Entergy 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

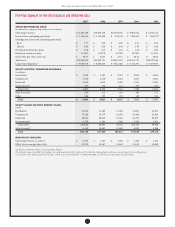

Entergy Corporation and Subsidiaries 2007

Parent & Other

Net revenue decreased for Parent & Other from $114 million for 2006

to $51 million for 2007 primarily due to the sale of the non-nuclear

wholesale asset business’ remaining interest in a power development

project in the second quarter 2006, which resulted in a $14.1 million

gain ($8.6 million net-of-tax). Also contributing to the decrease were

higher natural gas prices in 2007 compared to the same period in 2006

as well as lower production as a result of an additional plant outage in

2007 compared to the same period in 2006. A substantial portion of

the eect on net income of this decline is oset by a related decrease

in other operation and maintenance expenses.

Other Income Statement Items

Utility

Other operation and maintenance expenses increased from $1,749

million for 2006 to $1,855 million for 2007 primarily due to:

n an increase of $34 million in nuclear expenses primarily due to

non-refueling outages, increased nuclear labor and contract costs,

and higher NRC fees;

n an increase of $21 million related to expenses in the fourth quarter

2007 in connection with the nuclear operations eet alignment, as

discussed above;

n an increase of $20 million in transmission expenses, including

independent coordinator of transmission expenses and

transmission line and substation maintenance;

n an increase of $16 million as a result of higher insurance

premiums in addition to the timing of premium payments

compared to 2006;

n an increase of $16 million in fossil plant expenses due to diering

outage schedules and scopes from 2006 to 2007 and the return to

normal operations work in 2007 versus storm restoration activities

in 2006 as a result of Hurricane Katrina;

n an increase of $11 million due to a provision for storm-related bad

debts; and

n an increase of $10 million in distribution expenses, including higher

contract labor costs, increases in vegetation maintenance costs,

and the return to normal operations work in 2007 versus storm

restoration activities in 2006 as a result of Hurricane Katrina and

Hurricane Rita. is increase is net of an environmental liability

credit of $8 million for resolution of a pollution loss provision.

e increase is partially oset by a decrease of $23 million in payroll,

payroll-related, and benets costs.

Depreciation and amortization expenses increased from $835

million for 2006 to $850 million for 2007 primarily due to an increase

in plant in service and a revision made in the rst quarter 2006 to

estimated depreciable lives involving certain intangible assets.

e increase was partially oset by a revision in the third quarter

2007 related to depreciation previously recorded on storm-related

assets. Recovery of the cost of those assets will now be through the

securitization of storm costs approved by the LPSC in the third

quarter 2007. e securitization approval is discussed in Note 2 to the

nancial statements.

Non-Utility Nuclear

Other operation and maintenance expenses increased from

$637 million for 2006 to $760 million for 2007 primarily due to

the acquisition of the Palisades plant in April 2007 and expenses of

$29 million in the fourth quarter 2007 in connection with the nuclear

operations eet alignment.

Other expenses increased due to increases of $14.4 million in nuclear

refueling outage expense and $15.7 million in decommissioning

expense that resulted almost entirely from the acquisition of Palisades

in April 2007.

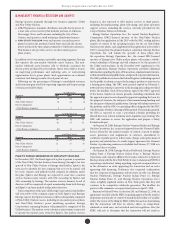

Parent & Other

Interest charges increased from $101 million for 2006 to $183 million

for 2007 primarily due to additional borrowings under Entergy

Corporation’s revolving credit facilities.

Other income decreased from $93 million for 2006 to $3 million for

2007 primarily due to a gain of approximately $55 million (net-of-tax)

in the fourth quarter of 2006 related to the Entergy-Koch investment.

In 2004, Entergy-Koch sold its energy trading and pipeline businesses

to third parties. At that time, Entergy received $862 million of the

sales proceeds in the form of a cash distribution by Entergy-Koch.

Due to the November 2006 expiration of contingencies on the sale

of Entergy-Koch’s trading business, and the corresponding release

to Entergy-Koch of sales proceeds held in escrow, Entergy received

additional cash distributions of approximately $163 million during

the fourth quarter of 2006 and recorded a gain of approximately $55

million (net-of-tax). Entergy expects future cash distributions upon

liquidation of the partnership will be less than $35 million.

Income Taxes

e eective income tax rate for 2007 was 30.7%. e reduction in

the eective income tax rate versus the federal statutory rate of 35%

in 2007 is primarily due to:

n a reduction in income tax expense due to a step-up in the tax basis

on the Indian Point 2 non-qualied decommissioning trust fund

resulting from restructuring of the trusts, which reduced deferred

taxes on the trust fund and reduced current tax expense;

n the resolution of tax audit issues involving the 2002-2003

audit cycle;

n an adjustment to state income taxes for Non-Utility Nuclear

to reect the eect of a change in the methodology of computing

New York state income taxes as required by that state’s

taxing authority;

n book and tax dierences related to the allowance for equity funds

used during construction; and

n the amortization of investment tax credits.

ese factors were partially oset by book and tax dierences for

utility plant items and state income taxes at the Utility operating

companies.

e eective income tax rate for 2006 was 27.6%. e reduction in

the eective income tax rate versus the federal statutory rate of 35%

in 2006 is primarily due to tax benets, net of reserves, resulting from

the tax capital loss recognized in connection with the liquidation of

Entergy Power International Holdings, Entergy’s holding company for

Entergy-Koch. Also contributing to the lower rate for 2006 is an IRS

audit settlement that allowed Entergy to release from its tax reserves

settled issues relating to 1996-1998 audit cycle.

See Note 3 to the nancial statements for a reconciliation of the

federal statutory rate of 35.0% to the eective income tax rates, and

for additional discussion regarding income taxes.

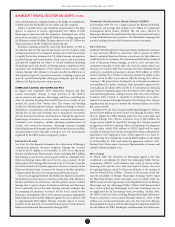

Management’s Financial Discussion and Analysis conti nued