Entergy 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

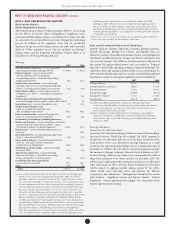

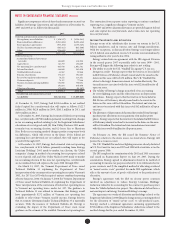

Signicant components of net deferred and noncurrent accrued tax

liabilities for Entergy Corporation and subsidiaries as of December 31,

2007 and 2006 are as follows (in thousands):

2007 2006

Deferred and noncurrent accrued tax liabilities:

Net regulatory assets/liabilities $ ( 838,507) $ (1,334,341)

Plant-related basis dierences (5,920,881) (5,992,434)

Power purchase agreements (935,876) (1,755,345)

Nuclear decommissioning trusts (885,411) (915,380)

Other (336,809) (615,371)

Total (8,917,484) (10,612,871)

Deferred tax assets:

Accumulated deferred investment

tax credit 130,609 118,990

Capital losses 161,793 256,089

Net operating loss carryforwards 405,640 2,002,541

Sale and leaseback 248,660 242,630

Unbilled/deferred revenues 24,567 39,566

Pension-related items 378,103 790,383

Reserve for regulatory adjustments 76,252 114,451

Customer deposits 76,317 77,166

Nuclear decommissioning liabilities 756,990 790,052

Other 391,603 405,490

Valuation allowance (74,612) (33,507)

Total 2,575,922- 4,803,851

Net deferred and noncurrent accrued

tax liability $(6,341,562) $ (5,809,020)

At December 31, 2007, Entergy had $453.6 million in net realized

federal capital loss carryforwards that will expire as follows: $122.7

million in 2008, $42.8 million in 2009, $263.1 million in 2011, and

$25.0 million in 2012.

At December 31, 2007, Entergy had estimated federal net operating

loss carryforwards of $798.8 million primarily resulting from changes

in tax accounting methods relating to (a) the Registrant Subsidiaries’

calculation of cost of goods sold, (b) Non-Utility Nuclear’s 2005 mark-

to-market tax accounting election, and (c) losses due to Hurricane

Rita. Both tax accounting method changes produce temporary book

tax dierences, which will reverse in the future. If the federal net

operating loss carryforwards are not utilized, they will expire in the

years 2023 through 2027.

At December 31, 2007, Entergy had estimated state net operating

loss carryforwards of $2.4 billion, primarily resulting from Entergy

Louisiana Holdings’ 2001 mark-to-market tax election, the Utility

companies’ change in method of accounting for tax purposes related

to cost of goods sold, and Non-Utility Nuclear’s 2005 mark-to-market

tax accounting election. If the state net operating loss carryforwards

are not utilized, they will expire in the years 2008 through 2022.

On March 13, 2007, the Vermont Department of Taxes issued

Technical Bulletin 35 explaining the Department of Taxes’

interpretation of the treatment of net operating losses under Vermont’s

2005, Act 207 (Act 207) which required unitary combined reporting

eective January 1, 2006. On January 7, 2008, the Vermont Department

of Taxes issued Technical Bulletin 40 explaining the Department of

Taxes’ interpretation of the conversion of federal net operating losses

to Vermont net operating losses under Act 207. e guidance in

Technical Bulletin 35 was utilized to determine that Entergy would

have approximately $272 million of Vermont net operating loss

available to oset future Vermont taxable income. Entergy believes

that its estimate determined under Technical Bulletin 35 is materially

accurate. With the issuance of Technical Bulletin 40, Entergy is

evaluating the impact of the Department of Taxes’ most recent

guidance on the estimate of the available Vermont net operating loss.

e conversion from separate entity reporting to unitary combined

reporting was a signicant change in Vermont tax law.

For 2007 and 2006, valuation allowances are provided against federal

and state capital loss carryforwards, and certain state net operating

loss carryforwards.

IN C O M E T A X AU D I T S A N D LITIGATION

Entergy or one of its subsidiaries les income tax returns in the U.S.

federal jurisdiction, and in various state and foreign jurisdictions.

With few exceptions, as discussed below, Entergy is no longer subject

to U.S. federal, state and local, or non-U.S. income tax examinations by

taxing authorities for years before 2004.

Entergy entered into an agreement with the IRS Appeals Division

in the second quarter 2007 to partially settle tax years 1999 - 2001.

Entergy will litigate the following issues that it is not settling:

n e ability to credit the U.K. Windfall Tax against U.S. tax as a

foreign tax credit - Entergy expects that the total tax to be included

in IRS Notices of Deciency already issued and to be issued in the

future on this issue will be $152 million. e U.K. Windfall Tax

relates to Entergy’s former investment in London Electricity. e

tax and interest associated with this issue total $216 million for all

open tax years.

n e validity of Entergy’s change in method of tax accounting

for street lighting assets and the related increase in depreciation

deductions - Entergy expects that the total tax to be included in

IRS Notices of Deciency already issued and to be issued in the

future on this issue will be $26 million. e federal and state tax

and interest associated with this issue total $42 million for all open

tax years.

n e allowance of depreciation deductions that resulted from Entergy’s

purchase price allocations on its acquisitions of its nuclear power

plants - Entergy expects that the total tax to be included in IRS Notices

of Deciency already issued and to be issued in the future on this issue

will be $34 million. e federal and state tax and interest associated

with this issue total $40 million for all open tax years.

On February 21, 2008, the IRS issued the Statutory Notice of

Deciency relative to the above issues. As stated above, Entergy will

pursue these issues in court.

e U.K. Windfall Tax and street lighting issues are already docketed

in U.S. Tax Court for tax years 1997 and 1998 with a trial date set in the

second quarter 2008.

e IRS completed its examination of the 2002 and 2003 tax returns

and issued an Examination Report on June 29, 2007. During the

examination, Entergy agreed to adjustments related to its method of

accounting for income tax purposes related to 1) its wholesale electric

power contracts and 2) the simplied method of allocating overhead

or “mixed service costs” provided for under IRS regulations, which

aects the amount of cost of goods sold related to the production of

electricity.

Entergy’s agreement with the IRS on electric power contracts

involved an adjustment to reduce Entergy Louisiana Holdings’

deduction related to its accounting for the contract to purchase power

from the Vidalia hydroelectric project. e adjustment did not have a

material impact on Entergy Louisiana Holdings’ earnings.

e agreement on overhead allocation methodology related to the

Registrant Subsidiaries’ 2003 ling of a change in tax accounting method

for the allocation of “mixed service costs” to self-produced assets.

Entergy reached a settlement agreement sustaining approximately

$700 million of the Registrant Subsidiaries’ deductions related to the

method change for the year ended December 31, 2003.