Entergy 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Entergy Corporation and Subsidiaries 2007

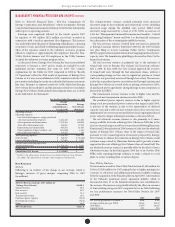

potential interconnection between Entergy Texas and ERCOT that

is discussed in Note 2 to the nancial statements. ese potential

interconnection costs are currently estimated to be approximately

$1 billion. Estimated capital expenditures are also subject to periodic

review and modication and may vary based on the ongoing eects

of business restructuring, regulatory constraints, environmental

regulations, business opportunities, market volatility, economic trends,

and the ability to access capital.

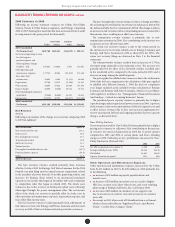

In April 2007, Entergy’s Non-Utility Nuclear business purchased

the 798 MW Palisades nuclear energy plant located near South

Haven, Michigan from Consumers Energy Company for a net

cash payment of $336 million. Entergy received the plant, nuclear

fuel, inventories, and other assets. e liability to decommission

the plant, as well as related decommissioning trust funds, was also

transferred to Entergy’s Non-Utility Nuclear business. Entergy’s

Non-Utility Nuclear business executed a unit-contingent, 15-year

purchased power agreement (PPA) with Consumers Energy for 100%

of the plant’s output, excluding any future uprates. Prices under the

PPA range from $43.50/MWh in 2007 to $61.50/MWh in 2022, and

the average price under the PPA is $51/MWh. In the rst quarter

2007, the NRC renewed Palisades’ operating license until 2031. Also

as part of the transaction, Entergy’s Non-Utility Nuclear business

assumed responsibility for spent fuel at the decommissioned Big

Rock Point nuclear plant, which is located near Charlevoix, Michigan.

Palisades’ nancial results since April 2007 are included in Entergy’s

Non-Utility Nuclear business segment. See Note 15 to the nancial

statements herein for a discussion of the purchase price allocation

and the amortization to revenue of the below-market PPA.

In April 2007, Entergy Louisiana announced that it plans to pursue

the solid fuel repowering of a 538 MW unit at its Little Gypsy plant.

Petroleum coke and coal will be the unit’s primary fuel sources. In

July 2007, Entergy Louisiana led with the LPSC for approval of the

repowering project, and stated that it expects to spend $1.55 billion on

the project. In addition to seeking a nding that the project is in the

public interest, the ling with the LPSC asks that Entergy Louisiana

be allowed to recover a portion of the project’s nancing costs during

the construction period. Hearings were held in October 2007, and

the LPSC approved the certication of the project in November 2007,

subject to several conditions. One of the conditions is the development

and approval of a construction monitoring plan. e approval allowed

Entergy Louisiana to order equipment, such as boiler and piping

components, so that components can be manufactured to keep the

project on schedule. A decision regarding whether to allow Entergy

Louisiana to recover a portion of the project’s nancing costs during

the construction period was deferred to Phase II of the proceedings.

In December 2007, Entergy Louisiana led testimony in the Phase II

proceeding seeking nancing cost recovery and proposing a procedure

for synchronizing future base rate recovery by a formula rate plan or

base rate ling of the project’s non-fuel costs. Phase II hearings are

scheduled to begin in May 2008. In December 2007, Entergy Louisiana

signed a target cost contract with the engineering, procurement, and

construction services contractor, and issued the contractor a notice to

proceed with construction. Entergy Louisiana expects the project to be

completed in 2012.

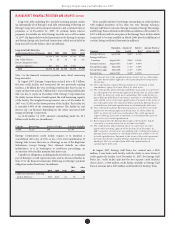

In July 2007, Entergy Arkansas announced that it had signed an

agreement to purchase the Ouachita Generating Facility, a 789 MW

power plant, from a subsidiary of Cogentrix Energy, Inc., for $210

million. e facility is a combined-cycle gas-red generating facility

located near the city of Sterlington in northern Louisiana. e facility

entered commercial service in 2002. Entergy Arkansas plans to

invest approximately $40 million in spare parts purchases and plant

improvements, and has estimated transaction costs and contingencies

of $6 million. e acquisition also may require transmission upgrades

in order for the facility to qualify as a network resource, which

costs were recently estimated by the Independent Coordinator of

Transmission for the Entergy System to be approximately $70 million,

subject to additional evaluation. e Ouachita plant will be 100 percent

owned by Entergy Arkansas, and the acquisition is expected to close in

2008. It is planned that, as part of the transaction, Entergy Gulf States

Louisiana will purchase one-third of the capacity and output of the

facility from Entergy Arkansas. e purchase of the plant is contingent

upon obtaining necessary approvals, including full cost recovery, from

various federal and state regulatory and permitting agencies. Entergy

Arkansas led with the APSC in September 2007 for its approval of

the acquisition, including full cost recovery. e APSC Sta and

the Arkansas attorney general have supported Entergy Arkansas’

acquisition of the plant, but oppose the sale of one-third of the capacity

and energy to Entergy Gulf States Louisiana. e industrial group

Arkansas Electric Energy Consumers (AEEC) has opposed Entergy

Arkansas’ purchase of the plant. e Arkansas attorney general has

opposed recovery of the non-fuel costs of the plant through a separate

rider, while the APSC Sta recommended revisions to the rider. In

December 2007, the APSC issued an order approving recovery

through a rider of the capacity costs associated with the interim tolling

agreement, which will be in eect until APSC action on the acquisition

of the plant. e APSC has scheduled a hearing in April 2008 to address

Entergy Arkansas’ request for acquisition of the plant and concurrent

cost recovery. In January 2008 the FERC issued an order authorizing

the acquisition. In November 2007, Entergy Gulf States Louisiana led

a request with the LPSC for authorization to purchase one-third of

the capacity and energy of the Ouachita plant during the term of the

interim tolling agreement and for authorization to purchase one-third

of the plant’s capacity and energy on a life-of-unit basis aer the plant’s

acquisition. In January 2008 the LPSC approved the recovery of costs

associated with the interim tolling agreement. An LPSC hearing on

approval of the purchase of one-third of the plant’s capacity and energy

on a life-of-unit basis is scheduled for June 2008.

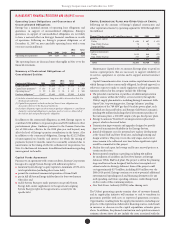

Entergy Louisiana plans to replace the Waterford 3 steam generators,

along with the reactor vessel closure head and control element drive

mechanisms, in 2011. Replacement of these components is common

to pressurized water reactors throughout the nuclear industry. e

nuclear industry continues to address susceptibility to stress corrosion

cracking of certain materials associated with these components within

the reactor coolant system. e issue is applicable to Waterford 3

and is managed in accordance with standard industry practices

and guidelines. Routine inspections of the steam generators during

Waterford 3’s Fall 2006 refueling outage identied degradation of

certain tube spacer supports in the steam generators that required

repair beyond that anticipated prior to the outage. Corrective measures

were successfully implemented to permit continued operation of

the steam generators. While potential future replacement of these

components had been contemplated, additional steam generator tube

and component degradation necessitates replacement of the steam

generators as soon as reasonably achievable. e earliest the new

steam generators can be manufactured and delivered for installation is

2011. A mid-cycle outage performed in 2007 supports Entergy’s 2011

replacement strategy. e reactor vessel head and control element

drive mechanisms will be replaced at the same time, utilizing the same

reactor building construction opening that is necessary for the steam

generator replacement. Entergy Louisiana estimates that it will spend

approximately $485 million on this project.

Management’s Financial Discussion and Analysis conti nued