

the collections as revenue because it is merely acting as the billing and

collection agent for the state.

AD D I T I O N A L SE C U R I T I Z AT I O N PR O C E E D I N G S

Entergy Gulf States Louisiana, Entergy Louisiana, and Entergy Texas

have led with their respective retail regulators for recovery of storm

restoration costs, including through securitization. ese lings and

their results are discussed in Note 2 to the nancial statements.

EN T E R G Y NE W OR L E A N S BA N K R U P T C Y

As a result of the eects of Hurricane Katrina and the eect of extensive

ooding that resulted from levee breaks in and around the New Orleans

area, on September 23, 2005, Entergy New Orleans led a voluntary

petition in bankruptcy court seeking reorganization relief under Chapter

11 of the U.S. Bankruptcy Code. On May 7, 2007, the bankruptcy

judge entered an order conrming Entergy New Orleans’ plan of

reorganization. With the receipt of CDBG funds, and the agreement on

insurance recovery with one of its excess insurers, Entergy New Orleans

waived the conditions precedent in its plan of reorganization, and the

plan became eective on May 8, 2007. Following are signicant terms in

Entergy New Orleans’ plan of reorganization:

n Entergy New Orleans paid in full, in cash, the allowed third-party

prepetition accounts payable (approximately $29 million, including

interest). Entergy New Orleans paid interest from September 23,

2005 at the Louisiana judicial rate of interest for 2005 (6%) and

2006 (8%), and at the Louisiana judicial rate of interest plus 1% for

2007 through the date of payment. e Louisiana judicial rate of

interest for 2007 is 9.5%.

n Entergy New Orleans issued notes due in three years in satisfaction

of its aliate prepetition accounts payable (approximately $74

million, including interest), including its indebtedness to the

Entergy System money pool. Entergy New Orleans included in the

principal amount of the notes accrued interest from September 23,

2005 at the Louisiana judicial rate of interest for 2005 (6%)

and 2006 (8%), and at the Louisiana judicial rate of interest plus

1% for 2007 through the date of issuance of the notes. Entergy

New Orleans will pay interest on the notes from their date of

issuance at the Louisiana judicial rate of interest plus 1%. e

Louisiana judicial rate of interest is 9.5% for 2007 and 8.5% for 2008.

n Entergy New Orleans repaid in full, in cash, the outstanding

borrowings under the debtor-in-possession credit agreement

between Entergy New Orleans and Entergy Corporation

(approximately $67 million).

n Entergy New Orleans’ rst mortgage bonds will remain

outstanding with their current maturity dates and interest terms.

Pursuant to an agreement with its rst mortgage bondholders,

Entergy New Orleans paid the rst mortgage bondholders an

amount equal to the one year of interest from the bankruptcy

petition date that the bondholders had waived previously in the

bankruptcy proceeding (approximately $12 million).

n Entergy New Orleans’ preferred stock will remain outstanding

on its current dividend terms, and Entergy New Orleans paid its

unpaid preferred dividends in arrears (approximately $1 million).

n Litigation claims will generally be unaltered, and will generally

proceed as if Entergy New Orleans had not led for bankruptcy

protection, with exceptions for certain claims.

With conrmation of the plan of reorganization, Entergy

reconsolidated Entergy New Orleans in the second quarter 2007,

retroactive to January 1, 2007. Because Entergy owns all of the

common stock of Entergy New Orleans, reconsolidation does not

aect the amount of net income that Entergy recorded from Entergy

New Orleans’ operations for the current or prior periods, but does

result in Entergy New Orleans’ nancial results being included in each

individual income statement line item in 2007, rather than only its

net income being presented as “Equity in earnings of unconsolidated

equity aliates,” as will remain the case for 2005 and 2006.

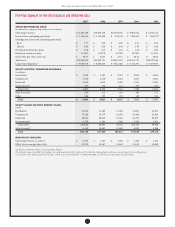

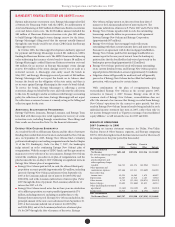

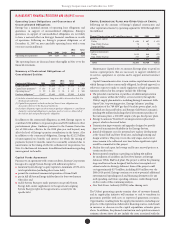

RESULTS OF OPERATIONS

2007 CO M P A R E D T O 2006

Following are income statement variances for Utility, Non-Utility

Nuclear, Parent & Other business segments, and Entergy comparing

2007 to 2006 showing how much the line item increased or (decreased)

in comparison to the prior period (in thousands):

Non-Utility Parent &

Utility Nuclear Other Entergy

2006 Consolidated

Net Income $691,160 $309,496 $131,946 $1,132,602

Net revenue (operating revenue

less fuel expense,

purchased power, and

other regulatory charges

(credits) 346,753 451,374 (62,994) 735,133

Other operation and

maintenance expenses 207,468 122,511 (15,689) 314,290

Taxes other than

income taxes 42,553 16,265 1,679 60,497

Depreciation 46,307 27,510 2,103 75,920

Other income 8,732 (12,193) (90,071) (93,532)

Interest charges 15,405 (12,686) 81,633 84,352

Other (including discontinued

operations) (3,285) (30,129) 492 (32,922)

Income taxes 48,920 25,748 (3,295) 71,373

2007 Consolidated

Net Income (Loss) $682,707 $539,200 $(87,058) $1,134,849

Management’s Financial Discussion and Analysis conti nued