Entergy 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

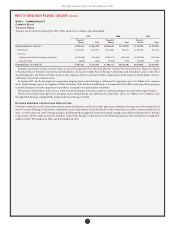

NOTE 11. RETIREMENT, OTHER POSTRETIREMENT BENEFITS,

AND DEFINED CONTRIBUTION PLANS

QUA L I F I E D PE N S I O N PL A N S

Entergy has seven qualied pension plans covering substantially all

of its employees: “Entergy Corporation Retirement Plan for Non-

Bargaining Employees,” “Entergy Corporation Retirement Plan for

Bargaining Employees,” “Entergy Corporation Retirement Plan II for

Non-Bargaining Employees,” “Entergy Corporation Retirement Plan

II for Bargaining Employees,” “Entergy Corporation Retirement Plan

III,” “Entergy Corporation Retirement Plan IV for Non-Bargaining

Employees,” and “Entergy Corporation Retirement Plan IV for

Bargaining Employees.” e Registrant Subsidiaries participate in

two of these plans: “Entergy Corporation Retirement Plan for Non-

Bargaining Employees” and “Entergy Corporation Retirement Plan

for Bargaining Employees.” Except for the Entergy Corporation

Retirement Plan III, the pension plans are noncontributory and

provide pension benets that are based on employees’ credited

service and compensation during the nal years before retirement.

e Entergy Corporation Retirement Plan III includes a mandatory

employee contribution of 3% of earnings during the rst 10 years of

plan participation, and allows voluntary contributions from 1% to

10% of earnings for a limited group of employees.

Entergy Corporation and its subsidiaries fund pension costs in

accordance with contribution guidelines established by the Employee

Retirement Income Security Act of 1974, as amended, and the Internal

Revenue Code of 1986, as amended. e assets of the plans include

common and preferred stocks, xed-income securities, interest

in a money market fund, and insurance contracts. e Registrant

Subsidiaries’ pension costs are recovered from customers as a

component of cost of service in each of their jurisdictions. Entergy

uses a December 31 measurement date for its pension plans.

In September 2006, FASB issued SFAS 158, “Employer’s

Accounting for Dened Benet Pension and Other Postretirement

Plans, an amendment of FASB Statements Nos. 87, 88, 106 and

132(R),” to be eective December 31, 2006. SFAS 158 requires an

employer to recognize in its balance sheet the funded status of its

benet plans. is is measured as the dierence between plan assets

at fair value and the benet obligation. Employers are to record

previously unrecognized gains and losses, prior service costs, and the

remaining transition asset or obligation as a result of adopting SFAS

87 and SFAS 106 as other comprehensive income (OCI) and/or as a

regulatory asset reective of the recovery mechanism for pension and

OPEB costs in the Utility’s jurisdictions. For the portion of Entergy

Gulf States Louisiana that is not regulated, the unrecognized prior

service cost, gains and losses, and transition asset/obligation for its

pension and other postretirement benet obligations are recorded

as other comprehensive income. Entergy Gulf States Louisiana

and Entergy Louisiana recover other postretirement benets costs

on a pay as you go basis and will record the unrecognized prior

service cost, gains and losses, and transition obligation for its other

postretirement benet obligation as other comprehensive income.

SFAS 158 also requires that changes in the funded status be recorded

as other comprehensive income and/or a regulatory asset in the

period in which the changes occur.

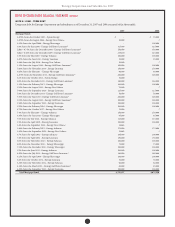

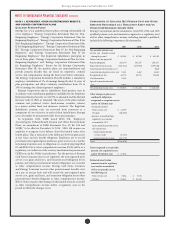

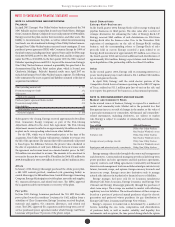

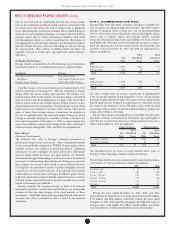

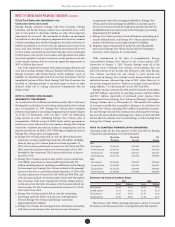

CO M P O N E N T S O F QUA L I F I E D NE T PE N S I O N CO S T A N D OT H E R

AM O U N T S RE C O G N I Z E D A S A RE G U L AT O R Y AS S E T A N D /O R

OT H E R CO M P R E H E N S I V E IN C O M E (OCI)

Entergy Corporation’s and its subsidiaries’ total 2007, 2006, and 2005

qualied pension costs and amounts recognized as a regulatory asset

and/or other comprehensive income, including amounts capitalized,

included the following components (in thousands):

2007 2006 2005

Net periodic pension cost:

Service cost - benets earned

during the period $ 96,565 $ 92,706 $ 82,520

Interest cost on projected

benet obligation 185,170 167,257 155,477

Expected return on assets (203,521) (177,930) (159,544)

Amortization of transition asset – – (662)

Amortization of prior service cost 5,531 5,462 4,863

Recognized net loss 45,775 43,721 35,604

Curtailment loss 2,336 – –

Special termination benet

loss 4,018 – –

Net periodic pension costs $ 135,874 $ 131,216 $ 118,258

Other changes in plan assets

and benet obligations

recognized as a regulatory asset

and/or OCI (before tax)

Arising this period:

Prior service cost $ 11,339

Net gain (68,853)

Amounts reclassied from

regulatory asset and/or

accumulated OCI

to net periodic pension cost in

the current year:

Amortization of prior

service credit (5,531)

Amortization of net gain (45,775)

Total $(108,820)

Total recognized as net periodic

pension cost, regulatory asset,

and/or OCI (before tax) $ 27,054

Estimated amortization

amounts from the regulatory

asset and/or accumulated

OCI to net periodic cost in

the following year

Prior service cost $ 5,064 $ 5,531

Net loss $ 25,641 $ 44,316