Entergy 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

As Entergy has a consolidated net operating loss for 2003, these

adjustments have the eect of reducing the consolidated net operating

loss carryover and do not require a payment to the IRS at this time.

e settlement did not have a material impact on the Registrant

Subsidiaries’ earnings. Proposed IRS regulations, eective in year

2005, could substantially reduce the benet of the 2003 settlement.

Subsequently, Entergy led an amended 2004 tax return which

capitalized $2.8 billion of costs to inventory. ese costs are not

part of the settlement agreement with the IRS and are subject to IRS

scrutiny. Overall, on a consolidated basis, using a with and without

methodology, there has been an estimated $20 million state cash tax

benet, but only a $2 million federal cash tax benet from the cost of

goods sold method changes. On a separate company basis, however,

Entergy currently estimates the cumulative federal and state cash tax

benet through 2007 to be $303 million at Entergy Arkansas; $253

million at System Energy; $25 million at Entergy Mississippi; and $4

million at Entergy Louisiana. e estimates of cumulative cash tax

benet are dependent on the outcome of several tax items (including

mark to market elections and storm cost deductions). Should these

other items fail to be sustained on audit, the estimated cash tax impact

of these tax accounting method changes for cost of goods sold would

be signicantly greater. Were the IRS to successfully deny the use of

Entergy’s tax accounting method for cost of goods sold, the companies

would have to pay back under Entergy’s intercompany tax allocation

agreement the benets received.

In the report for the 2002-2003 audit cycle, the IRS also proposed

adjustments which Entergy did not agree to as follows: 1) the U.K.

Windfall Tax foreign tax credit issue mentioned above; 2) the

street lighting issue mentioned above; 3) certain repair deductions;

4) deductions claimed for research and experimentation (R&E)

expenditures; 5) income tax credits claimed for R&E; and 6) a 2003

deduction associated with the revisions to the emergency plans at the

Indian Point Energy Center. Regarding all of these issues, Entergy

disagrees with the IRS Examination Division position and led a formal

protest on July 30, 2007 with the IRS and will pursue administrative

relief within the IRS Appeals Division.

Entergy believes that the provisions recorded in its nancial

statements are sucient to address these issues as well as other

liabilities that are reasonably estimable, including an estimate of

probable interest expense, associated with all uncertain tax positions.

e IRS commenced an examination of Entergy’s 2004 and 2005

U.S. income tax returns in the fourth quarter 2007. As of December

31, 2007, the IRS has not proposed any adjustments to Entergy’s

computation of tax for those years.

Entergy has $237 million in deposits on account with the IRS to

cover its uncertain tax positions.

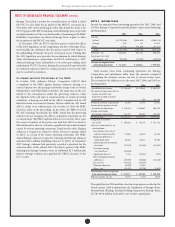

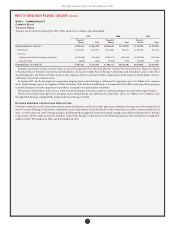

FASB IN T E R P R E TAT I O N NO. 48

FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes” (FIN 48) was issued in July 2006. FIN 48 establishes a “more-

likely-than-not” recognition threshold that must be met before a tax

benet can be recognized in the nancial statements. If a tax deduction

is taken on a tax return, but does not meet the more-likely-than-not

recognition threshold, an increase in income tax liability, above what

is payable on the tax return, is required to be recorded. Entergy and

the Registrant Subsidiaries adopted the provisions of FIN 48, on

January 1, 2007. As a result of the implementation of FIN 48, Entergy

recognized an increase in the liability for unrecognized tax benets of

approximately $5 million, which was accounted for as a reduction to

the January 1, 2007 balance of retained earnings. A reconciliation of

Entergy’s beginning and ending amount of unrecognized tax benets

is as follows (in thousands):

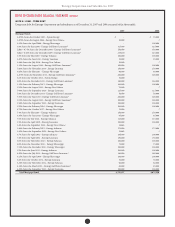

Balance at January 1, 2007 upon implementation $1,977,001

Additions based on tax positions

related to the current year 142,827

Additions for tax positions of prior years 670,385

Reductions for tax positions of prior years (564,162)

Settlements (102,485)

Lapse of statute of limitations (1,938)

Balance at December 31, 2007 $2,121,628

Included in the December 31, 2007 balance of unrecognized

tax benets are $1.9 billion of tax positions for which the ultimate

deductibility is highly certain but for which there is uncertainty about

the timing of such deductibility. Because of the eect of deferred tax

accounting, other than on interest and penalties, the disallowance of

the shorter deductibility period would not aect the annual eective

income tax rate but would accelerate the payment of cash to the taxing

authority to an earlier period. Entergy’s December 31, 2007 balance

of unrecognized tax benets includes $242 million which could aect

the eective income tax rate. Entergy accrues interest and penalties

expenses related to unrecognized tax benets in income tax expense.

Entergy’s December 31, 2007 balance of unrecognized tax benets

includes approximately $50 million accrued for the possible payment

of interest and penalties.

Entergy and the Registrant Subsidiaries do not expect that total

unrecognized tax benets will signicantly change within the next

twelve months; however, the results of audit settlements and pending

litigation could result in changes to this total. Entergy is unable to

predict or quantify any changes at this time.

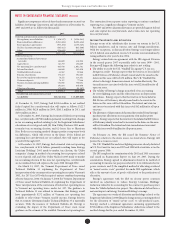

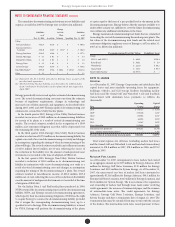

NOTE 4. REVOLVING CREDIT FACILITIES, LINES OF CREDIT

AND SHORT-TERM BORROWINGS

Entergy Corporation has in place a ve-year credit facility, which

expires in August 2012 and has a borrowing capacity of $3.5 billion.

Entergy Corporation also has the ability to issue letters of credit

against the total borrowing capacity of the credit facility. e facility

fee is currently 0.09% of the commitment amount. Facility fees and

interest rates on loans under the credit facility can uctuate depending

on the senior unsecured debt ratings of Entergy Corporation. e

weighted average interest rate as of December 31, 2007 was 5.524%

on the drawn portion of the facility. Following is a summary of the

borrowings outstanding and capacity available under the facility as of

December 31, 2007 (in millions):

Capacity Borrowings Letters of Credit Capacity Available

$3,500 $2,251 $69 $1,180

Entergy Corporation’s facility requires it to maintain a consolidated

debt ratio of 65% or less of its total capitalization. If Entergy fails to

meet this ratio, or if Entergy or one of the Registrant Subsidiaries

(except Entergy New Orleans) defaults on other indebtedness or is in

bankruptcy or insolvency proceedings, an acceleration of the facility

maturity date may occur.