Entergy 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

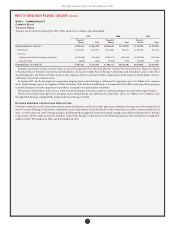

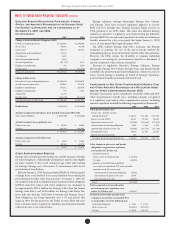

e annual long-term debt maturities (excluding lease obligations) for

debt outstanding as of December 31, 2007, for the next ve years are as

follows (in thousands):

2008 $ 970,002

2009 $ 515,950

2010 $ 762,061

2011 $ 896,961

2012 $2,537,488

In November 2000, Entergy’s Non-Utility Nuclear business

purchased the FitzPatrick and Indian Point 3 power plants in a seller-

nanced transaction. Entergy issued notes to NYPA with seven annual

installments of approximately $108 million commencing one year from

the date of the closing, and eight annual installments of $20 million

commencing eight years from the date of the closing. ese notes do

not have a stated interest rate, but have an implicit interest rate of 4.8%.

In accordance with the purchase agreement with NYPA, the purchase

of Indian Point 2 in 2001 resulted in Entergy’s Non-Utility Nuclear

business becoming liable to NYPA for an additional $10 million per

year for 10 years, beginning in September 2003. is liability was

recorded upon the purchase of Indian Point 2 in September 2001, and

is included in the note payable to NYPA balance above. In July 2003,

a payment of $102 million was made prior to maturity on the note

payable to NYPA. Under a provision in a letter of credit supporting

these notes, if certain of the Utility operating companies or System

Energy were to default on other indebtedness, Entergy could be

required to post collateral to support the letter of credit.

Covenants in the Entergy Corporation notes require it to maintain

a consolidated debt ratio of 65% or less of its total capitalization. If

Entergy’s debt ratio exceeds this limit, or if Entergy or certain of the

Utility operating companies default on other indebtedness or are in

bankruptcy or insolvency proceedings, an acceleration of the notes’

maturity dates may occur.

Entergy Gulf States Louisiana, Entergy Louisiana, Entergy

Mississippi, Entergy Texas, and System Energy have received FERC

long-term nancing orders authorizing long-term securities issuances.

Entergy Arkansas has received an APSC long-term nancing order

authorizing long-term securities issuances. e long-term securities

issuances of Entergy New Orleans are limited to amounts authorized

by the City Council, and it intends to le a request during 2008 for

renewal of its authority.

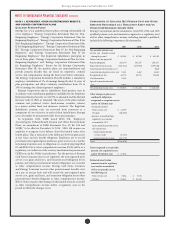

CA P I TA L FU N D S AG R E E M E N T

Pursuant to an agreement with certain creditors, Entergy Corporation

has agreed to supply System Energy with sucient capital to:

n maintain System Energy’s equity capital at a minimum of 35% of

its total capitalization (excluding short-term debt);

n permit the continued commercial operation of Grand Gulf;

n pay in full all System Energy indebtedness for borrowed money

when due; and

n enable System Energy to make payments on specic System

Energy debt, under supplements to the agreement assigning

System Energy’s rights in the agreement as security for the

specic debt.

EN T E R G Y T E X A S SE C U R I T I Z AT I O N BO N D S

In April 2007, the PUCT issued a nancing order authorizing the

issuance of securitization bonds to recover $353 million of Entergy

Texas’ Hurricane Rita reconstruction costs and up to $6 million of

transaction costs, oset by $32 million of related deferred income tax

benets. In June 2007, Entergy Gulf States Reconstruction Funding I,

LLC, a company wholly-owned and consolidated by Entergy Texas,

issued $329.5 million of senior secured transition bonds (securitization

bonds), as follows (in thousands):

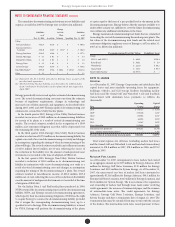

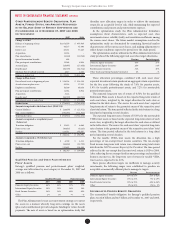

Senior Secured Transition Bonds, Series A:

Tranche A-1 (5.51%) due October 2013 $ 93,500

Tranche A-2 (5.79%) due October 2018 121,600

Tranche A-3 (5.93%) due June 2022 114,400

Tot al senior secured transition bonds $329,500

Although the principal amount of each tranche is not due until the

dates given above, Entergy Gulf States Reconstruction Funding expects

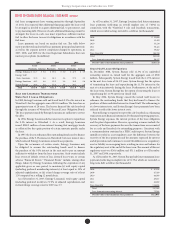

to make principal payments on the bonds over the next ve years in

the amounts of $19.1 million for 2008, $17.7 million for 2009, $18.6

million for 2010, $19.7 million for 2011, and $20.8 million for 2012.

All of the scheduled principal payments for 2008-2012 are for Tranche

A-1, except for $2.3 million for Tranche A-2 in 2012.

With the proceeds, Entergy Gulf States Reconstruction Funding

purchased from Entergy Texas the transition property, which is the

right to recover from customers through a transition charge amounts

sucient to service the securitization bonds. Entergy Texas began cost

recovery through the transition charge in July 2007. e creditors of

Entergy Texas do not have recourse to the assets or revenues of Entergy

Gulf States Reconstruction Funding, including the transition property,

and the creditors of Entergy Gulf States Reconstruction Funding do not

have recourse to the assets or revenues of Entergy Texas. Entergy Texas

has no payment obligations to Entergy Gulf States Reconstruction

Funding except to remit transition charge collections.