Entergy 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

hedged. Gains or losses accumulated in other comprehensive income

are reclassied as earnings in the periods in which earnings are aected

by the variability of the cash ows of the hedged item. e ineective

portions of all hedges are recognized in current-period earnings.

Entergy has determined that contracts to purchase uranium do not

meet the denition of a derivative under SFAS 133 because they do not

provide for net settlement and the uranium markets are not suciently

liquid to conclude that forward contracts are readily convertible to

cash. If the uranium markets do become suciently liquid in the

future and Entergy begins to account for uranium purchase contracts

as derivative instruments, the fair value of these contracts would be

accounted for consistent with Entergy’s other derivative instruments.

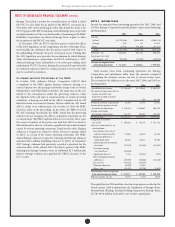

FA I R V A L U E S

e estimated fair values of Entergy’s nancial instruments and

derivatives are determined using bid prices and market quotes.

Considerable judgment is required in developing the estimates of fair

value. erefore, estimates are not necessarily indicative of the amounts

that Entergy could realize in a current market exchange. Gains or

losses realized on nancial instruments held by regulated businesses

may be reected in future rates and therefore do not accrue to the

benet or detriment of stockholders. Entergy considers the carrying

amounts of most nancial instruments classied as current assets and

liabilities to be a reasonable estimate of their fair value because of the

short maturity of these instruments.

IM P A I R M E N T O F LONG-LI V E D AS S E T S

Entergy periodically reviews long-lived assets held in all of its business

segments whenever events or changes in circumstances indicate that

recoverability of these assets is uncertain. Generally, the determination

of recoverability is based on the undiscounted net cash ows expected

to result from such operations and assets. Projected net cash ows

depend on the future operating costs associated with the assets, the

eciency and availability of the assets and generating units, and the

future market and price for energy over the remaining life of the assets.

See Note 13 to the nancial statements for a discussion of the asset

impairment recognized by Entergy in 2005.

RI V E R BE N D AFUDC

e River Bend AFUDC gross-up is a regulatory asset that represents

the incremental dierence imputed by the LPSC between the AFUDC

actually recorded by Entergy Gulf States Louisiana on a net-of-tax

basis during the construction of River Bend and what the AFUDC

would have been on a pre-tax basis. e imputed amount was only

calculated on that portion of River Bend that the LPSC allowed in rate

base and is being amortized through August 2025.

RE A C Q U I R E D DE B T

e premiums and costs associated with reacquired debt of

Entergy’s Utility operating companies and System Energy (except

that portion allocable to the deregulated operations of Entergy Gulf

States Louisiana) are included in regulatory assets and are being

amortized over the life of the related new issuances, in accordance

with ratemaking treatment.

TA X E S IM P O S E D O N RE V E N U E -PR O D U C I N G T R A N S A C T I O N S

Governmental authorities assess taxes that are both imposed on and

concurrent with a specic revenue-producing transaction between a

seller and a customer, including, but not limited to, sales, use, value

added, and some excise taxes. Entergy presents these taxes on a net

basis, excluding them from revenues, unless required to report them

dierently by a regulatory authority.

NE W AC C O U N T I N G PR O N O U N C E M E N T S

In September 2006 the FASB issued Statement of Financial Accounting

Standards No. 157, “Fair Value Measurements” (SFAS 157), which

denes fair value, establishes a framework for measuring fair value

in GAAP, and expands disclosures about fair value measurements.

SFAS 157 generally does not require any new fair value measurements.

However, in some cases, the application of SFAS 157 in the future may

change Entergy’s practice for measuring and disclosing fair values

under other accounting pronouncements that require or permit fair

value measurements. SFAS 157 is eective for Entergy in the rst

quarter 2008 and will be applied prospectively. Entergy does not expect

the application of SFAS 157 to materially aect its nancial position,

results of operations, or cash ows.

e FASB issued Statement of Financial Accounting Standards

No. 159, “e Fair Value Option for Financial Assets and Financial

Liabilities” (SFAS 159) during the rst quarter 2007. SFAS 159 provides

an option for companies to select certain nancial assets and liabilities

to be accounted for at fair value with changes in the fair value of those

assets or liabilities being reported through earnings. e intent of the

standard is to mitigate volatility in reported earnings caused by the

application of the more complicated fair value hedging accounting

rules. Under SFAS 159, companies can select existing assets or liabilities

for this fair value option concurrent with the eective date of January 1,

2008 for companies with scal years ending December 31 or can select

future assets or liabilities as they are acquired or entered into. Entergy

does not expect that the adoption of this standard will have a material

eect on its nancial position, results of operations, or cash ows.

e FASB issued Statement of Financial Accounting Standards No.

141(R), “Business Combinations” (SFAS 141(R)) during the fourth

quarter 2007. e signicant provisions of SFAS 141R are that: (i) assets,

liabilities and non-controlling (minority) interests will be measured

at fair market value; (ii) costs associated with the acquisition such as

transaction-related costs or restructuring costs will be separately

recorded from the acquisition and expensed as incurred; (iii) any

excess of fair market value of the assets, liabilities and minority interests

acquired over the fair market value of the purchase price will be

recognized as a bargain purchase and a gain recorded at the acquisition

date; and (iv) contractual contingencies resulting in potential future

assets or liabilities will be recorded at fair market value at the date of

acquisition. SFAS 141(R) applies prospectively to business combinations

for which the acquisition date is on or aer the beginning of the rst

annual reporting period beginning on or aer December 15, 2008. An

entity may not apply SFAS 141(R) before that date.

e FASB issued Statement of Financial Accounting Standards No.

160, “Noncontrolling Interests in Consolidated Financial Statements”

(SFAS 160) during the fourth quarter 2007. SFAS 160 enhances

disclosures surrounding minority interests in the balance sheet,

income statement and statement of comprehensive income. SFAS 160

will also require a parent to record a gain or loss when a subsidiary in

which it retains a minority interest is deconsolidated from the parent

company. SFAS 160 applies prospectively to business combinations

for which the acquisition date is on or aer the beginning of the rst

annual reporting period beginning on or aer December 15, 2008. An

entity may not apply SFAS 160 before that date.

In April 2007 the FASB issued Sta Position No. 39-1, “Amendment

of FASB Interpretation No. 39” (FSP FIN 39-1). FSP FIN 39-1 allows an

entity to oset the fair value of a receivable or payable against the fair

value of a derivative that is executed with the same counterparty under a

master netting arrangement. is guidance becomes eective for scal

years beginning aer November 15, 2007. Entergy does not expect these

provisions to have a material eect on it its nancial position.