Entergy 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2007

19

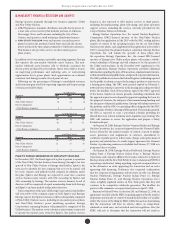

Our Power Marketing Point of View

In 2007, we continued to execute an eective, risk-balanced forward

contracting strategy. We pursue opportunities with natural buyers in the

region who can commit for large blocks of power on a longer-term basis

as well as other counterparties such as nancial buyers. We also maintain

dynamic points of view on key factors including commodity prices, the

regulation of carbon emissions and regional infrastructure and capacity

constraints. As a result, we can layer in hedges on an annual basis consistent

with our dynamic points of view. Our strategy enables us to reserve up to

15 percent for spot market sales. At the end of 2007, 92 percent of our planned

generation for 2008 was under contract, 83 percent for 2009 and 59 percent

for 2010 at average energy prices per MWh of $54, $61 and $58, respectively.

Unlocking the Value: The Future of SpinCo

In 2008, we will pursue the regulatory approvals needed and take action to

complete the separation of our non-utility nuclear business. We are condent

this is the best approach to unlock the full value of these assets for our shareholders.

As an independent company, SpinCo will have the ability to pursue its

optimal capital structure, including executing approximately $4.5 billion in

debt, subject to market terms and conditions. Our positive point of view on

future power pricing trends supports our decision to separate our non-utility

nuclear assets from our utility business. With an optimal capital structure and

a risk prole consistent with a merchant business rather than a utility, SpinCo

will have additional opportunities as it executes its generation hedging strategy.

e existing team of experienced and skilled non-utility nuclear engineers

and operators to be employed by the joint venture owned equally by SpinCo

and Entergy Classic will continue to operate SpinCo nuclear assets. SpinCo

will benet from that operational expertise and the potential that exists to expand

that business by oering nuclear services to third parties. e experienced

and skilled nuclear utility operators will continue to operate the utility nuclear

plants. Retaining the existing operators for the nuclear stations reects our

commitment to maintain safe, secure operations.

We believe SpinCo will be a unique nuclear generation entity with the

potential to deliver $2 billion in earnings before interest, taxes, depreciation

and amortization in 2012. is robust cash projection should generate cash

ow for acquisitions and/or distributions through share repurchases with a

nancial aspiration in the range of $0.5 billion to $1.0 billion annually.

“Our nuclear business offers a significant opportunity for value realization.”

Using our operational and risk management

expertise, we have transformed underperforming

non-utility nuclear assets into a valuable portfolio of

emission-free power-generating assets that are safe

and secure.

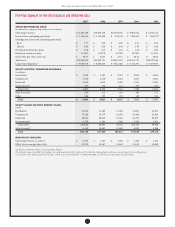

Northeast Nuclear Fleet Production Costs

$ per MWh

Before ETR

ownership

29

2007

21

Northeast Nuclear Fleet Capacity Factor

%

Before ETR

ownership

77

2007

89