Entergy 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

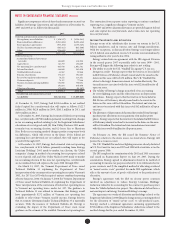

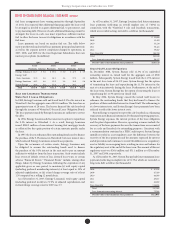

net insurance recoveries for the losses caused by the hurricanes,

including the eects of the primary insurance aggregation limit

being exceeded and the litigation against the excess insurer, will be

approximately $270 million, including $31 million for Entergy Gulf

States Louisiana, $27 million for Entergy Louisiana, $151 million for

Entergy New Orleans and $51 million for Entergy Texas.

To the extent that Entergy New Orleans receives insurance proceeds

for future construction expenditures associated with rebuilding its

gas system, the October 2006 City Council resolution approving the

settlement of Entergy New Orleans’ rate and storm-cost recovery

lings requires Entergy New Orleans to record those proceeds in a

designated sub-account of other deferred credits. is other deferred

credit is shown as “Gas system rebuild insurance proceeds” on Entergy

New Orleans’ balance sheet.

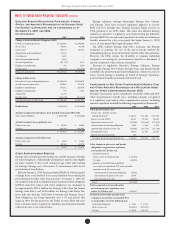

NYPA VA L U E SH A R I N G AG R E E M E N T S

Non-Utility Nuclear’s purchase of the FitzPatrick and Indian Point 3

plants from NYPA included value sharing agreements with NYPA. In

October 2007, Non-Utility Nuclear and NYPA amended and restated

the value sharing agreements to clarify and amend certain provisions

of the original terms. Under the amended value sharing agreements,

Non-Utility Nuclear will make annual payments to NYPA based on

the generation output of the Indian Point 3 and FitzPatrick plants from

January 2007 through December 2014. Non-Utility Nuclear will pay

NYPA $6.59 per MWh for power sold from Indian Point 3, up to an

annual cap of $48 million, and $3.91 per MWh for power sold from

FitzPatrick, up to an annual cap of $24 million. e annual payment

for each year is due by January 15 of the following year, with the

payment for year 2007 output due on January 15, 2008. If Entergy or

an Entergy aliate ceases to own the plants, then, aer January 2009,

the annual payment obligation terminates for generation aer the date

that Entergy ownership ceases.

Non-Utility Nuclear will record its liability for payments to NYPA

as power is generated and sold by Indian Point 3 and FitzPatrick. Non-

Utility Nuclear recorded a $72 million liability for generation through

December 31, 2007. An amount equal to the liability will be recorded

to the plant asset account as contingent purchase price consideration

for the plants. is amount will be depreciated over the expected

remaining useful life of the plants.

Non-Utility Nuclear had previously calculated that $0 was owed

to NYPA under the value sharing agreements for generation output

in 2005 and 2006. In November 2006, NYPA led a demand for

arbitration claiming that $90.5 million was due to NYPA for 2005

under these agreements, and NYPA led in April 2007 an amended

demand for arbitration claiming that an additional $54 million was

due to NYPA for 2006 under the value sharing agreements. As part of

their agreement to amend the value sharing agreements, Non-Utility

Nuclear and NYPA waived all present and future claims under the

previous value sharing terms, including the claims for 2005 and 2006

pending before the arbitrator.

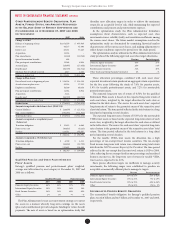

EM P L O Y M E N T A N D LA B O R -R E L AT E D PR O C E E D I N G S

e Registrant Subsidiaries and other Entergy subsidiaries are

responding to various lawsuits in both state and federal courts and

to other labor-related proceedings led by current and former

employees. ese actions include, but are not limited to, allegations of

wrongful employment actions; wage disputes and other claims under

the Fair Labor Standards Act or its state counterparts; claims of race,

gender and disability discrimination; disputes arising under collective

bargaining agreements; unfair labor practice proceedings and other

administrative proceedings before the National Labor Relations

Board; claims of retaliation; and claims for or regarding benets

under various Entergy Corporation sponsored plans. Entergy and the

Registrant Subsidiaries are responding to these suits and proceedings

and deny liability to the claimants.

AS B E S T O S A N D HA Z A R D O U S MAT E R I A L LITIGATION

Numerous lawsuits have been led in federal and state courts in

Texas, Louisiana, and Mississippi primarily by contractor employees

in the 1950-1980 timeframe against Entergy Gulf States, Inc., Entergy

Louisiana, Entergy New Orleans, and Entergy Mississippi as premises

owners of power plants, for damages caused by alleged exposure to

asbestos or other hazardous material. Many other defendants are

named in these lawsuits as well. Presently, there are approximately

600 lawsuits involving approximately 8,000 claimants. Management

believes that adequate provisions have been established to cover any

exposure. Additionally, negotiations continue with insurers to recover

reimbursements. Management believes that loss exposure has been and

will continue to be handled successfully so that the ultimate resolution

of these matters will not be material, in the aggregate, to the nancial

position or results of operation of these companies.

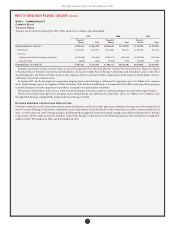

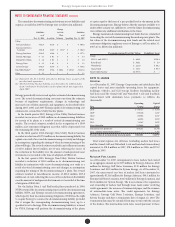

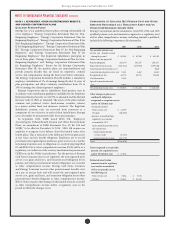

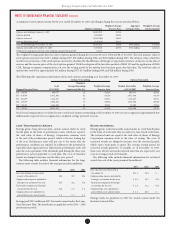

NOTE 9. ASSET RETIREMENT OBLIGATIONS

SFAS 143, “Accounting for Asset Retirement Obligations,” requires

the recording of liabilities for all legal obligations associated with the

retirement of long-lived assets that result from the normal operation

of those assets. For Entergy, substantially all of its asset retirement

obligations consist of its liability for decommissioning its nuclear

power plants. In addition, an insignicant amount of removal costs

associated with non-nuclear power plants is also included in the

decommissioning line item on the balance sheets.

ese liabilities are recorded at their fair values (which are the

present values of the estimated future cash outows) in the period

in which they are incurred, with an accompanying addition to the

recorded cost of the long-lived asset. e asset retirement obligation

is accreted each year through a charge to expense, to reect the time

value of money for this present value obligation. e accretion will

continue through the completion of the asset retirement activity. e

amounts added to the carrying amounts of the long-lived assets will be

depreciated over the useful lives of the assets. e application of SFAS

143 is expected to be earnings neutral to the rate-regulated business of

the Registrant Subsidiaries.

In accordance with ratemaking treatment and as required by SFAS

71, the depreciation provisions for the Utility operating companies and

System Energy include a component for removal costs that are not asset

retirement obligations under SFAS 143. In accordance with regulatory

accounting principles, the Utility operating companies and System

Energy have recorded regulatory assets (liabilities) in the following

amounts to reect their estimates of the dierence between estimated

incurred removal costs and estimated removal costs recovered in rates

(in millions):

December 31, 2007 2006

Entergy Arkansas $ 23.0 $45.0

Entergy Gulf States Louisiana $(13.9) $ 5.6

Entergy Louisiana $(64.0) $ 2.3

Entergy Mississippi $ 35.7 $41.2

Entergy New Orleans $ 1.5 $13.9

Entergy Texas $ (4.9) $ (1.8)

System Energy $ 16.9 $20.7