Entergy 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

Entergy Corporation and Subsidiaries 2007

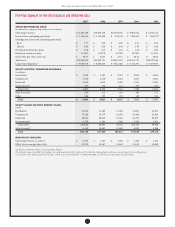

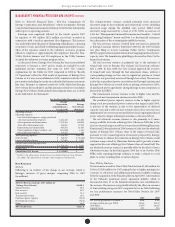

Long-term debt, including the currently maturing portion, makes

up substantially all of Entergy’s total debt outstanding. Following are

Entergy’s long-term debt principal maturities and estimated interest

payments as of December 31, 2007. To estimate future interest

payments for variable rate debt, Entergy used the rate as of December

31, 2007. e gures below include payments on the Entergy Louisiana

and System Energy sale-leaseback transactions, which are included in

long-term debt on the balance sheet (in millions):

Long-term Debt Maturities 2011- After

and Estimated Interest Payments 2008 2009 2010 2012 2012

Utility $1,214 $ 610 $1,026 $1,236 $7,189

Non-Utility Nuclear 36 36 36 68 161

Parent Company & Other

Business Segments 452 474 456 3,052 –

Total $1,702 $1,120 $1,518 $4,356 $7,350

Note 5 to the nancial statements provides more detail concerning

long-term debt.

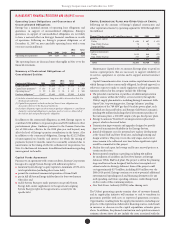

In August 2007, Entergy Corporation entered into a $3.5 billion,

ve-year credit facility, and terminated the two previously existing

facilities, a $2 billion ve-year revolving credit facility that was due to

expire in May 2010 and a $1.5 billion three-year revolving credit facility

that was due to expire in December 2008. Entergy Corporation has

the ability to issue letters of credit against the total borrowing capacity

of the facility. e weighted average interest rate as of December 31,

2007 was 5.524% on the drawn portion of the facility. e facility fee

is currently 0.09% of the commitment amount. e facility fee and

interest rate can uctuate depending on the senior unsecured debt

ratings of Entergy Corporation.

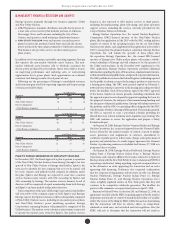

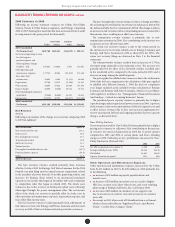

As of December 31, 2007, amounts outstanding under the $3.5

billion credit facility are (in millions):

Capacity Borrowings Letters of Credit Capacity Available

$3,500 $2,251 $69 $1,180

Entergy Corporation’s credit facility requires it to maintain a

consolidated debt ratio of 65% or less of its total capitalization. If

Entergy fails to meet this ratio, or if Entergy or one of the Registrant

Subsidiaries (except Entergy New Orleans) defaults on other

indebtedness or is in bankruptcy or insolvency proceedings, an

acceleration of the facility maturity date may occur.

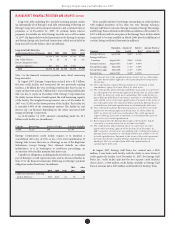

Capital lease obligations, including nuclear fuel leases, are a minimal

part of Entergy’s overall capital structure, and are discussed further in

Note 10 to the nancial statements. Following are Entergy’s payment

obligations under those leases (in millions):

2011- After

2008 2009 2010 2012 2012

Capital lease payments, including

nuclear fuel leases $153 $213 $2 $3 $2

Notes payable includes borrowings outstanding on credit facilities

with original maturities of less than one year. Entergy Arkansas,

Entergy Gulf States Louisiana, Entergy Louisiana, Entergy Mississippi,

and Entergy Texas each had credit facilities available as of December 31,

2007 as follows (with the exception of the Entergy Texas facility, which

is expected to become available in March 2008 aer the fulllment of

certain closing conditions) (amounts in millions):

Expiration Amount of Interest Amount Drawn as

Company Date Facility Rate(a) of Dec. 31, 2007

Entergy Arkansas April 2008 $100(b) 6.75% –

Entergy Gulf States

Louisiana August 2012 $100(c) 5.025% –

Entergy Louisiana August 2012 $200(d) 4.96% –

Entergy Mississippi May 2008 $ 30(e) 5.85% –

Entergy Mississippi May 2008 $ 20(e) 5.85% –

Entergy Texas August 2012 $100(f) 5.025% –

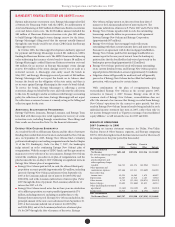

(a) The interest rate is the weighted average interest rate as of December

31, 2007 that would be applied to the outstanding borrowings under

the facility.

(b) The credit facility requires Entergy Arkansas to maintain a total

shareholders’ equity of at least 25% of its total assets.

(c) The credit facility allows Entergy Gulf States Louisiana to issue letters

of credit against the borrowing capacity of the facility. As of December

31, 2007, no letters of credit were outstanding. The credit facility re-

quires Entergy Gulf States Louisiana to maintain a consolidated debt

ratio of 65% or less of its total capitalization. Pursuant to the terms of

the credit agreement, the amount of debt assumed by Entergy Texas is

excluded from debt and capitalization in calculating the debt ratio.

(d) The credit facility allows Entergy Louisiana to issue letters of credit

against the borrowing capacity of the facility. As of December 31,

2007, no letters of credit were outstanding. The credit agreement

requires Entergy Louisiana to maintain a consolidated debt ratio of

65% or less of its total capitalization.

(e) Borrowings under the Entergy Mississippi credit facilities may be

secured by a security interest in its accounts receivable.

(f) The credit facility allows Entergy Texas to issue letters of credit

against the borrowing capacity of the facility. As of December 31,

2007, no letters of credit were outstanding. The credit facility requires

Entergy Texas to maintain a consolidated debt ratio of 65% or less of

its total capitalization. Pursuant to the terms of the credit agreement,

the transition bonds issued by Entergy Gulf States Reconstruction

Funding I, LLC are excluded from debt and capitalization in

calculating the debt ratio.

In August 2007, Entergy Gulf States, Inc. entered into a $200

million, 5-year bank credit facility, with the ability to issue letters of

credit against the facility. As of December 31, 2007, the Entergy Gulf

States, Inc. credit facility split into the two separate credit facilities

shown above, a $100 million credit facility available to Entergy Gulf

States Louisiana and a $100 million credit facility for Entergy Texas.

Management’s Financial Discussion and Analysis conti nued