Entergy 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

NOTE 15. ACQUISITIONS AND DISPOSITIONS

PA L I S A D E S

In April 2007, Entergy’s Non-Utility Nuclear business purchased the 798

MW Palisades nuclear energy plant located near South Haven, Michigan

from Consumers Energy Company for a net cash payment of $336 million.

Entergy received the plant, nuclear fuel, inventories, and other assets. e

liability to decommission the plant, as well as related decommissioning

trust funds, was also transferred to Entergy’s Non-Utility Nuclear business.

Entergy’s Non-Utility Nuclear business executed a unit-contingent, 15-year

purchased power agreement (PPA) with Consumers Energy for 100% of

the plant’s output, excluding any future uprates. Prices under the PPA range

from $43.50/MWh in 2007 to $61.50/MWh in 2022, and the average price

under the PPA is $51/MWh. In the rst quarter 2007, the NRC renewed

Palisades’ operating license until 2031. As part of the transaction, Entergy’s

Non-Utility Nuclear business assumed responsibility for spent fuel at the

decommissioned Big Rock Point nuclear plant, which is located near

Charlevoix, Michigan. Palisades’ nancial results since April 2007 are

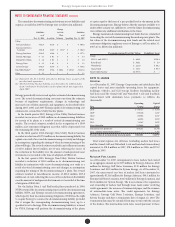

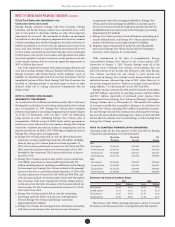

included in Entergy’s Non-Utility Nuclear business segment. e following

table summarizes the assets acquired and liabilities assumed at the date of

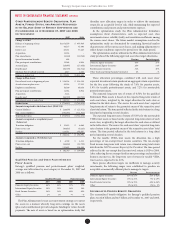

acquisition (in millions):

Plant (including nuclear fuel) $ 727

Decommissioning trust funds 252

Other assets 41

Total assets acquired 1,020

Purchased power agreement (below market) 420

Decommissioning liability 220

Other liabilities 44

Total liabilities assumed 684

Net assets acquired $ 336

Subsequent to the closing, Entergy received approximately $6 million

from Consumers Energy Company as part of the Post-Closing

Adjustment dened in the Asset Sale Agreement. e Post-Closing

Adjustment amount resulted in an approximately $6 million reduction

in plant and a corresponding reduction in other liabilities.

For the PPA, which was at below-market prices at the time of the

acquisition, Non-Utility Nuclear will amortize a liability to revenue over

the life of the agreement. e amount that will be amortized each period

is based upon the dierence between the present value calculated at

the date of acquisition of each year’s dierence between revenue under

the agreement and revenue based on estimated market prices. In 2007,

$50 million was amortized to revenue. e amounts to be amortized to

revenue for the next ve years will be $76 million for 2008, $53 million for

2009, $46 million for 2010, $43 million for 2011, and $17 million in 2012.

Attala

In January 2006, Entergy Mississippi purchased the Attala power plant,

a 480 MW natural gas-red, combined-cycle generating facility in

central Mississippi, for $88 million from Central Mississippi Generating

Company. Entergy Mississippi received the plant, materials and supplies,

SO2 emission allowances, and related real estate. e MPSC approved

the acquisition and the investment cost recovery of the plant.

Perryville

In June 2005, Entergy Louisiana purchased the 718 MW Perryville

power plant located in northeast Louisiana for $162 million from a

subsidiary of Cleco Corporation. Entergy Louisiana received the plant,

materials and supplies, SO2 emission allowances, and related real

estate. e LPSC approved the acquisition and the long-term cost-of-

service purchased power agreement under which Entergy Gulf States

Louisiana will purchase 75 percent of the plant’s output.

AS S E T DI S P O S I T I O N S

Entergy-Koch Businesses

In the fourth quarter 2004, Entergy-Koch sold its energy trading and

pipeline businesses to third parties. e sales came aer a review of

strategic alternatives for enhancing the value of Entergy-Koch, LP.

Entergy received $862 million of cash distributions in 2004 from

Entergy-Koch aer the business sales. Due to the November 2006

expiration of contingencies on the sale of Entergy-Koch’s trading

business, and the corresponding release to Entergy-Koch of sales

proceeds held in escrow, Entergy recorded a gain related to its

Entergy-Koch investment of approximately $55 million, net-of-tax, in

the fourth quarter 2006 and received additional cash distributions of

approximately $163 million. Entergy expects future cash distributions

upon liquidation of the partnership will be less than $35 million.

Other

In the second quarter 2006, Entergy sold its remaining interest in a

power development project and realized a $14.1 million ($8.6 million

net-of-tax) gain on the sale.

In April 2006, Entergy sold the retail electric portion of the

Competitive Retail Services business operating in the ERCOT region

of Texas, realized an $11.1 million gain (net-of-tax) on the sale, and

now reports this portion of the business as a discontinued operation.

NOTE 16. RISK MANAGEMENT AND FAIR VALUES

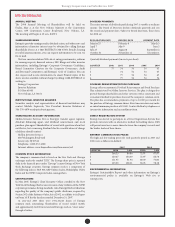

MA R K E T A N D CO M M O D I T Y RI S K S

In the normal course of business, Entergy is exposed to a number of

market and commodity risks. Market risk is the potential loss that

Entergy may incur as a result of changes in the market or fair value of

a particular instrument or commodity. All nancial and commodity-

related instruments, including derivatives, are subject to market

risk. Entergy is subject to a number of commodity and market risks,

including:

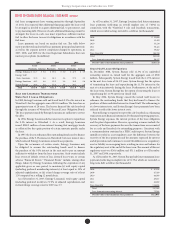

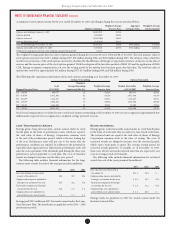

Type of Risk Aected Businesses

Power price risk Utility, Non-Utility Nuclear,

Non-Nuclear Wholesale Assets

Fuel price risk Utility, Non-Utility Nuclear,

Non-Nuclear Wholesale Assets

Foreign currency exchange rate risk Utility, Non-Utility Nuclear,

Non-Nuclear Wholesale Assets

Equity price and interest rate risk – investments Utility, Non-Utility Nuclear

Entergy manages these risks through both contractual arrangements

and derivatives. Contractual risk management tools include long-term

power purchase and sales agreements and fuel purchase agreements,

capacity contracts, and tolling agreements. Commodity and nancial

derivative risk management tools can include natural gas and electricity

futures, forwards, swaps, and options; foreign currency forwards; and

interest rate swaps. Entergy enters into derivatives only to manage

natural risks inherent in its physical or nancial assets or liabilities.

Entergy manages fuel price risk for its Louisiana jurisdictions

(Entergy Gulf States Louisiana, Entergy Louisiana, and Entergy New

Orleans) and Entergy Mississippi primarily through the purchase of

short-term swaps. ese swaps are marked-to-market with osetting

regulatory assets or liabilities. e notional volumes of these swaps are

based on a portion of projected annual purchases of gas for electric

generation and projected winter purchases for gas distribution at

Entergy Gulf States Louisiana and Entergy New Orleans.

Entergy’s exposure to market risk is determined by a number of

factors, including the size, term, composition, and diversication

of positions held, as well as market volatility and liquidity. For

instruments such as options, the time period during which the option