Entergy 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Entergy Corporation and Subsidiaries 2007

Some of the agreements to sell the power produced by Entergy’s

Non-Utility Nuclear power plants contain provisions that require an

Entergy subsidiary to provide collateral to secure its obligations under

the agreements. e Entergy subsidiary will be required to provide

collateral based upon the dierence between the current market and

contracted power prices in the regions where Non-Utility Nuclear sells

power. e primary form of collateral to satisfy these requirements

would be an Entergy Corporation guaranty. Cash and letters of

credit are also acceptable forms of collateral. At December 31, 2007,

based on power prices at that time, Entergy had in place as collateral

$702 million of Entergy Corporation guarantees for wholesale

transactions, including $63 million of guarantees that support letters

of credit. e assurance requirement associated with Non-Utility

Nuclear is estimated to increase by an amount up to $294 million if

gas prices increase $1 per MMBtu in both the short- and long-term

markets. In the event of a decrease in Entergy Corporation’s credit

rating to below investment grade, Entergy will be required to replace

Entergy Corporation guarantees with cash or letters of credit under

some of the agreements.

In addition to selling the power produced by its plants, the Non-

Utility Nuclear business sells installed capacity to load-serving

distribution companies in order for those companies to meet

requirements placed on them by the ISO in their area. Following is a

summary of the amount of the Non-Utility Nuclear business’ installed

capacity that is currently sold forward, and the blended amount of the

Non-Utility Nuclear business’ planned generation output and installed

capacity that is currently sold forward:

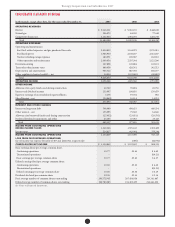

2008 2009 2010 2011 2012

Non-Utility Nuclear:

Percent of capacity sold forward:

Bundled capacity and

energy contracts 27% 26% 26% 26% 19%

Capacity contracts 59% 34% 16% 9% 2%

Total 86% 60% 42% 35% 21%

Planned net MW in operation 4,998 4,998 4,998 4,998 4,998

Average capacity contract

price per kW per month $1.8 $1.7 $2.5 $3.1 $3.5

Blended capacity and

energy (based on revenues):

% of planned generation

and capacity sold forward 89% 78% 51% 35% 17%

Average contract revenue

per MWh $56 $62 $59 $56 $52

As of December 31, 2007, approximately 96% of Non-Utility Nuclear’s

counterparty exposure from energy and capacity contracts is with

counterparties with public investment grade credit ratings.

CE N T R A L STAT E S CO M P A C T CL A I M

e Low-Level Radioactive Waste Policy Act of 1980 holds each state

responsible for disposal of low-level radioactive waste originating in

that state, but allows states to participate in regional compacts to fulll

their responsibilities jointly. Arkansas and Louisiana participate in

the Central Interstate Low-Level Radioactive Waste Compact (Central

States Compact or Compact). Commencing in early 1988, Entergy

Arkansas, Entergy Gulf States, Inc. and Entergy Louisiana made

a series of contributions to the Central States Compact to fund the

Central States Compact’s development of a low-level radioactive waste

disposal facility to be located in Boyd County, Nebraska. In December

1998, Nebraska, the host state for the proposed Central States Compact

disposal facility, denied the compact’s license application for the

proposed disposal facility. Several parties, including the commission

that governs the compact (the Compact Commission), led a lawsuit

against Nebraska seeking damages resulting from Nebraska’s denial of

the proposed facility’s license. Aer a trial, the U.S. District Court

concluded that Nebraska violated its good faith obligations regarding

the proposed waste disposal facility and rendered a judgment against

Nebraska in the amount of $151 million. In August 2004, Nebraska

agreed to pay the Compact $141 million in settlement of the judgment.

In July 2005, the Compact Commission decided to distribute a

substantial portion of the proceeds from the settlement to the nuclear

power generators that had contributed funding for the Boyd County

facility, including Entergy Arkansas, Entergy Gulf States, Inc. and

Entergy Louisiana. On August 1, 2005, Nebraska paid $145 million,

including interest, to the Compact, and the Compact distributed from

the settlement proceeds $23.6 million to Entergy Arkansas, $19.9

million to Entergy Gulf States, Inc., and $19.4 million to Entergy

Louisiana. The proceeds contributed $28.7 million in pre-tax income

in 2005.

CRITICAL ACCOUNTING ESTIMATES

e preparation of Entergy’s nancial statements in conformity with

generally accepted accounting principles requires management to

apply appropriate accounting policies and to make estimates and

judgments that can have a signicant eect on reported nancial

position, results of operations, and cash ows. Management has

identied the following accounting policies and estimates as critical

because they are based on assumptions and measurements that involve

a high degree of uncertainty, and the potential for future changes in

the assumptions and measurements that could produce estimates that

would have a material eect on the presentation of Entergy’s nancial

position or results of operations.

NU C L E A R DE C O M M I S S I O N I N G CO S T S

Entergy owns a signicant number of nuclear generation facilities in

both its Utility and Non-Utility Nuclear business units. Regulations

require Entergy to decommission its nuclear power plants aer each

facility is taken out of service, and money is collected and deposited

in trust funds during the facilities’ operating lives in order to provide

for this obligation. Entergy conducts periodic decommissioning cost

studies to estimate the costs that will be incurred to decommission the

facilities. e following key assumptions have a signicant eect on

these estimates:

n COST ESCALATION FACTORS – Entergy’s decommissioning

revenue requirement studies include an assumption that

decommissioning costs will escalate over present cost levels by

annual factors ranging from approximately CPI-U to 5.5%. A 50

basis point change in this assumption could change the ultimate

cost of decommissioning a facility by as much as 11%.

n TIMING – In projecting decommissioning costs, two assumptions

must be made to estimate the timing of plant decommissioning.

First, the date of the plant’s retirement must be estimated. e

expiration of the plant’s operating license is typically used for

this purpose, but the assumption may be made that the plant’s

license will be renewed and operate for some time beyond the

original license term. Second, an assumption must be made

whether decommissioning will begin immediately upon plant

retirement, or whether the plant will be held in “safestore” status

for later decommissioning, as permitted by applicable regulations.

While the eect of these assumptions cannot be determined with

precision, assuming either license renewal or use of a “safestore”

status can possibly change the present value of these obligations.

Future revisions to appropriately reect changes needed to the

Management’s Financial Discussion and Analysis conti nued