Entergy 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

Earnings were negatively aected in the fourth quarter 2007 by

expenses of $22.2 million ($13.6 million net-of-tax) for Utility and

$29.9 million ($18.4 million net-of-tax) for Non-Utility Nuclear

recorded in connection with a nuclear operations eet alignment. is

process was undertaken with the goals of eliminating redundancies,

capturing economies of scale, and clearly establishing organizational

governance. Most of the expenses related to the voluntary severance

program oered to employees. Approximately 200 employees from

the Non-Utility Nuclear business and 150 employees in the Utility

business accepted the voluntary severance program oers.

In the fourth quarter 2005, Entergy decided to divest the retail

electric portion of the Competitive Retail Services business operating

in the ERCOT region of Texas. Due to this planned divestiture, activity

from this business is reported as discontinued operations in the

Consolidated Statements of Income. In connection with the planned

sale, an impairment reserve of $39.8 million ($25.8 million net-of-tax)

was recorded for the remaining net book value of the Competitive

Retail Services business’ information technology systems.

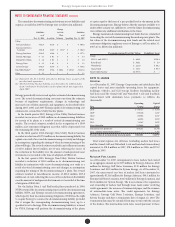

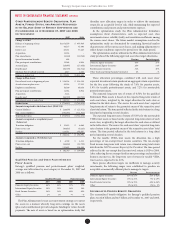

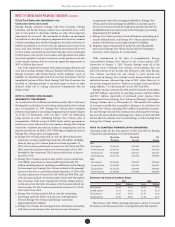

Revenues and pre-tax income (loss) related to the Competitive

Retail Services business’ discontinued operations were as follows

(in thousands):

2007 2006 2005

Operating revenues $– $134,444 $654,333

Pre-tax income (loss) $– $ (429) $(68,854)

ere were no assets or liabilities related to the Competitive Retail

Services business’ discontinued operations as of December 31, 2007

and 2006.

GE O G R A P H I C AR E A S

For the year ended December 31, 2007, Entergy derived none of

its revenue from outside of the United States. For the years ended

December 31, 2006 and 2005, Entergy derived less than 1% of its

revenue from outside of the United States.

As of December 31, 2007 and 2006, Entergy had no long-lived assets

located outside of the United States.

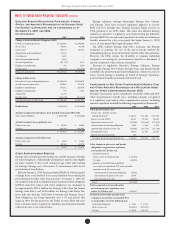

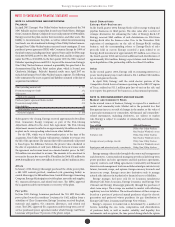

NOTE 14. EQUITY METHOD INVESTMENTS

As of December 31, 2007, Entergy owns investments in the

following companies that it accounts for under the equity method of

accounting:

Company Ownership Description

Entergy-Koch, LP 50% partnership interest Entergy-Koch was in the

energy commodity marketing

and trading business and gas

transportation and storage

business until the fourth

quarter of 2004 when these

businesses were sold.

RS Cogen LLC 50% member interest Co-generation project that

produces power and steam on

an industrial and merchant

basis in the Lake Charles,

Louisiana area.

Top Deer 50% member interest Wind-powered electric

generation joint venture.

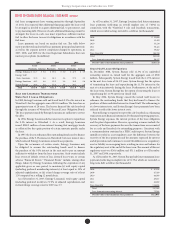

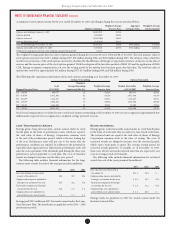

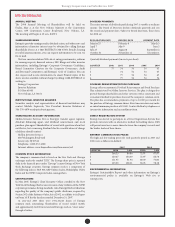

Following is a reconciliation of Entergy’s investments in equity aliates

(in thousands):

2007 2006 2005

Beginning of year $229,089 $296,784 $231,779

Entergy New Orleans(a) (153,988) – 154,462

Income from the investments 3,176 93,744 985

Distributions received – (163,697) (80,901)

Dispositions and other adjustments 715 2,258 (9,541)

End of year $ 78,992 $229,089 $296,784

(a) As a result of Entergy New Orleans’ bankruptcy filing in September

2005, Entergy deconsolidated Entergy New Orleans and reflected

Entergy New Orleans’ financial results under the equity method of ac-

counting retroactive to January 1, 2005. In May 2007, with confirma-

tion of the plan of reorganization, Entergy reconsolidated Entergy New

Orleans retroactive to January 1, 2007 and no longer accounts for

Entergy New Orleans under the equity method of accounting. See Note

18 to the financial statements for further discussion of the bankruptcy

proceeding.

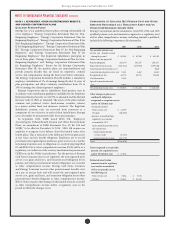

e following is a summary of combined nancial information

reported by Entergy’s equity method investees (in thousands):

2007 2006(1) 2005(1)

Income Statement Items

Operating revenues $ 65,600 $ 632,820 $721,410

Operating income $ 22,606 $ 27,452 $ 9,526

Net income $ 6,257 $ 212,210(2) $ 1,592

Balance Sheet Items

Current assets $ 96,624 $ 262,506

Noncurrent assets $372,421 $1,163,392

Current liabilities $ 92,423 $ 389,526

Noncurrent liabilities $229,037 $ 722,524

(1) Includes financial information for Entergy New Orleans which

was accounted for under the equity method of accounting in 2006

and 2005.

(2) Includes gains recorded by Entergy-Koch on the sales of its energy

trading and pipeline businesses.

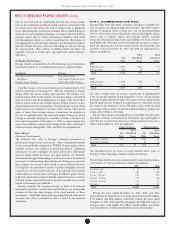

RE L AT E D -PA R T Y T R A N S A C T I O N S A N D GUA R A N T E E S

See Note 18 to the nancial statements for a discussion of the Entergy

New Orleans bankruptcy proceedings and activity between Entergy

and Entergy New Orleans.

Entergy Louisiana and Entergy New Orleans entered into purchase

power agreements with RS Cogen that expired in April 2006, and

purchased a total of $15.8 million and $61.2 million of capacity

and energy from RS Cogen in 2006 and 2005, respectively. Entergy

Gulf States Louisiana purchased approximately $68.4 million, $64.3

million, and $12.4 million, of electricity generated from Entergy’s

share of RS Cogen in 2007, 2006, and 2005, respectively. Entergy’s

operating transactions with its other equity method investees were not

signicant in 2007, 2006, or 2005.

In the purchase agreements for its energy trading and the pipeline

business sales, Entergy-Koch agreed to indemnify the respective

purchasers for certain potential losses relating to any breaches of

the seller’s representations, warranties, and obligations under each

of the purchase agreements. Entergy Corporation has guaranteed

up to 50% of Entergy-Koch’s indemnication obligations to the

purchasers. Entergy does not expect any material claims under these

indemnication obligations.